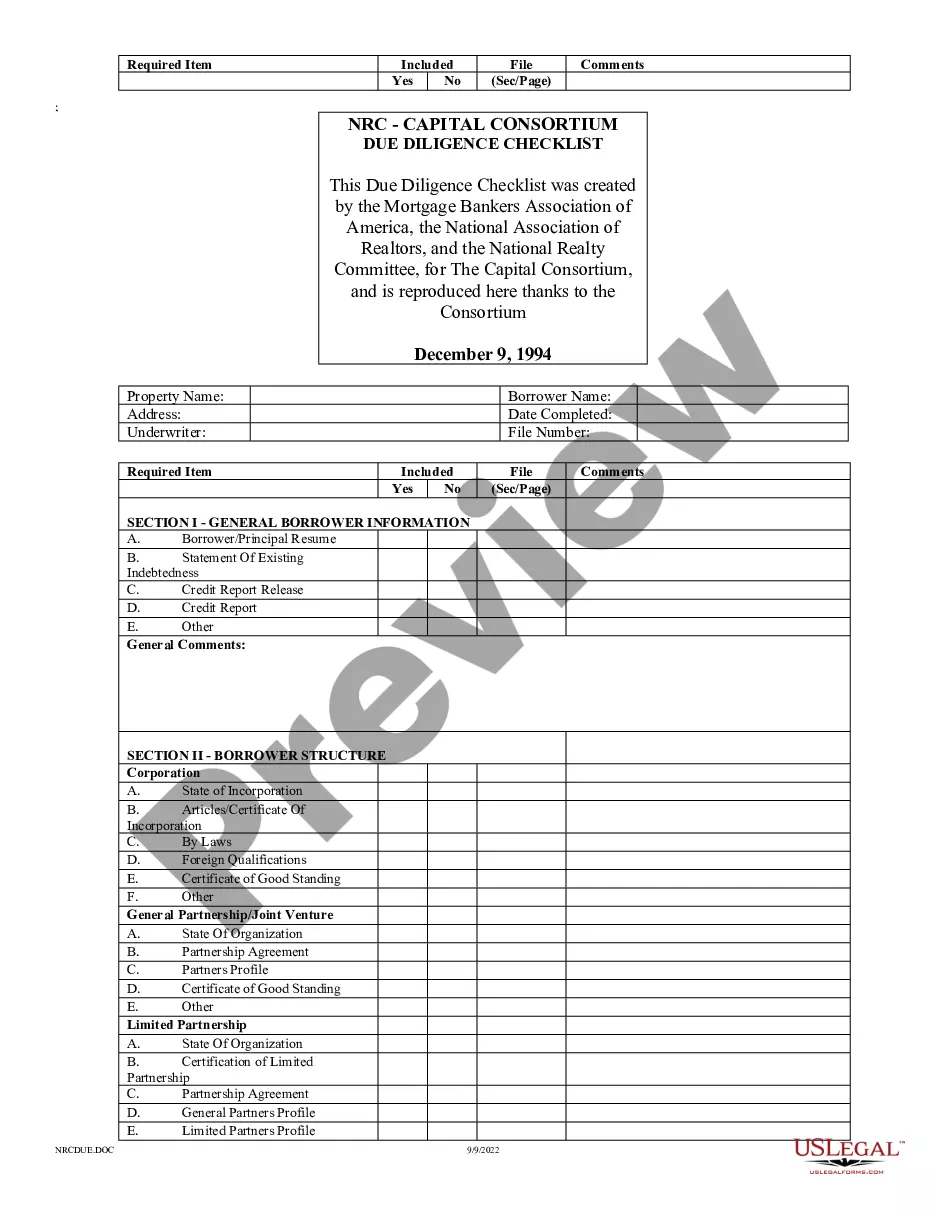

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

The Virginia Capital Consortium Due Diligence Checklist is a comprehensive document used to assess the viability, credibility, and potential risks associated with investment opportunities within the region. The checklist aims to ensure that thorough research and evaluation are conducted before making any significant financial commitments. Keywords: Virginia Capital Consortium, due diligence, checklist, investment opportunities, viability, credibility, potential risks, financial commitments. The Virginia Capital Consortium Due Diligence Checklist is specifically tailored for investors looking to engage with the Virginia Capital Consortium. It assists in identifying and assessing various aspects of an investment opportunity, enabling investors to make informed decisions. The checklist covers multiple areas crucial to due diligence, encompassing market analysis, financial assessment, legal and regulatory compliance, operational performance, and risk evaluation. It helps investors gain a comprehensive understanding of potential investments, allowing them to identify any red flags or areas of concern. Different types of Virginia Capital Consortium Due Diligence Checklists may exist based on the specific investment sectors or industries. Some examples include real estate due diligence checklists, technology due diligence checklists, healthcare due diligence checklists, and so on. These industry-specific checklists further refine the evaluation process by focusing on sector-specific considerations and relevant regulations. The Virginia Capital Consortium Due Diligence Checklist streamlines the assessment process by providing a structured framework and standardized format. It typically includes sections such as company background and history, financial statements, market analysis, competitive landscape, legal and regulatory compliance, intellectual property rights, management team evaluation, operational efficiency, and potential risks analysis. Investors can utilize the checklist as a reference tool throughout the due diligence process, documenting their findings and ensuring all necessary aspects are thoroughly reviewed. It serves as a valuable resource for conducting in-depth research, engaging with industry experts, and seeking professional advice to support sound investment decisions. By utilizing the Virginia Capital Consortium Due Diligence Checklist, investors can minimize potential risks, gain confidence in their investment choices, and align their strategies with the goals and objectives of the Virginia Capital Consortium. It offers a systematic approach to evaluating investment opportunities, allowing investors to make well-informed decisions while reducing the likelihood of unexpected setbacks or failures. In conclusion, the Virginia Capital Consortium Due Diligence Checklist is a comprehensive and adaptable tool that enables investors to undertake an in-depth analysis of investment opportunities. With its structured framework and industry-specific variations, it assists in effectively evaluating risks, ensuring