Virginia Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation

Description

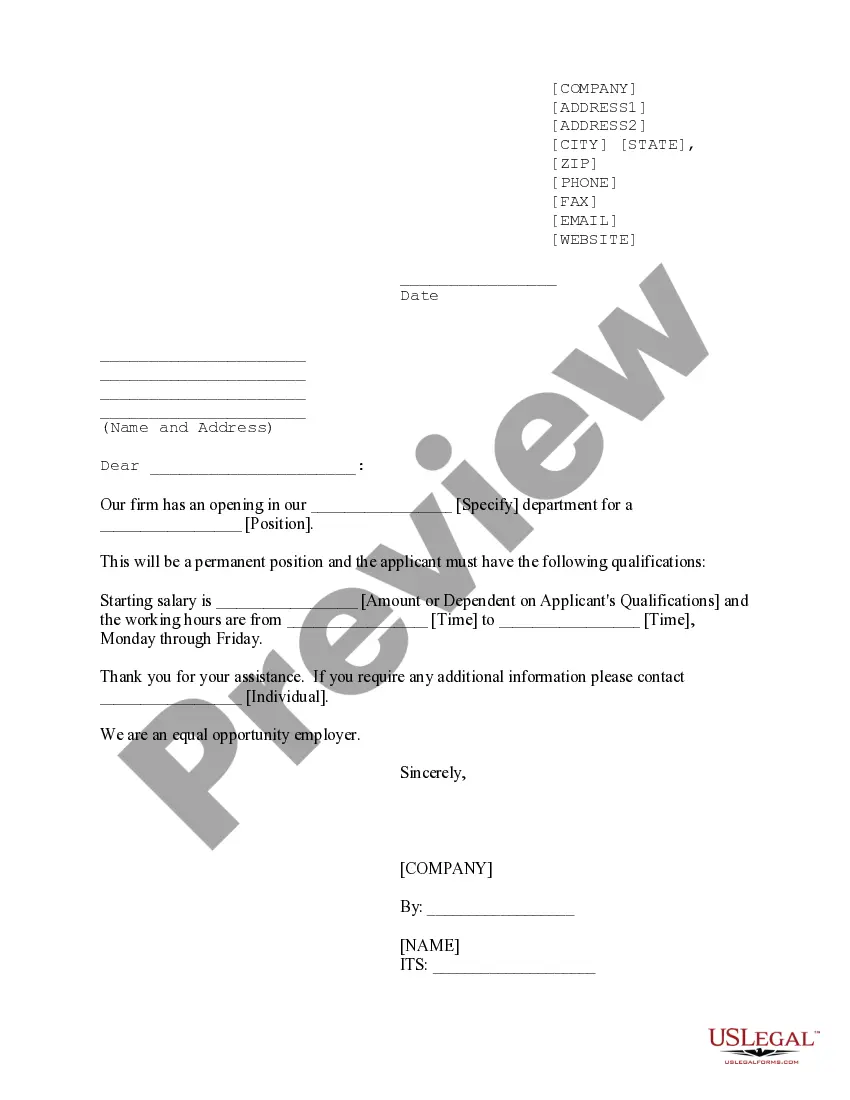

How to fill out Underwriting Agreement Between Advanta Equipment Receivable Series LLC And Advanta Bank Corporation?

Choosing the right lawful record template might be a have difficulties. Naturally, there are a variety of templates available on the Internet, but how will you obtain the lawful develop you will need? Use the US Legal Forms website. The service gives a large number of templates, such as the Virginia Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation, which you can use for company and private needs. Each of the types are checked out by pros and fulfill state and federal demands.

Should you be currently listed, log in to your profile and then click the Acquire key to get the Virginia Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation. Utilize your profile to search with the lawful types you possess acquired earlier. Visit the My Forms tab of your respective profile and acquire yet another copy from the record you will need.

Should you be a whole new end user of US Legal Forms, listed below are easy instructions for you to adhere to:

- Very first, be sure you have selected the right develop to your area/state. You are able to look through the form utilizing the Preview key and browse the form explanation to make sure it is the right one for you.

- When the develop will not fulfill your needs, utilize the Seach discipline to get the appropriate develop.

- Once you are sure that the form is proper, select the Buy now key to get the develop.

- Choose the prices strategy you would like and type in the necessary information. Build your profile and pay money for an order using your PayPal profile or bank card.

- Pick the submit formatting and download the lawful record template to your system.

- Comprehensive, change and printing and indicator the acquired Virginia Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation.

US Legal Forms will be the greatest library of lawful types for which you can discover various record templates. Use the service to download skillfully-created papers that adhere to condition demands.