Virginia Compensation Agreement, also known as the Virginia Compromise Agreements or Virginia Compensation Contracts, refers to a legally binding document that outlines the terms and conditions related to compensation arrangements between employers and employees in the state of Virginia. These agreements provide a comprehensive framework for determining the financial remuneration and benefits that employees are entitled to receive in exchange for their services. Under the Virginia Compensation Agreement, various key aspects of the employment relationship are addressed, ensuring clarity and fairness for both parties involved. These aspects may include, but are not limited to, base salary, overtime pay, bonuses, commissions, pension plans, profit-sharing, stock options, health insurance, retirement benefits, vacation and sick leave policies, and other forms of compensation. One type of Virginia Compensation Agreement is the Wage and Hour Agreement, which specifically focuses on the payment of wages and related matters, such as overtime rates, working hours, and wage deductions. This agreement ensures compliance with the Virginia Wage Payment Act, which governs the timing and manner of wage payments, among other provisions. Another type of Virginia Compensation Agreement is the Severance Agreement, also known as the Separation Agreement. This agreement is typically entered into when an employer and employee decide to part ways, either due to termination, resignation, or retirement. It outlines the severance package offered to the employee, including monetary compensation, continuation of benefits, confidentiality clauses, and non-compete agreements. A third type of Virginia Compensation Agreement is the Non-Disclosure Agreement (NDA), which is commonly used to protect confidential information, trade secrets, and proprietary data. NDAs ensure that employees do not disclose sensitive information to third parties and establish legal remedies in case of breaches. It is important for both employers and employees in Virginia to ensure that their compensation agreements are well-drafted, aligned with state laws, and meet their specific needs. Seeking legal advice or consulting an employment attorney can help in creating and reviewing the terms and conditions of these agreements to ensure compliance and avoid potential disputes in the future.