compliance, and making informed investment decisions.The Virginia Capital Consortium Due Diligence Checklist is a comprehensive document used to assess the viability, credibility, and potential risks associated with investment opportunities within the region. The checklist aims to ensure that thorough research and evaluation are conducted before making any significant financial commitments. Keywords: Virginia Capital Consortium, due diligence, checklist, investment opportunities, viability, credibility, potential risks, financial commitments. The Virginia Capital Consortium Due Diligence Checklist is specifically tailored for investors looking to engage with the Virginia Capital Consortium. It assists in identifying and assessing various aspects of an investment opportunity, enabling investors to make informed decisions. The checklist covers multiple areas crucial to due diligence, encompassing market analysis, financial assessment, legal and regulatory compliance, operational performance, and risk evaluation. It helps investors gain a comprehensive understanding of potential investments, allowing them to identify any red flags or areas of concern. Different types of Virginia Capital Consortium Due Diligence Checklists may exist based on the specific investment sectors or industries. Some examples include real estate due diligence checklists, technology due diligence checklists, healthcare due diligence checklists, and so on. These industry-specific checklists further refine the evaluation process by focusing on sector-specific considerations and relevant regulations. The Virginia Capital Consortium Due Diligence Checklist streamlines the assessment process by providing a structured framework and standardized format. It typically includes sections such as company background and history, financial statements, market analysis, competitive landscape, legal and regulatory compliance, intellectual property rights, management team evaluation, operational efficiency, and potential risks analysis. Investors can utilize the checklist as a reference tool throughout the due diligence process, documenting their findings and ensuring all necessary aspects are thoroughly reviewed. It serves as a valuable resource for conducting in-depth research, engaging with industry experts, and seeking professional advice to support sound investment decisions. By utilizing the Virginia Capital Consortium Due Diligence Checklist, investors can minimize potential risks, gain confidence in their investment choices, and align their strategies with the goals and objectives of the Virginia Capital Consortium. It offers a systematic approach to evaluating investment opportunities, allowing investors to make well-informed decisions while reducing the likelihood of unexpected setbacks or failures. In conclusion, the Virginia Capital Consortium Due Diligence Checklist is a comprehensive and adaptable tool that enables investors to undertake an in-depth analysis of investment opportunities. With its structured framework and industry-specific variations, it assists in effectively evaluating risks, ensuring compliance, and making informed investment decisions.