Virginia Moving Services Contract - Self-Employed

Description

How to fill out Virginia Moving Services Contract - Self-Employed?

If you wish to total, acquire, or produce authorized record themes, use US Legal Forms, the greatest collection of authorized varieties, which can be found on-line. Make use of the site`s basic and convenient research to find the documents you need. A variety of themes for company and person reasons are sorted by types and suggests, or search phrases. Use US Legal Forms to find the Virginia Moving Services Contract - Self-Employed with a few clicks.

If you are previously a US Legal Forms consumer, log in for your accounts and then click the Download option to obtain the Virginia Moving Services Contract - Self-Employed. You can even access varieties you formerly saved from the My Forms tab of your respective accounts.

If you work with US Legal Forms the first time, refer to the instructions below:

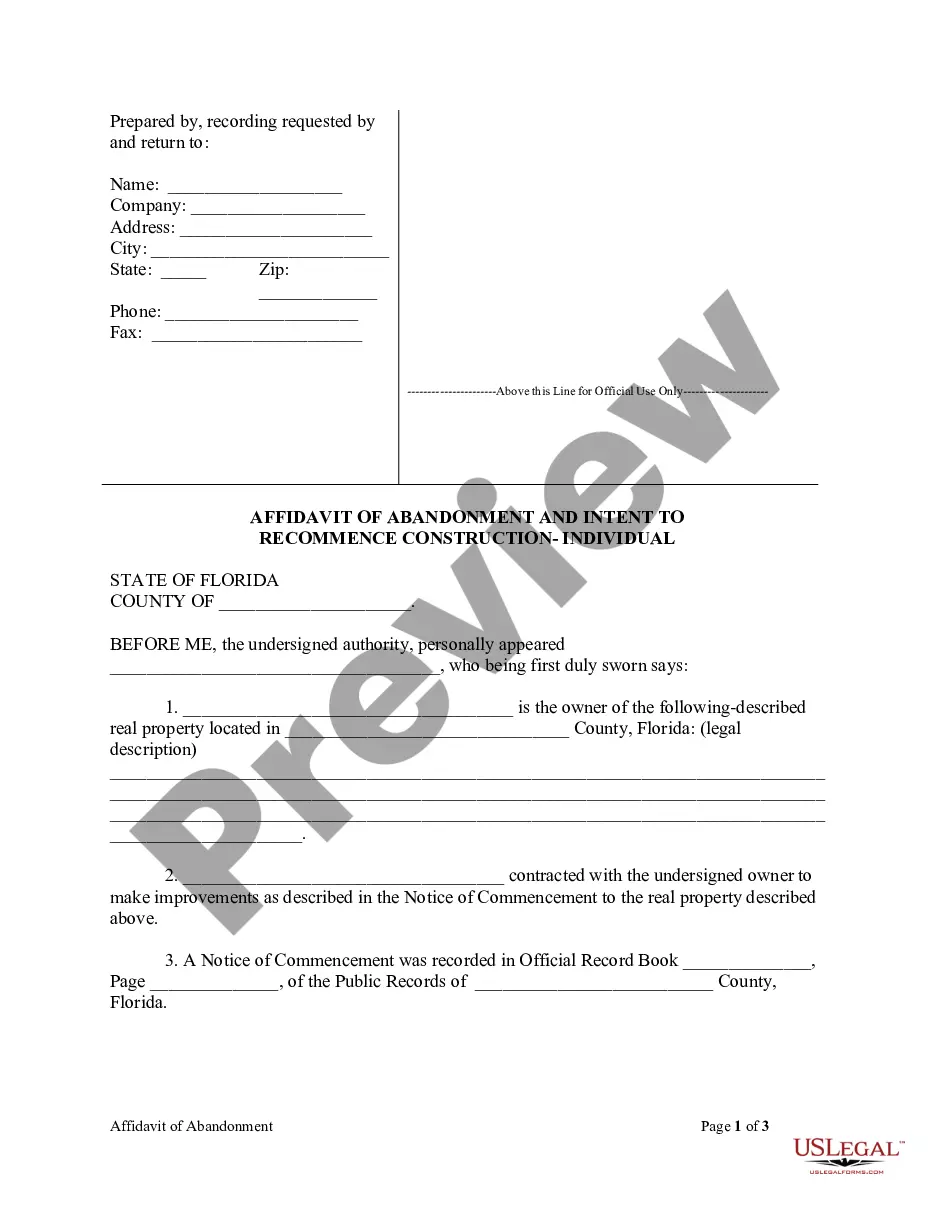

- Step 1. Be sure you have selected the shape for that right metropolis/country.

- Step 2. Make use of the Preview choice to look over the form`s content material. Do not neglect to learn the information.

- Step 3. If you are unsatisfied with all the kind, use the Look for discipline near the top of the monitor to locate other variations in the authorized kind web template.

- Step 4. After you have discovered the shape you need, click the Acquire now option. Pick the pricing prepare you choose and include your qualifications to register for an accounts.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Choose the structure in the authorized kind and acquire it on your system.

- Step 7. Complete, revise and produce or signal the Virginia Moving Services Contract - Self-Employed.

Each authorized record web template you buy is the one you have permanently. You might have acces to every kind you saved with your acccount. Go through the My Forms area and decide on a kind to produce or acquire again.

Compete and acquire, and produce the Virginia Moving Services Contract - Self-Employed with US Legal Forms. There are millions of professional and state-distinct varieties you may use for your personal company or person requirements.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.