Virginia Audio Systems Contractor Agreement - Self-Employed

Description

How to fill out Virginia Audio Systems Contractor Agreement - Self-Employed?

If you have to full, obtain, or print lawful papers web templates, use US Legal Forms, the biggest collection of lawful types, which can be found online. Use the site`s easy and convenient research to discover the papers you will need. Various web templates for organization and individual reasons are categorized by groups and says, or keywords and phrases. Use US Legal Forms to discover the Virginia Audio Systems Contractor Agreement - Self-Employed within a couple of mouse clicks.

Should you be already a US Legal Forms client, log in to the accounts and click on the Download option to obtain the Virginia Audio Systems Contractor Agreement - Self-Employed. You can even accessibility types you in the past saved within the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that appropriate town/nation.

- Step 2. Make use of the Review solution to look through the form`s content. Don`t neglect to learn the description.

- Step 3. Should you be unhappy with the develop, utilize the Search industry towards the top of the monitor to discover other versions in the lawful develop template.

- Step 4. When you have found the shape you will need, click the Buy now option. Opt for the rates strategy you like and put your qualifications to sign up to have an accounts.

- Step 5. Method the transaction. You can use your charge card or PayPal accounts to finish the transaction.

- Step 6. Pick the formatting in the lawful develop and obtain it on your own device.

- Step 7. Comprehensive, revise and print or indication the Virginia Audio Systems Contractor Agreement - Self-Employed.

Each and every lawful papers template you buy is your own property forever. You possess acces to every single develop you saved within your acccount. Click the My Forms portion and select a develop to print or obtain again.

Compete and obtain, and print the Virginia Audio Systems Contractor Agreement - Self-Employed with US Legal Forms. There are millions of expert and express-specific types you may use for the organization or individual demands.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

An employee is on a company's payroll and receives wages and benefits in exchange for following the organization's guidelines and remaining loyal. A contractor is an independent worker who has autonomy and flexibility but does not receive benefits such as health insurance and paid time off.

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.

