Virginia Sample Identity Theft Policy for FCRA and FACTA Compliance

Description

How to fill out Sample Identity Theft Policy For FCRA And FACTA Compliance?

Discovering the right legitimate document template can be a battle. Naturally, there are a variety of web templates available on the Internet, but how do you get the legitimate develop you need? Utilize the US Legal Forms site. The service provides 1000s of web templates, for example the Virginia Sample Identity Theft Policy for FCRA and FACTA Compliance, that can be used for organization and private demands. Each of the varieties are inspected by experts and meet up with federal and state needs.

In case you are previously signed up, log in to the accounts and click the Download key to have the Virginia Sample Identity Theft Policy for FCRA and FACTA Compliance. Utilize your accounts to look from the legitimate varieties you possess ordered previously. Check out the My Forms tab of the accounts and acquire yet another version from the document you need.

In case you are a brand new consumer of US Legal Forms, listed here are basic directions that you should adhere to:

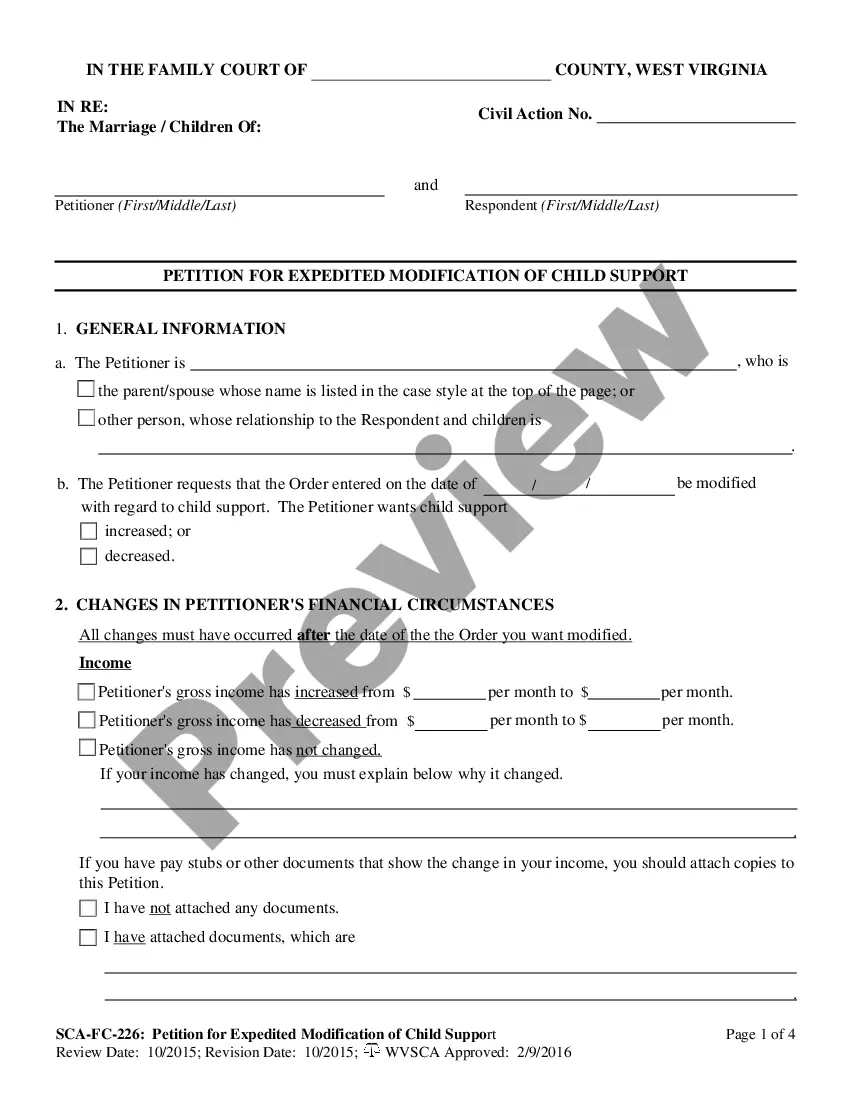

- Very first, ensure you have selected the right develop to your metropolis/state. You can examine the form utilizing the Review key and look at the form outline to make sure it is the right one for you.

- In case the develop will not meet up with your preferences, use the Seach industry to find the proper develop.

- When you are certain that the form is acceptable, go through the Purchase now key to have the develop.

- Choose the rates strategy you want and enter the essential info. Build your accounts and pay money for the transaction using your PayPal accounts or bank card.

- Pick the document formatting and acquire the legitimate document template to the device.

- Full, edit and print out and indication the received Virginia Sample Identity Theft Policy for FCRA and FACTA Compliance.

US Legal Forms is definitely the most significant local library of legitimate varieties for which you will find numerous document web templates. Utilize the service to acquire expertly-manufactured documents that adhere to express needs.

Form popularity

FAQ

The Red Flags Rule calls for financial institutions and creditors to implement red flags to detect and prevent against identity theft. Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers.

Are you up on the Red Flags Rule? (Sometimes it's referred to as one of the Fair Credit Reporting Act's Identity Theft Rules and it appears in the Code of Federal Regulations as ?Detection, Prevention, and Mitigation of Identity Theft.?) The Red Flags Rule requires many businesses and organizations to implement a ...

For example, the address does not match the address on the consumer report; or the Social Security number has not been issued or is listed on the Social Security Administration's Death Master File. Personal identifying information provided is not consistent with other information provided by the customer.

FACTA amends the Fair Credit Reporting Act (FCRA) to: help consumers combat identity theft; establish national standards for the regulation of consumer report information; assist consumers in controlling the type and amount of marketing solicitations they receive; and.

The Fair and Accurate Credit Transactions Act (FACTA) is intended to help prevent identity theft and credit-related fraud in an increasingly online economy. The law requires creditors and reporting agencies to protect consumers' identifying information and take steps to guard against identity theft.

This ITPP addresses 1) identifying relevant identity theft Red Flags for our firm, 2) detecting those Red Flags, 3) responding appropriately to any that are detected to prevent and mitigate identity theft, and 4) updating our ITPP periodically to reflect changes in risks.

In Anti-Money Laundering (AML) compliance, a red flag describes a warning sign that indicates the possibility of money laundering or other criminal activity. Red flags can include transactions involving companies in sanctioned jurisdictions, large volumes, or funds being transmitted from unknown or opaque sources.

A copy of your FTC Identity Theft Report. A government-issued ID with a photo. Proof of your address (mortgage statement, rental agreement, or utilities bill) Any other proof you have of the theft?bills, Internal Revenue Service (IRS) notices, etc.