Virginia Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Virginia Carpentry Services Contract - Self-Employed Independent Contractor?

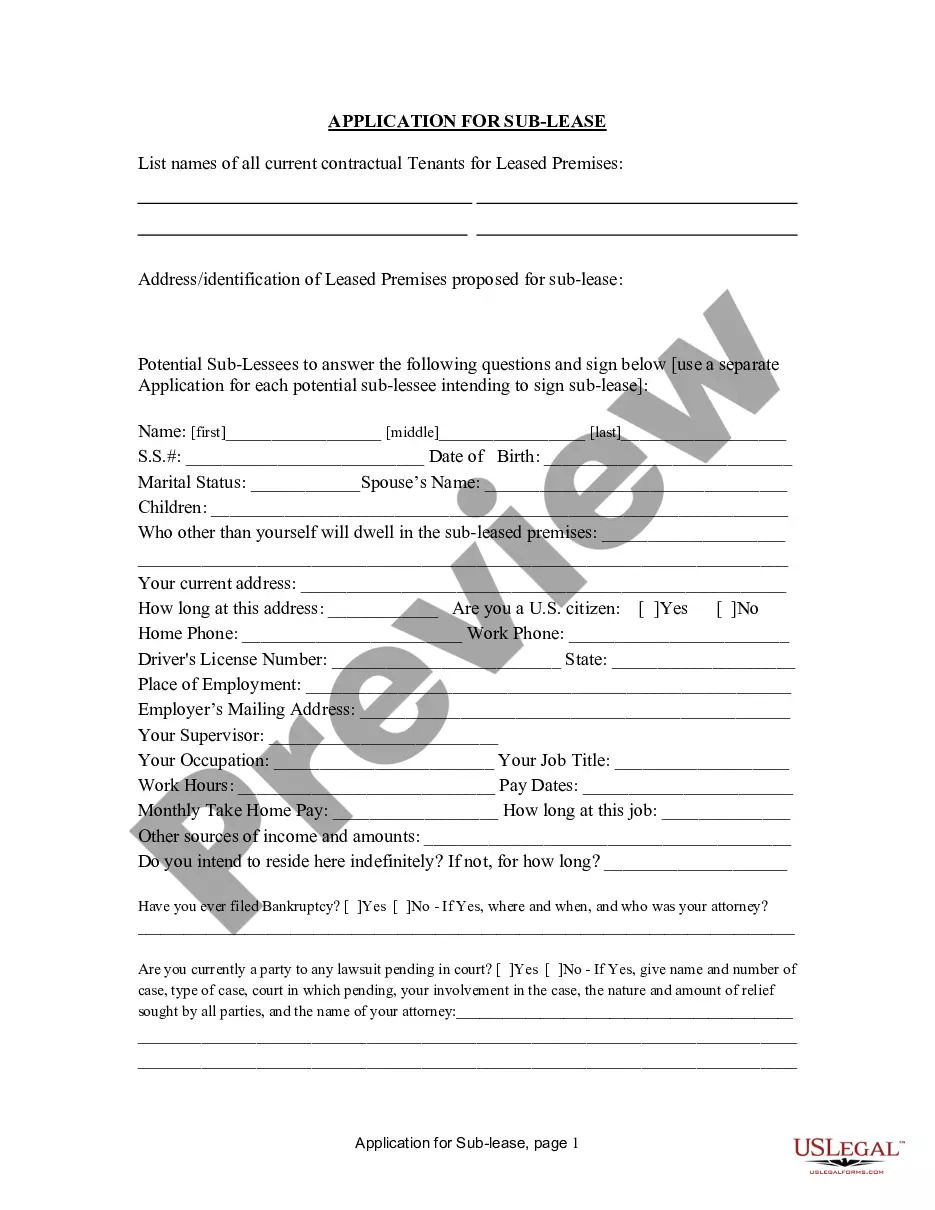

Have you been inside a place in which you will need files for either organization or personal functions almost every working day? There are tons of lawful papers themes available on the Internet, but finding kinds you can depend on is not effortless. US Legal Forms gives a huge number of kind themes, like the Virginia Carpentry Services Contract - Self-Employed Independent Contractor, which are composed in order to meet state and federal specifications.

Should you be currently acquainted with US Legal Forms web site and also have an account, basically log in. Next, it is possible to obtain the Virginia Carpentry Services Contract - Self-Employed Independent Contractor web template.

If you do not offer an accounts and wish to begin using US Legal Forms, adopt these measures:

- Get the kind you require and make sure it is to the appropriate town/region.

- Take advantage of the Review key to examine the form.

- Look at the description to ensure that you have chosen the proper kind.

- In case the kind is not what you are looking for, make use of the Research field to obtain the kind that meets your needs and specifications.

- When you obtain the appropriate kind, just click Get now.

- Choose the prices prepare you desire, fill in the required information and facts to produce your account, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Select a handy document file format and obtain your version.

Locate each of the papers themes you might have purchased in the My Forms food selection. You can aquire a extra version of Virginia Carpentry Services Contract - Self-Employed Independent Contractor at any time, if needed. Just click on the necessary kind to obtain or print the papers web template.

Use US Legal Forms, by far the most comprehensive assortment of lawful types, to conserve efforts and stay away from mistakes. The support gives expertly produced lawful papers themes which can be used for an array of functions. Create an account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...