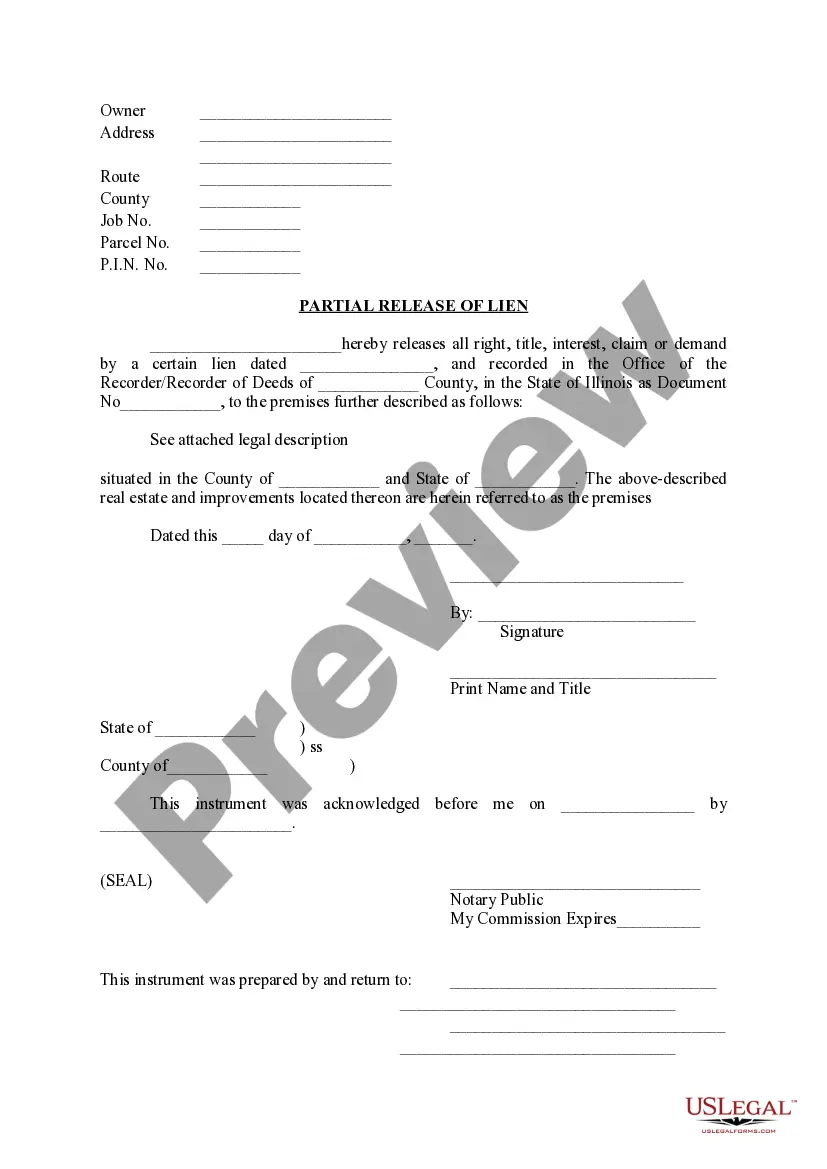

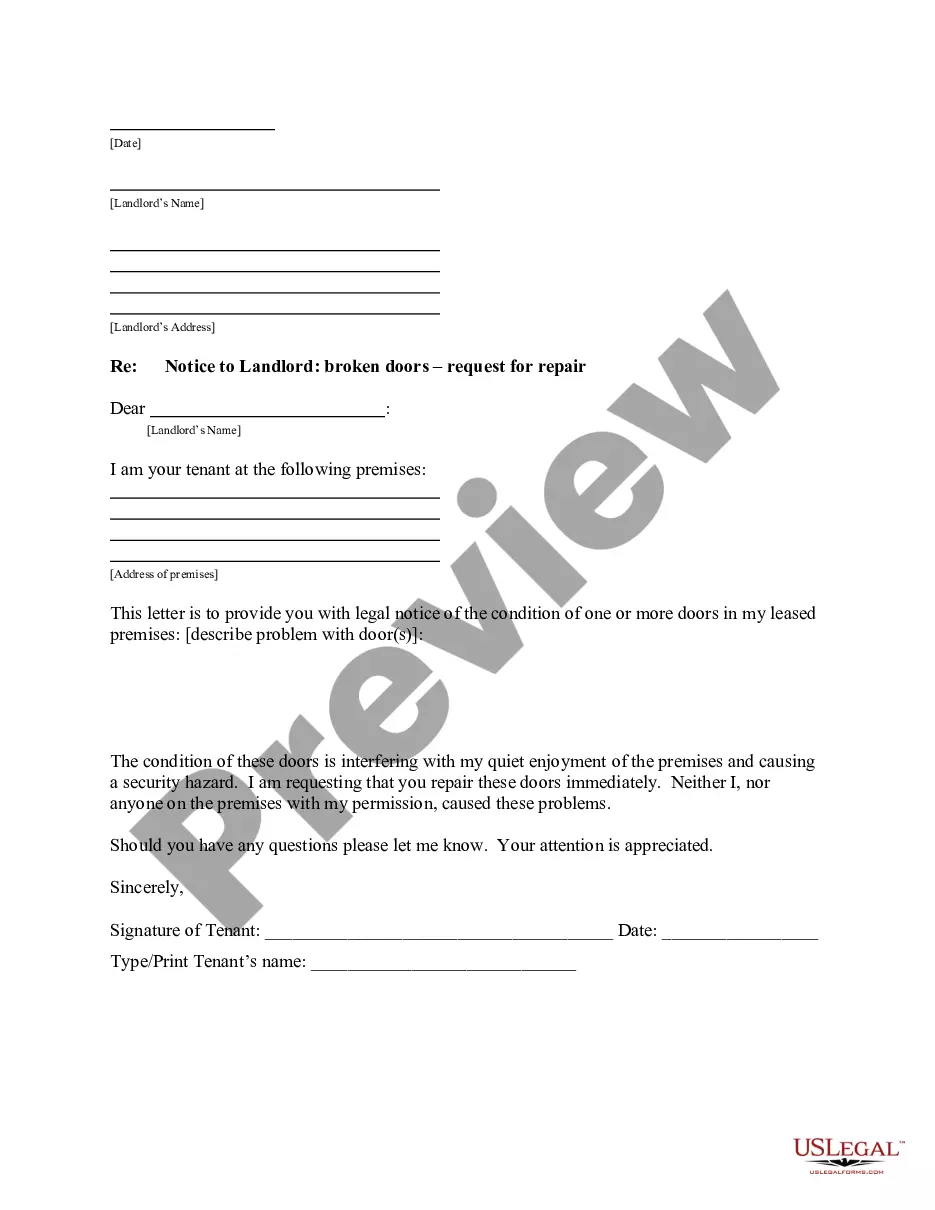

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax.

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.