This due diligence form entails policies and procedures for the identification, retention, storage, protection and disposal of company records. This Records Retention Policy is intended to ensure that the company's records management policies adhere to customer, legal and business requirements and are conducted in a cost-efficient manner.

Virginia Records Retention Policy

Description

How to fill out Virginia Records Retention Policy?

If you need to comprehensive, down load, or printing lawful record templates, use US Legal Forms, the largest assortment of lawful varieties, that can be found on the Internet. Use the site`s easy and convenient research to find the paperwork you require. Numerous templates for enterprise and personal functions are categorized by categories and suggests, or keywords. Use US Legal Forms to find the Virginia Records Retention Policy with a handful of mouse clicks.

Should you be presently a US Legal Forms customer, log in to your bank account and click on the Obtain switch to get the Virginia Records Retention Policy. You can also gain access to varieties you previously delivered electronically within the My Forms tab of the bank account.

If you are using US Legal Forms the very first time, follow the instructions beneath:

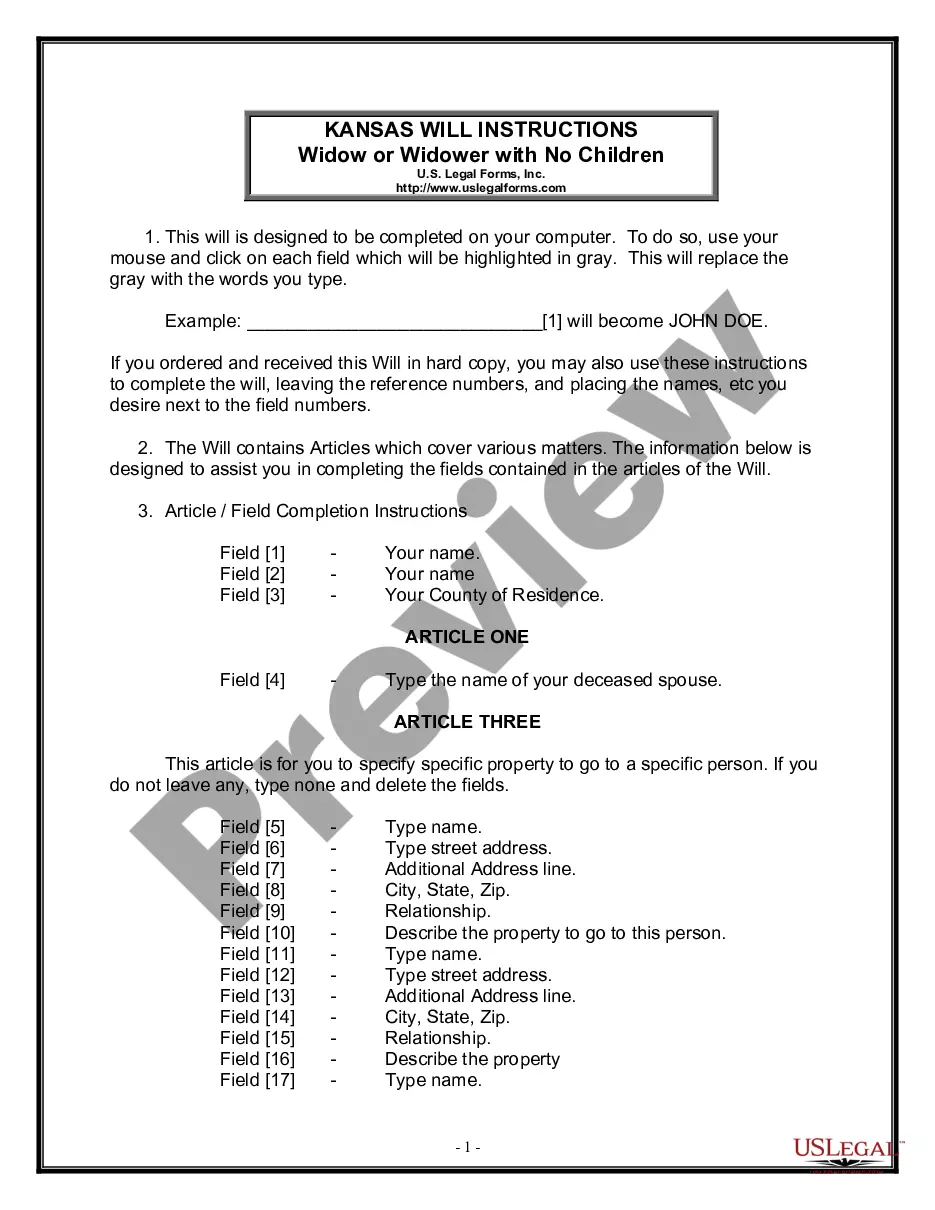

- Step 1. Be sure you have selected the form for that correct town/land.

