Title: Virginia Sample Founder Stock Purchase Agreement between Machine Communications, Inc. and Peter D. Olson Introduction: The Virginia Sample Founder Stock Purchase Agreement between Machine Communications, Inc. and Peter D. Olson represents a legally binding document that outlines the terms and conditions for the purchase of founder stock in the company by Peter D. Olson. This agreement serves to establish the rights, responsibilities, and obligations of both parties involved. Keywords: Virginia, Sample Founder Stock Purchase Agreement, Machine Communications Inc., Peter D. Olson 1. Parties Involved: The agreement identifies Machine Communications, Inc. as the company offering founder stock and Peter D. Olson as the individual interested in purchasing the stock. Keywords: Machine Communications Inc., Peter D. Olson, founder stock 2. Purpose of the Agreement: The agreement highlights the purpose of the stock purchase, emphasizing the intent to transfer ownership rights and associated benefits from Machine Communications, Inc. to Peter D. Olson. It outlines the objectives, expectations, and desired outcomes for both parties. Keywords: stock purchase, transfer of ownership, benefits, objectives 3. Purchase Terms and Consideration: This section comprehensively defines the stock purchase terms, including the number of shares, the purchase price per share, and the total consideration or payment due from Peter D. Olson to secure the stock. It also specifies the deadlines for payment and any conditions or contingencies associated with the purchase. Keywords: purchase terms, consideration, stock price, shares 4. Purchase Agreement Restrictions and Obligations: This portion outlines any restrictions or limitations placed on both parties concerning the stock purchase. It may include clauses related to voting rights, transfer restrictions, non-competition agreements, or any other obligations necessary for safeguarding the interests and reputation of Machine Communications, Inc. Keywords: restrictions, obligations, voting rights, transfer restrictions, non-competition agreements 5. Vesting Schedule: This section details the vesting schedule for the founder stock, specifying the duration of time necessary for Peter D. Olson to fully acquire ownership rights. It also outlines any accelerated vesting provisions, such as in the event of termination of employment, change in control, or other specified triggering events. Keywords: vesting schedule, ownership rights, accelerated vesting 6. Consent and Legal Compliance: The agreement highlights each party's responsibility to obtain any necessary consents, approvals, or waivers required by law or other relevant regulations before executing the stock purchase. This ensures compliance with legal and regulatory requirements in the state of Virginia. Keywords: consent, legal compliance, approvals, Virginia regulations 7. Representations and Warranties: This section includes statements made by both parties regarding their authority, ownership, and other critical factors associated with the stock purchase. It provides the opportunity to disclose any potential legal or financial issues that may impact the agreement. Keywords: representations, warranties, authority, ownership, disclosure Types of Virginia Sample Founder Stock Purchase Agreements: 1. Virginia Sample Founder Stock Purchase Agreement with Cash Consideration: This agreement type involves the purchase of founder stock with a pre-determined cash payment from Peter D. Olson to Machine Communications, Inc. 2. Virginia Sample Founder Stock Purchase Agreement with Equity Consideration: This variation involves the purchase of founder stock where Peter D. Olson provides equity or other non-cash consideration in exchange for the stock. 3. Virginia Sample Founder Stock Purchase Agreement with Earn-out Provision: This agreement includes an earn-out provision, enabling Peter D. Olson to earn additional compensation based on specific performance criteria or milestones after the stock purchase. Keywords: cash consideration, equity consideration, earn-out provision

Virginia Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

Choosing the best legitimate document format can be a have difficulties. Obviously, there are a variety of layouts available online, but how can you get the legitimate develop you will need? Use the US Legal Forms site. The support provides thousands of layouts, for example the Virginia Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, which you can use for company and personal requires. Every one of the forms are checked by experts and meet up with state and federal needs.

Should you be already registered, log in to your profile and then click the Obtain switch to find the Virginia Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson. Use your profile to check from the legitimate forms you may have purchased earlier. Proceed to the My Forms tab of the profile and get another backup of your document you will need.

Should you be a new user of US Legal Forms, listed below are simple instructions that you should follow:

- Initial, make sure you have selected the appropriate develop to your metropolis/state. You may check out the shape while using Preview switch and browse the shape information to ensure it will be the right one for you.

- In the event the develop fails to meet up with your preferences, make use of the Seach area to get the appropriate develop.

- Once you are sure that the shape is proper, select the Get now switch to find the develop.

- Select the rates program you want and enter the required information. Build your profile and buy the transaction utilizing your PayPal profile or charge card.

- Select the document structure and acquire the legitimate document format to your gadget.

- Total, revise and print and indicator the attained Virginia Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson.

US Legal Forms may be the biggest local library of legitimate forms where you can see various document layouts. Use the service to acquire expertly-manufactured documents that follow condition needs.

