The Virginia Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks, and Financial Institutions is a legally binding document that outlines the terms and conditions of a credit facility obtained by SBA Communications, Corp. and its subsidiary, SBA Telecommunications, Inc., from multiple banks and financial institutions. This credit agreement is designed to provide SBA Communications, Corp. and SBA Telecommunications, Inc. with access to a substantial amount of funds that can be utilized for various purposes. The agreement typically includes provisions for borrowing limits, repayment terms, interest rates, fees, and other important financial details. One type of Virginia Second Amended and Restated Credit Agreement that may exist is a revolving credit facility. This type of agreement allows the borrower to borrow, repay, and borrow again up to a certain limit without needing to renegotiate the terms of the agreement each time. It provides flexibility for the borrower to manage their short-term financing needs efficiently. Another type of Virginia Second Amended and Restated Credit Agreement might be a term loan facility. Unlike a revolving credit facility, a term loan agreement provides a one-time lump-sum disbursement to the borrower. The borrower must repay this loan over a specified period, usually in fixed installments. Furthermore, it is important to note that the Virginia Second Amended and Restated Credit Agreement may include provisions for financial covenants that the borrower must comply with. These covenants are designed to protect the interests of the lenders and ensure that the borrower maintains certain financial ratios or conditions to support the repayment of the credit facility. The agreement also specifies the rights and obligations of all parties involved. It outlines the roles of the borrower, lenders, and any agents or representatives appointed by the parties. Additionally, it may include provisions for events of default, remedies, and dispute resolution mechanisms to address potential conflicts that may arise during the term of the agreement. Overall, the Virginia Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks, and Financial Institutions is a critical tool that enables SBA Communications, Corp. and its subsidiary to secure necessary funding from multiple sources to support their operations, expansions, or other strategic initiatives. The specific terms and types of credit facilities can vary depending on the specific needs and arrangements between the parties involved.

Virginia Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

Description

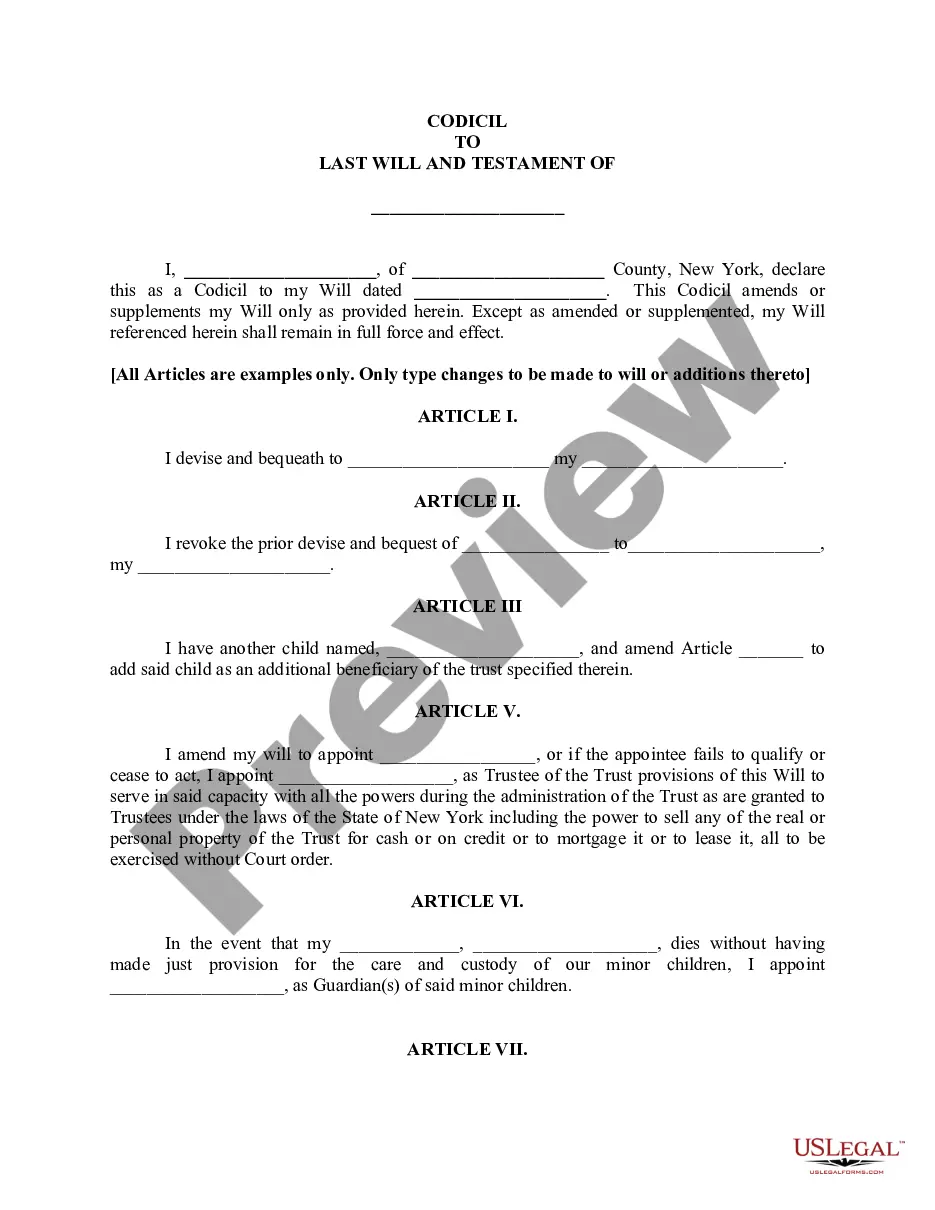

How to fill out Virginia Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

US Legal Forms - among the largest libraries of lawful varieties in the United States - gives an array of lawful record web templates you may down load or printing. Utilizing the internet site, you will get thousands of varieties for company and personal purposes, sorted by categories, claims, or keywords and phrases.You will find the most up-to-date models of varieties just like the Virginia Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions in seconds.

If you currently have a registration, log in and down load Virginia Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions from the US Legal Forms library. The Download option will appear on every develop you view. You get access to all in the past acquired varieties inside the My Forms tab of your respective account.

If you want to use US Legal Forms the very first time, allow me to share simple instructions to help you get started out:

- Be sure to have picked out the right develop for the town/state. Click the Preview option to examine the form`s content. Read the develop description to ensure that you have selected the right develop.

- If the develop doesn`t satisfy your specifications, use the Research field on top of the display to obtain the one which does.

- When you are happy with the shape, verify your selection by visiting the Purchase now option. Then, choose the pricing plan you like and supply your accreditations to register for the account.

- Method the financial transaction. Make use of your credit card or PayPal account to accomplish the financial transaction.

- Select the structure and down load the shape in your system.

- Make modifications. Fill up, modify and printing and indication the acquired Virginia Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

Each web template you put into your account lacks an expiry particular date and it is your own eternally. So, in order to down load or printing another copy, just check out the My Forms area and click about the develop you will need.

Get access to the Virginia Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions with US Legal Forms, the most comprehensive library of lawful record web templates. Use thousands of skilled and express-certain web templates that meet up with your company or personal requires and specifications.