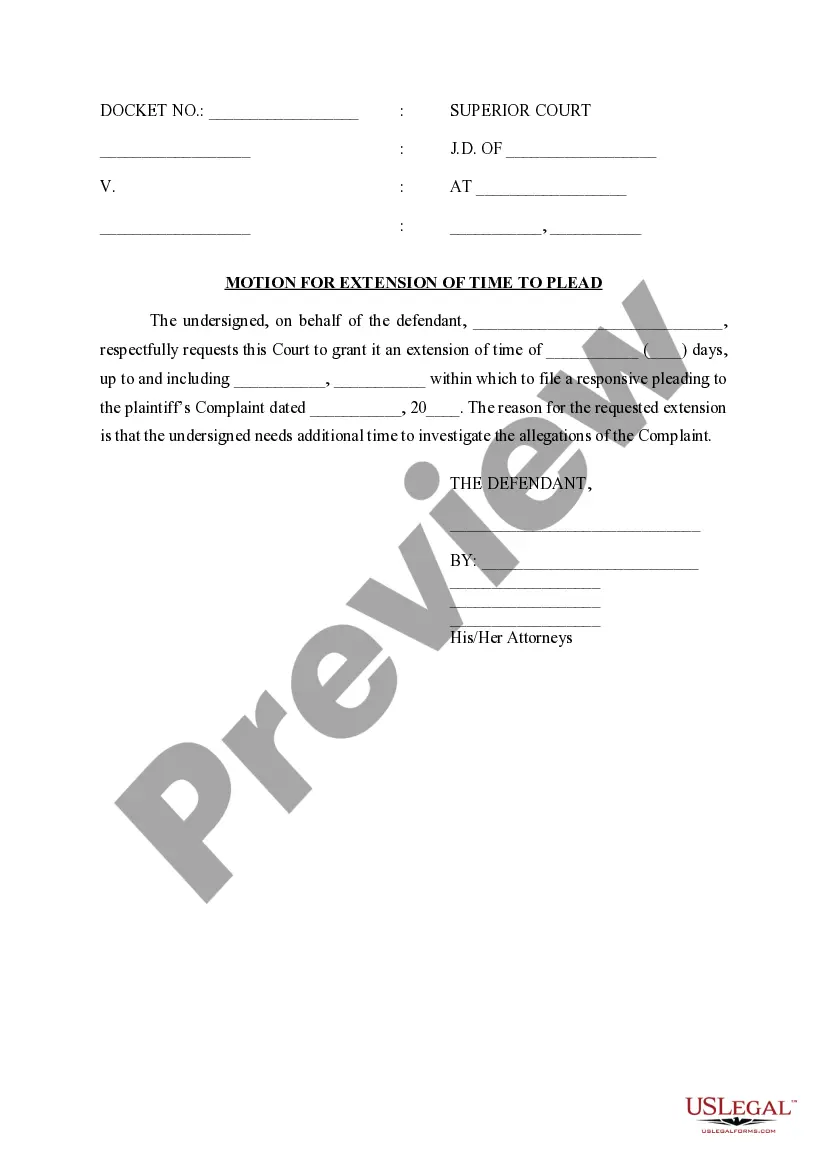

- Step 2. Utilize the Review option to look over the form`s content. Never overlook to learn the information.

- Step 3. Should you be unsatisfied with the kind, take advantage of the Research discipline towards the top of the screen to discover other variations in the lawful kind template.

- Step 4. Upon having identified the form you require, select the Buy now switch. Opt for the costs strategy you prefer and add your references to sign up on an bank account.

- Step 5. Approach the deal. You can use your credit card or PayPal bank account to accomplish the deal.

- Step 6. Choose the file format in the lawful kind and down load it in your system.

- Step 7. Full, change and printing or sign the Virginia Records Retention Policy.

Each and every lawful record template you get is the one you have for a long time. You possess acces to every kind you delivered electronically with your acccount. Click the My Forms section and select a kind to printing or down load yet again.

Be competitive and down load, and printing the Virginia Records Retention Policy with US Legal Forms. There are millions of expert and condition-distinct varieties you can use for your enterprise or personal requires.

Form popularity

FAQ

Federal regulations require research records to be retained for at least 3 years after the completion of the research (45 CFR 46) and UVA regulations require that data are kept for at least 5 years. Additional standards from your discipline may also be applicable to your data storage plan.

Accounting and Tax Records For that reason, you should keep most income tax records for seven years. Depending on the nature of your business, it may also be wise to retain insurance policies permanently since claims can occasionally arise from acts that occurred many years in the past.

The record for the preceding twelve months for each such minor employee shall be kept on the premises for a period of thirty-six months from the date of the latest work period recorded for the minor employee involved. 1972, c. 480; 1982, c. 134; 1991, c.

(1) Category-I (e-Files/records to preserved permanently on which are of historical importance) For 10 years, it will be kept in the Department's sever and thereafter transferred to the server of the National Archives of India.

All Personnel Files and Training Records: 6 years from the end of employment. Redundancy Records: 6 years. Sickness Absence Records: A minimum of 3 months but potentially up to 6 years after employment ends.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

Records typically fall into four categories: those securing property such as titles or shares; those that mark certain crucial events such as businesses incorporations; those used for assessing operations; and those collected or retained in compliance with government regulation.

Personnel records for employees separating from state service are to be retained by the separating agency for five years. (Contact the Records Management Section of the Virginia State Library and Archives concerning medical records.)

Records Retention Guideline #4: Keep everyday paperwork for 3 yearsMonthly financial statements.Credit card statements.Utility records.Employment applications (for businesses)Medical bills (in case of insurance disputes)

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.