Virginia Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al.

Description

How to fill out Grantor Trust Agreement Between Cumberland Mountain Bancshares, James J. Shoffner, Et Al.?

Are you currently in the placement where you will need paperwork for either organization or personal purposes almost every day? There are a lot of lawful file templates available on the net, but locating types you can rely is not simple. US Legal Forms provides thousands of develop templates, such as the Virginia Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al., that happen to be published to fulfill state and federal demands.

Should you be already informed about US Legal Forms internet site and have a merchant account, just log in. Next, you are able to download the Virginia Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al. design.

If you do not have an bank account and want to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is for that correct metropolis/region.

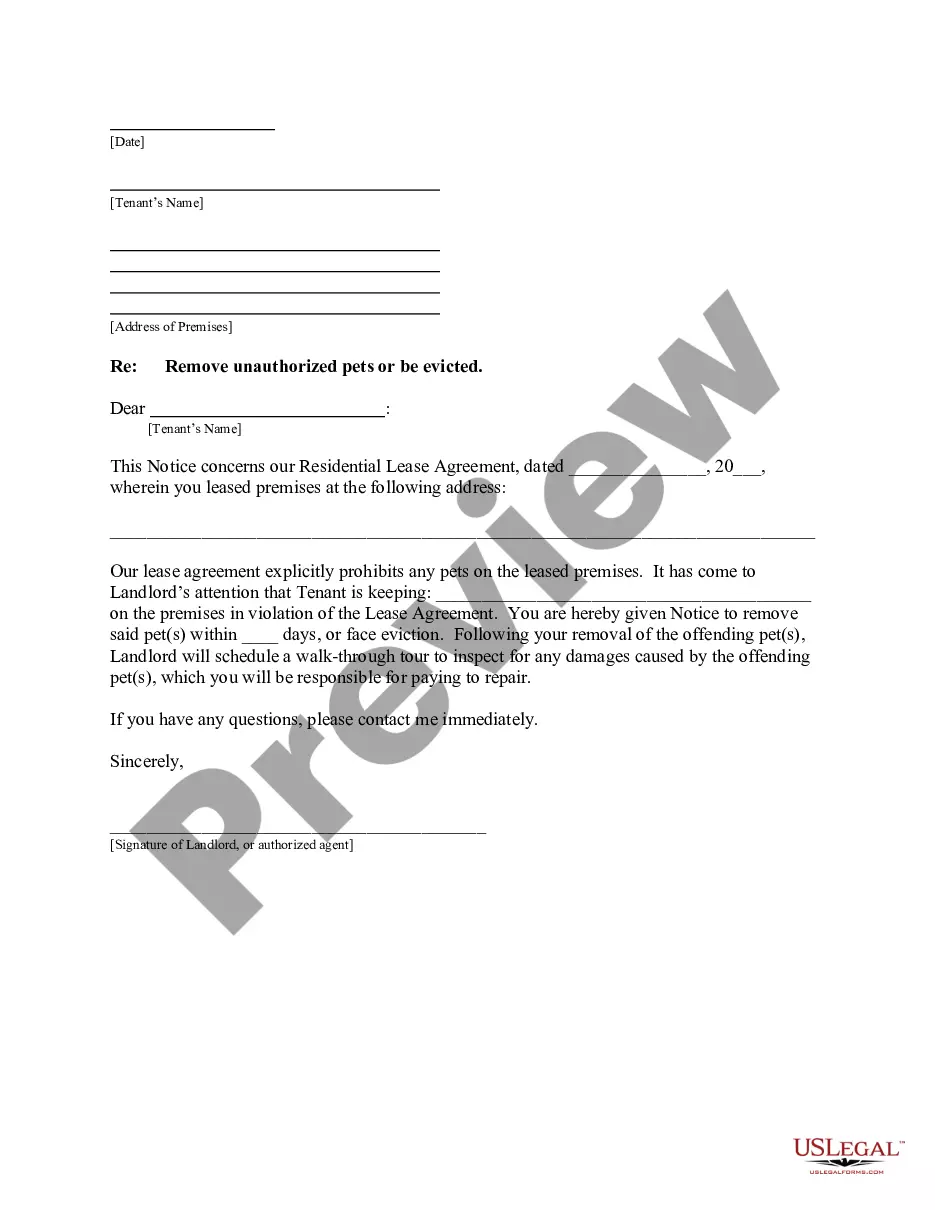

- Utilize the Review option to analyze the shape.

- See the outline to actually have selected the appropriate develop.

- When the develop is not what you`re trying to find, make use of the Lookup industry to get the develop that meets your needs and demands.

- Whenever you get the correct develop, simply click Acquire now.

- Choose the pricing plan you would like, submit the specified information to produce your account, and pay for the order with your PayPal or charge card.

- Pick a convenient data file format and download your copy.

Get each of the file templates you possess bought in the My Forms food selection. You can obtain a more copy of Virginia Grantor Trust Agreement between Cumberland Mountain Bancshares, James J. Shoffner, et al. any time, if needed. Just go through the necessary develop to download or printing the file design.

Use US Legal Forms, one of the most substantial variety of lawful varieties, to conserve time and stay away from blunders. The assistance provides expertly manufactured lawful file templates which you can use for a range of purposes. Make a merchant account on US Legal Forms and start generating your lifestyle easier.