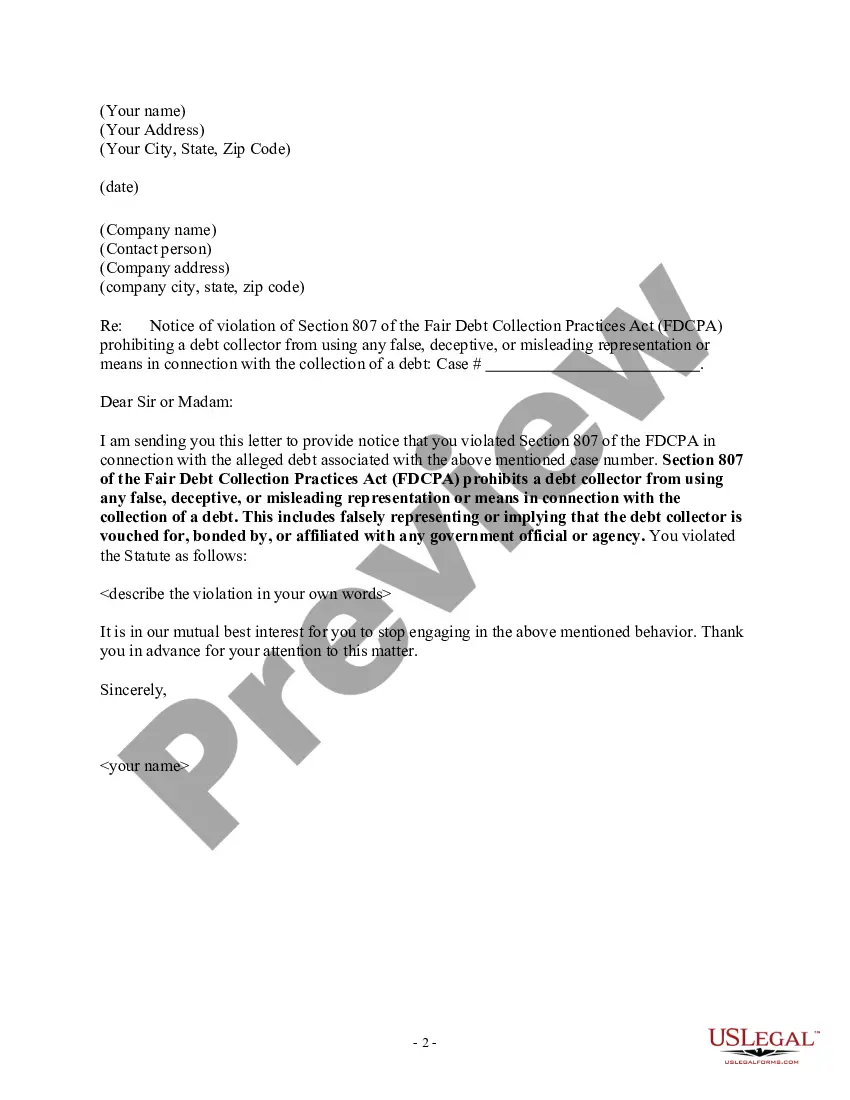

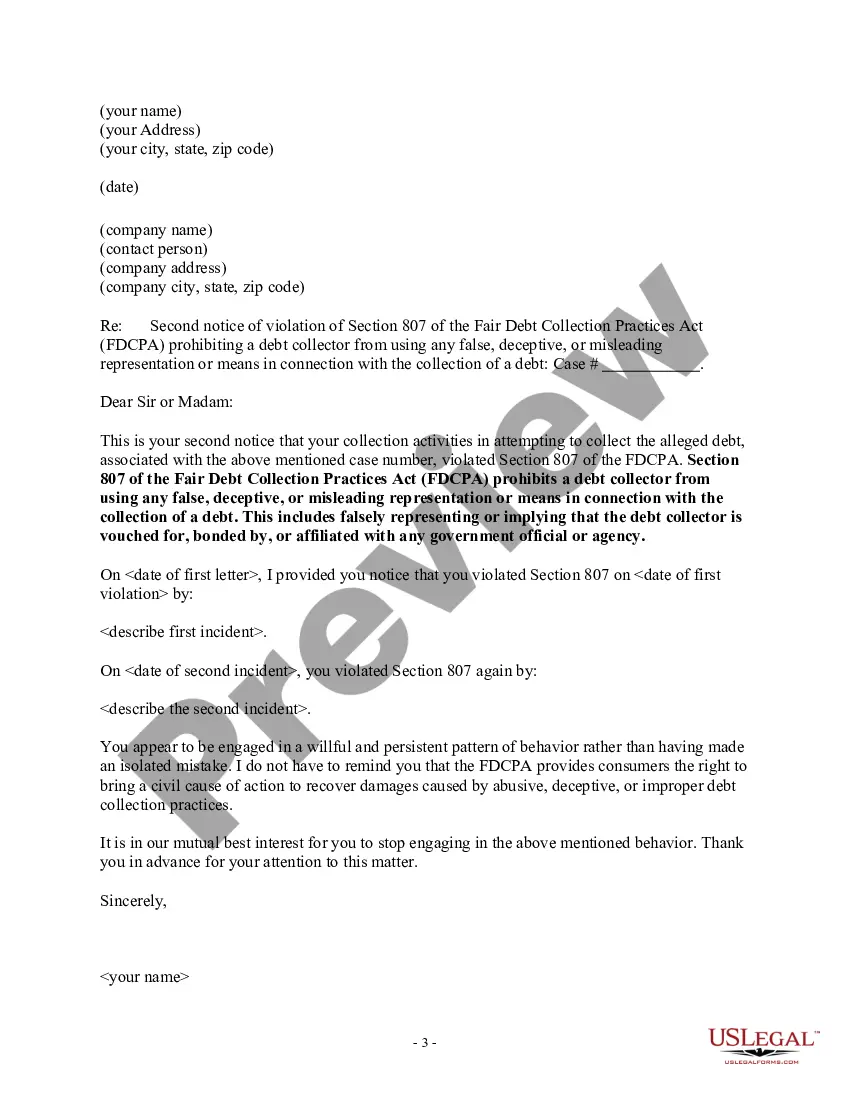

Virginia Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Virginia Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

US Legal Forms - one of many greatest libraries of lawful kinds in America - offers an array of lawful papers templates you are able to acquire or print. Utilizing the website, you may get a large number of kinds for business and specific functions, sorted by types, says, or keywords and phrases.You will discover the latest versions of kinds like the Virginia Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself in seconds.

If you have a monthly subscription, log in and acquire Virginia Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself in the US Legal Forms catalogue. The Acquire switch can look on every kind you look at. You get access to all formerly delivered electronically kinds in the My Forms tab of your respective profile.

If you would like use US Legal Forms for the first time, listed below are easy recommendations to get you started out:

- Be sure to have picked the best kind for your metropolis/region. Click the Preview switch to examine the form`s information. See the kind outline to actually have chosen the correct kind.

- In the event the kind doesn`t satisfy your requirements, utilize the Research area towards the top of the display screen to get the one which does.

- In case you are pleased with the form, verify your choice by clicking on the Acquire now switch. Then, opt for the rates strategy you like and offer your qualifications to sign up for the profile.

- Approach the deal. Utilize your credit card or PayPal profile to perform the deal.

- Choose the file format and acquire the form in your gadget.

- Make alterations. Fill up, revise and print and indication the delivered electronically Virginia Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

Each and every design you put into your bank account does not have an expiry day which is the one you have permanently. So, if you want to acquire or print an additional version, just go to the My Forms section and then click around the kind you want.

Gain access to the Virginia Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself with US Legal Forms, the most comprehensive catalogue of lawful papers templates. Use a large number of expert and status-specific templates that fulfill your company or specific demands and requirements.

Form popularity

FAQ

This finite period of time is known as the statute of limitations. In Virginia, the applicable statute of limitations for credit card debts, mortgage debts, and medical debts is five years.

The FDCPA prohibits debt collectors from engaging in harassment or abuse, making false or misleading representations, and engaging in unfair practices.

5 Things Debt Collectors Are Forbidden to DoPretend to Work for a Government Agency. The FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement.Threaten to Have You Arrested.Publicly Shame You.Try to Collect Debt You Don't Owe.Harass You.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.