Form popularity

FAQ

A: The most common provisions included in restricted stock purchase agreements are restrictions on when and how stock can be sold or transferred; non-compete agreements; rights of first refusal; and termination clauses which allow either party to terminate the agreement under specified conditions. Step-by-Step Guide to Drafting a Restricted Stock Purchase Agreement genieai.co ? blog ? step-by-step-guide-to-dr... genieai.co ? blog ? step-by-step-guide-to-dr...

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder.

RSUs are a type of restricted stock (which may also be known as ?letter stock? or ?restricted securities?). Restricted stock is company stock that cannot be fully transferable until certain restrictions have been met. These can be performance or timing restrictions, similar to restrictions for options. RSU vs. stock options: What's the difference? - Empower empower.com ? the-currency ? money ? sto... empower.com ? the-currency ? money ? sto...

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder. Restricted Stock Purchase Agreement (RSPA) - Vela Wood Vela Wood ? glossary-term ? restricted-stoc... Vela Wood ? glossary-term ? restricted-stoc...

An RSPA will typically allow the Company to buyback shares from the founder through a repurchase option. The repurchase option can be triggered by a number of events, including the founder being fired or force to quit. Single / Double Trigger Acceleration.

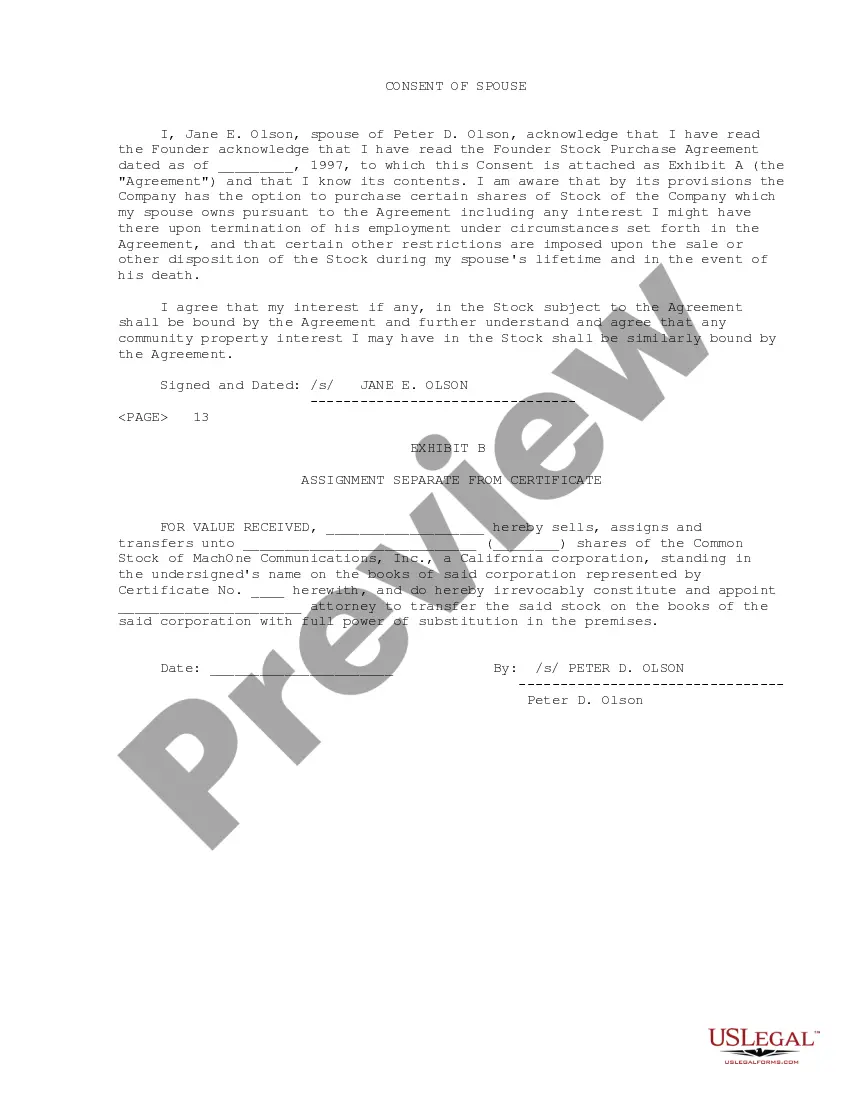

This agreement allows the founders to document their initial ownership in the Company, including standard transfer restrictions and any vesting provisions with respect to their shares.

RSUs. Restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to compensate their employees. While stock options offer employees the ?option? to buy shares at a fixed price, RSAs and RSUs are grants of stock. RSA vs RSU: Key Differences & Tax Treatments - Carta Carta ? blog ? breaking-down-rsas-and-rsus Carta ? blog ? breaking-down-rsas-and-rsus