Virginia Specialty Services Contact - Self-Employed

Description

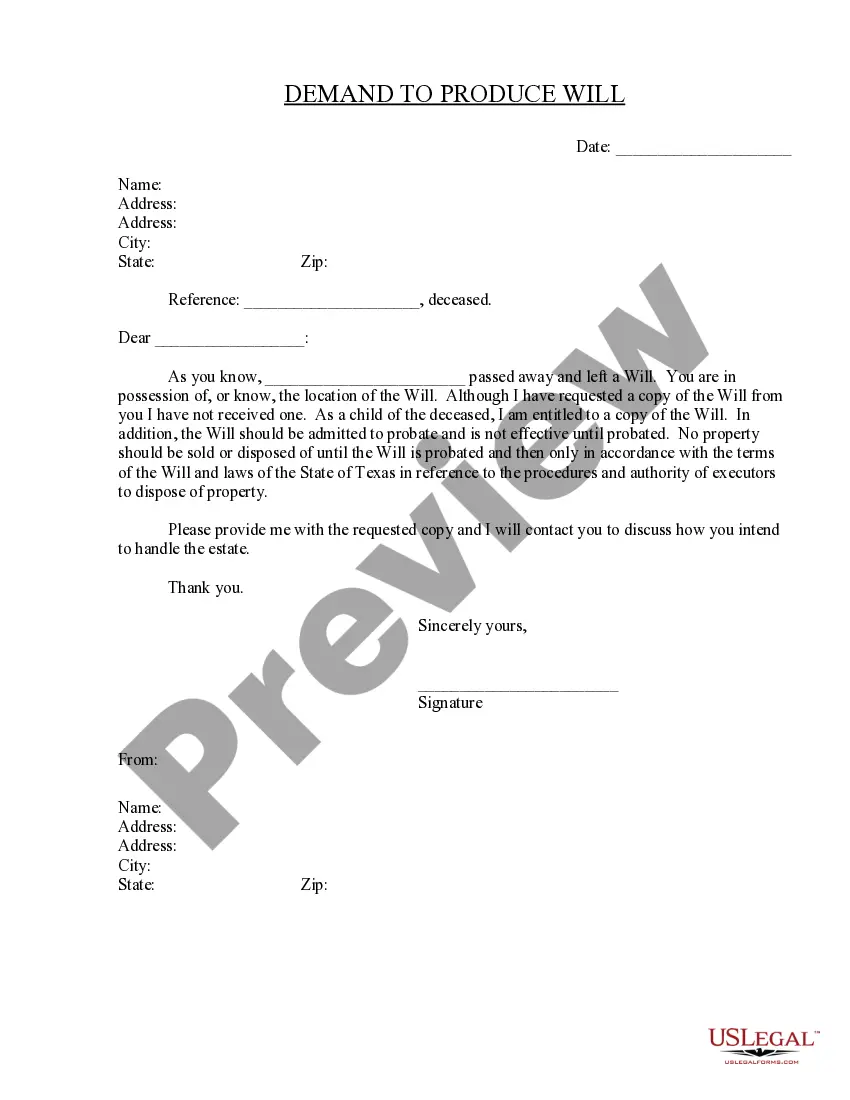

How to fill out Virginia Specialty Services Contact - Self-Employed?

If you need to full, down load, or produce authorized file templates, use US Legal Forms, the greatest collection of authorized types, which can be found on-line. Utilize the site`s simple and hassle-free search to discover the files you want. A variety of templates for company and person functions are sorted by categories and suggests, or search phrases. Use US Legal Forms to discover the Virginia Specialty Services Contact - Self-Employed in a couple of click throughs.

In case you are previously a US Legal Forms consumer, log in to your account and click on the Obtain option to get the Virginia Specialty Services Contact - Self-Employed. Also you can gain access to types you previously downloaded in the My Forms tab of your account.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape for that proper city/nation.

- Step 2. Use the Preview option to look through the form`s content material. Do not neglect to see the outline.

- Step 3. In case you are not satisfied using the develop, take advantage of the Lookup field towards the top of the display screen to discover other versions in the authorized develop format.

- Step 4. Upon having identified the shape you want, click on the Get now option. Pick the rates strategy you prefer and add your credentials to sign up to have an account.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal account to accomplish the purchase.

- Step 6. Find the file format in the authorized develop and down load it in your system.

- Step 7. Total, change and produce or sign the Virginia Specialty Services Contact - Self-Employed.

Each and every authorized file format you acquire is your own eternally. You possess acces to every single develop you downloaded within your acccount. Click the My Forms section and decide on a develop to produce or down load yet again.

Remain competitive and down load, and produce the Virginia Specialty Services Contact - Self-Employed with US Legal Forms. There are thousands of specialist and condition-specific types you may use for your personal company or person needs.

Form popularity

FAQ

In order to be eligible to receive unemployment benefits, you must have sufficient earnings in your base period from a covered employer. The base period is defined as the first four of the last five completed calendar quarters. Without sufficient earnings, you will not be eligible to receive benefits.

You may contact the VEC Customer Contact Center at 1-866-832-2363 (Available am to pm, Monday - Friday.

You will need to call 866-832-2363 (Available am to pm, Monday - Friday. Closed Saturday, Sunday and state holidays.) to resolve the problem or reopen your claim.

You will be disqualified if the deputy determines that you quit your job without good cause, or you were fired from your job for misconduct in connection with your work. You and your employer have the right to appeal the deputy's determination if either of you disagrees with the results.

Sometimes you just have to talk to a live person to get answers to your questions. In that case, you can call the VA Unemployment Phone Number: Toll Free: 1-866-832-2363.

Q: When can I expect my first payment? A: You should receive your payment within 14 calendar days after you file your weekly request for payment of benefits. You may not receive your payment on the same day of the week each time you file your request for payment.

How can I get information on the status of my claim? You can obtain this information through the Voice Response System (1-800-897-5630). Listen to the menu, and select "Claims and Benefits" (option 1), and enter your Social Security number and PIN.

Freelancers, self-employed workers now eligible for unemployment benefits in Virginia. Under the CARES Act, self-employed workers and independent contractors can apply for temporary unemployment benefits.

Existing claimants who are eligible for PUA log in here to file their weekly claims. To find out your claim's status, call the Voice Response System at 800-897-5630, and choose Claims and Benefits.

More info

Substance Abuse Disorders Temporary Assistance Needy Families TANK Supported Employment Self Employment Enterprises Employment Service Organizations Resources Meeting Minutes Download meeting minutes Form Download Transcript Form Download Schedule PDF Deafness Programs and Services This page provides an overview of the program offered by the Canada Revenue Agency (CRA). The CRA supports those individuals who are deaf and hard of hearing by providing financial and legal help and by assisting them in gaining employment. To register for this program, follow the steps below: Please fill out the registration form to register your application. Note : The above information is only used to obtain an application or a copy of your tax return. It cannot be used to provide any other form of support. Once your application has been approved, and you have received a reference number, you will have the following: Your application number, which will be sent to you in the mail.