Virginia Compensation Agreement

Description

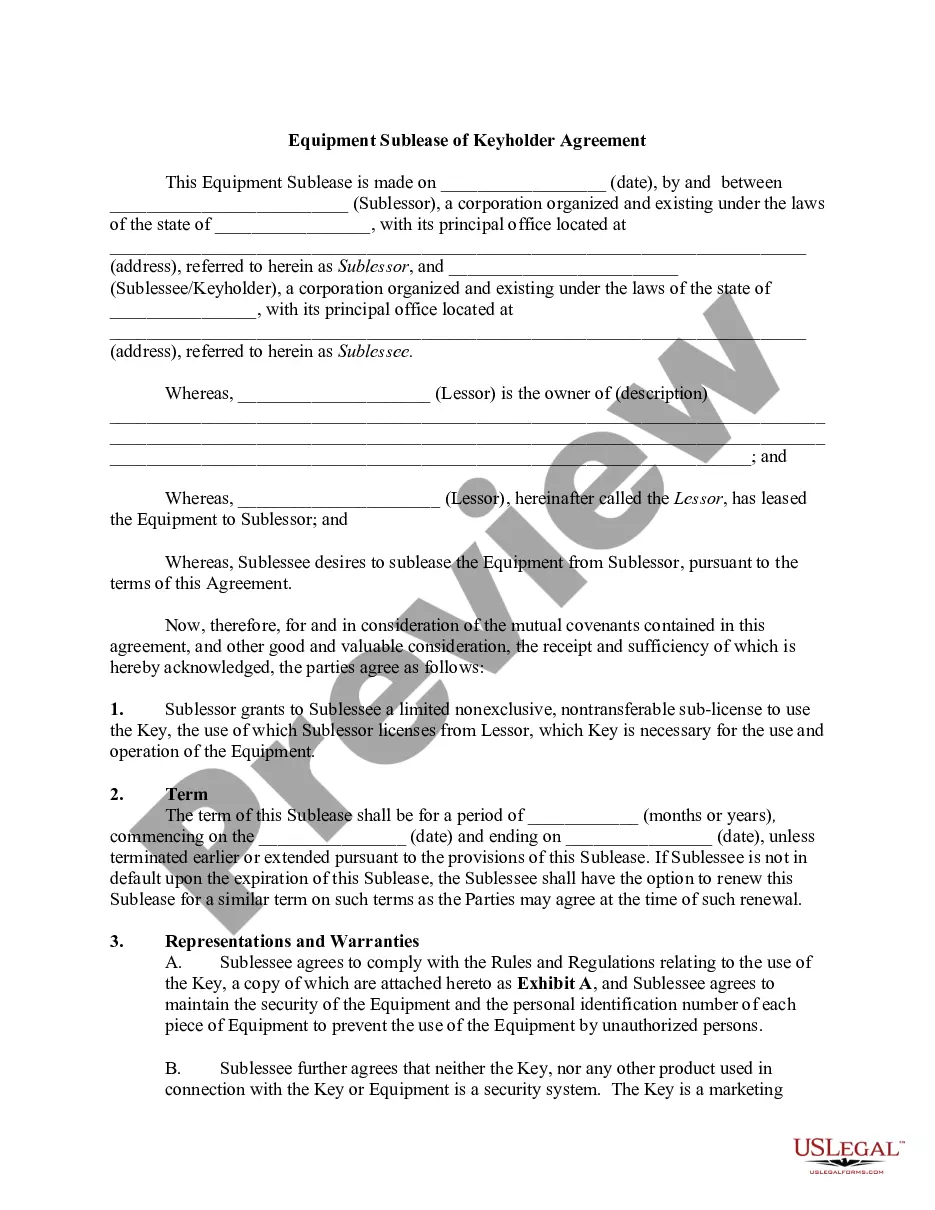

How to fill out Virginia Compensation Agreement?

If you wish to full, down load, or printing lawful papers layouts, use US Legal Forms, the greatest selection of lawful forms, that can be found on the web. Utilize the site`s easy and handy search to find the papers you need. A variety of layouts for company and specific reasons are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to find the Virginia Compensation Agreement in just a handful of mouse clicks.

In case you are currently a US Legal Forms buyer, log in for your profile and then click the Down load key to find the Virginia Compensation Agreement. You can also accessibility forms you formerly acquired inside the My Forms tab of your profile.

If you are using US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape to the correct area/country.

- Step 2. Use the Review solution to check out the form`s articles. Don`t forget about to read through the explanation.

- Step 3. In case you are unsatisfied with all the type, make use of the Lookup industry on top of the monitor to find other types of the lawful type template.

- Step 4. After you have found the shape you need, click the Purchase now key. Choose the prices plan you favor and put your accreditations to register for an profile.

- Step 5. Process the purchase. You should use your credit card or PayPal profile to complete the purchase.

- Step 6. Pick the file format of the lawful type and down load it on your system.

- Step 7. Complete, change and printing or indicator the Virginia Compensation Agreement.

Every lawful papers template you buy is your own property permanently. You have acces to every single type you acquired in your acccount. Go through the My Forms area and select a type to printing or down load yet again.

Contend and down load, and printing the Virginia Compensation Agreement with US Legal Forms. There are millions of skilled and status-certain forms you can utilize to your company or specific demands.

Form popularity

FAQ

The three forms typically used in workers' compensation billing are the HCFA-1500, CMS-1500, and UB-04 forms. HCFA-1500: Also known as the CMS-1500, this form is used for billing outpatient or non-hospital services.

Workers' comp cases with head injuries settle for the most money compared to settlements for all other body parts.

More videos on YouTube $10 million workers comp settlement in an exception to the ?coming and going rule? (California) ... $8.9 million workers comp settlement for a painter who fell from scaffolding (California) ... $6.2 million workers comp settlement for a construction worker struck in the head (Virginia)

2023 Rates: Effective July 1, 2023 the maximum compensation rate will be $1343.00. Effective July 1, 2023 the minimum compensation rate will be $335.75.

The Agreement to Compensate Code of L- With Liability indicates acceptance of a claim. The Agreement to Compensate Code of W- Without Liability indicates: The claim has been accepted without prejudice and without admitting liability and payments will be made pursuant to §21-a, or.

Instructions ONLINE: WebFile users may upload this form through their account. Click here to learn more about WebFile. FAX: Fax the complete form to 804-823-6956. MAIL: Mail the completed form to 333 E. Franklin St., Richmond, VA 23219. IN PERSON: Bring the completed form to any of our VWC Office Locations.

If your doctor says you cannot work because of your work-related injury or illness, you may be entitled to compensation equaling 66 2/3% of your regular wages based upon earnings for the 52 weeks prior to your injury. This amount is subject to a statewide maximum reimbursement amount.

Several organizations provide data on average workers compensation settlement amounts. For example: In 2021, the Virginia Workers Compensation Commission approved 4,839 settlements with a total aggregate value of $253,600,035. Therefore, the average workers comp settlement payout in Virginia was $52,407.53.