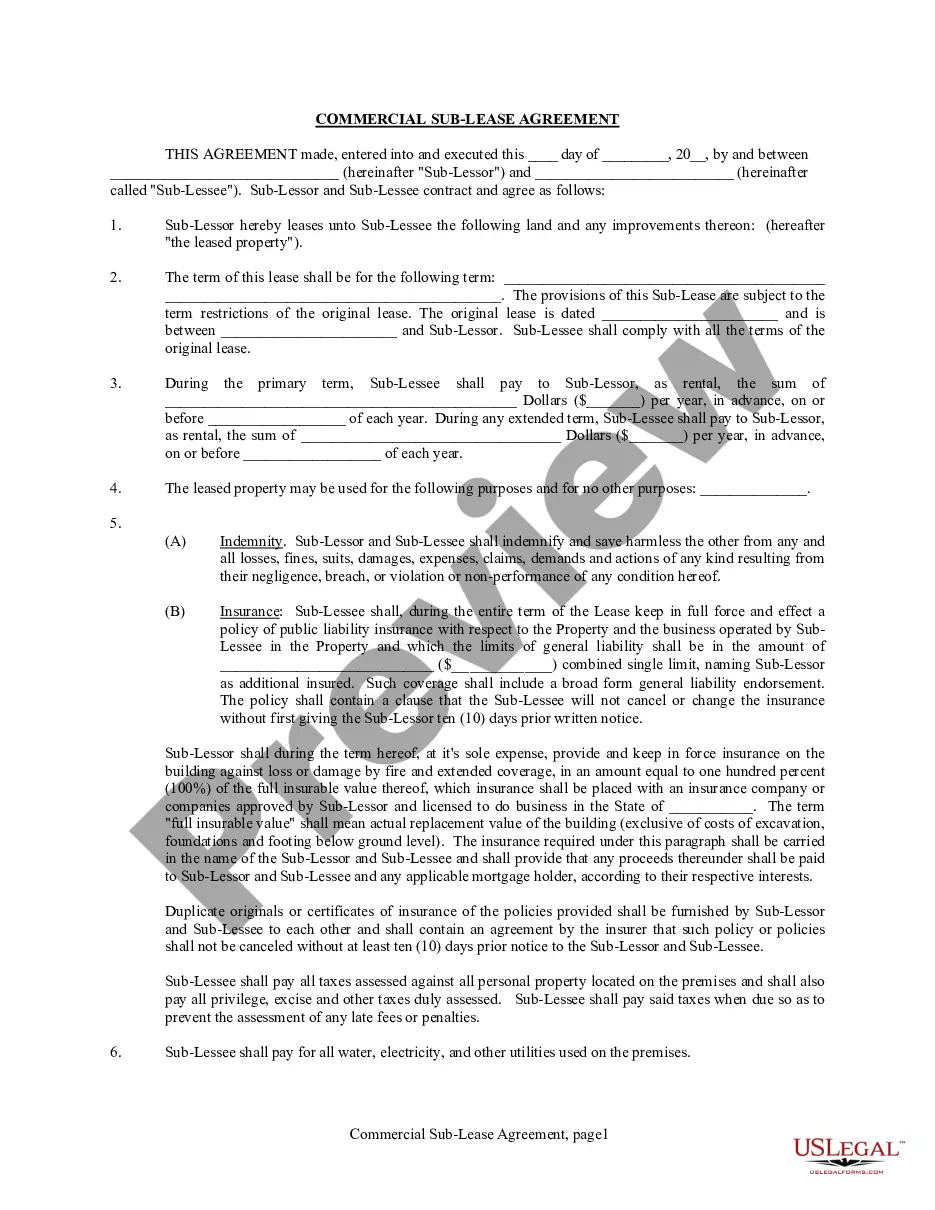

A Virginia Term Sheet — Six Month Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between two parties, where one party (the lender) agrees to lend a specific amount of money to another party (the borrower) for a period of six months. This type of promissory note is commonly used in Virginia and provides a clear understanding of the loan terms to protect the rights and obligations of both parties. Keywords: Virginia, Term Sheet, Six Month Promissory Note, legal document, loan agreement, lender, borrower, terms and conditions, loan terms. There may be different types of Virginia Term Sheet — Six Month Promissory Note, such as: 1. Secured Virginia Term Sheet — Six Month Promissory Note: This type of promissory note includes collateral or security interest provided by the borrower to the lender, ensuring repayment of the loan amount. 2. Unsecured Virginia Term Sheet — Six Month Promissory Note: In this case, the loan does not involve any collateral, making it a riskier option for the lender. The borrower's creditworthiness becomes the key factor in determining the loan approval. 3. Convertible Virginia Term Sheet — Six Month Promissory Note: This type of promissory note allows the lender to convert the loan amount into equity shares or any other form of ownership interest in the borrower's business under certain conditions. 4. Virginia Term Sheet — Six Month Promissory Note with Interest: This variation of the promissory note includes an agreed-upon interest rate that the borrower must pay to the lender on top of the loan amount within the specified time frame. 5. Virginia Term Sheet — Six Month Promissory Note with Balloon Payment: It is a promissory note that requires the borrower to make regular payments throughout the loan period, with a large final payment (balloon payment) due at the end. By clearly understanding the different types and variations of Virginia Term Sheet — Six Month Promissory Note, borrowers and lenders alike can choose the most appropriate option that suits their specific financial needs and risk tolerance. It is essential to consult legal and financial professionals to ensure compliance with applicable laws and regulations before entering into any loan agreement.

Virginia Term Sheet - Six Month Promissory Note

Description

How to fill out Virginia Term Sheet - Six Month Promissory Note?

Choosing the best legitimate file design can be quite a struggle. Needless to say, there are a lot of web templates accessible on the Internet, but how do you get the legitimate form you will need? Utilize the US Legal Forms website. The services offers a large number of web templates, for example the Virginia Term Sheet - Six Month Promissory Note, that can be used for enterprise and personal demands. Every one of the types are checked by specialists and meet federal and state needs.

In case you are already authorized, log in for your profile and click the Download button to get the Virginia Term Sheet - Six Month Promissory Note. Make use of your profile to look with the legitimate types you possess acquired formerly. Visit the My Forms tab of the profile and have an additional version of your file you will need.

In case you are a whole new end user of US Legal Forms, here are basic directions that you can comply with:

- First, make certain you have chosen the proper form to your town/state. You are able to check out the shape using the Preview button and look at the shape explanation to ensure this is the best for you.

- In case the form fails to meet your needs, utilize the Seach area to find the correct form.

- When you are certain that the shape would work, click on the Buy now button to get the form.

- Select the costs plan you would like and enter the necessary information. Create your profile and purchase the order making use of your PayPal profile or bank card.

- Choose the document file format and download the legitimate file design for your gadget.

- Total, change and printing and indicator the obtained Virginia Term Sheet - Six Month Promissory Note.

US Legal Forms may be the largest library of legitimate types that you can see a variety of file web templates. Utilize the company to download professionally-created paperwork that comply with state needs.