Virginia Appliance Refinish Services Contract - Self-Employed

Description

How to fill out Virginia Appliance Refinish Services Contract - Self-Employed?

Have you been in a situation the place you will need documents for either organization or person purposes virtually every day time? There are a lot of lawful papers templates accessible on the Internet, but locating versions you can rely on isn`t simple. US Legal Forms offers a large number of develop templates, such as the Virginia Appliance Refinish Services Contract - Self-Employed, which are created in order to meet state and federal needs.

Should you be currently familiar with US Legal Forms web site and possess a free account, basically log in. After that, you can obtain the Virginia Appliance Refinish Services Contract - Self-Employed format.

Unless you have an account and would like to begin to use US Legal Forms, follow these steps:

- Find the develop you need and make sure it is to the appropriate metropolis/area.

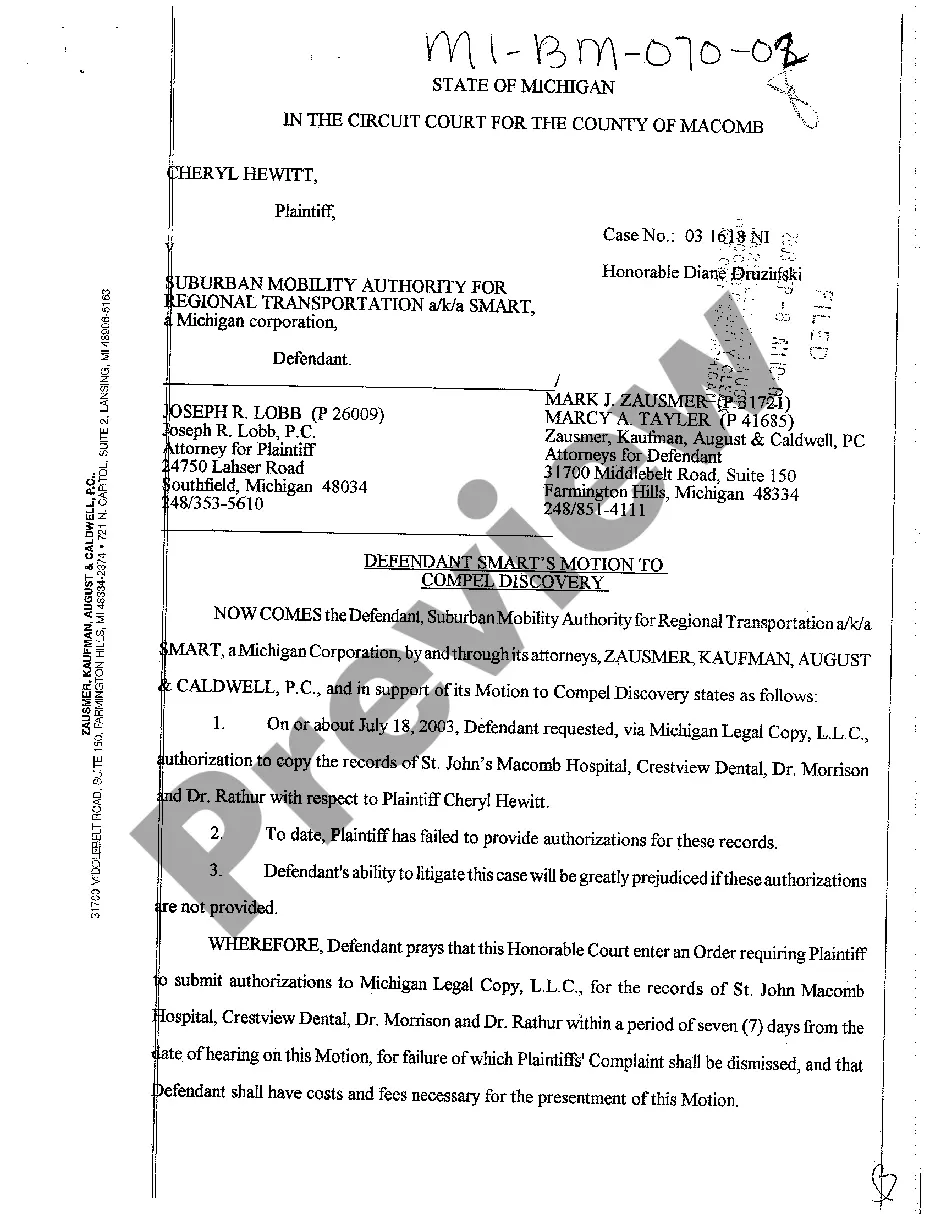

- Utilize the Preview option to examine the form.

- See the information to ensure that you have selected the appropriate develop.

- In the event the develop isn`t what you`re looking for, utilize the Research area to obtain the develop that suits you and needs.

- If you obtain the appropriate develop, click on Acquire now.

- Pick the costs plan you want, fill in the desired details to generate your bank account, and buy your order using your PayPal or bank card.

- Choose a hassle-free file format and obtain your duplicate.

Locate each of the papers templates you possess bought in the My Forms menu. You can aquire a further duplicate of Virginia Appliance Refinish Services Contract - Self-Employed whenever, if needed. Just click the needed develop to obtain or produce the papers format.

Use US Legal Forms, by far the most comprehensive assortment of lawful varieties, to save lots of time and avoid mistakes. The assistance offers skillfully produced lawful papers templates that can be used for a selection of purposes. Make a free account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

Five U.S. states (New Hampshire, Oregon, Montana, Alaska and Delaware) do not impose any general, statewide sales tax on goods or services. Of the 45 states remaining, four (Hawaii, South Dakota, New Mexico and West Virginia) tax services by default, with exceptions only for services specifically exempted in the law.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

If you work for an employer, you're an employee. If you're self-employed, you're an independent contractor.

Depending on your state, the installation and warranty might be subject to sales tax. In other instances, if you provide a service in conjunction with a tangible product, but the product is secondary or incidental, the service might not be taxable at all.

Charges for services generally are exempt from the retail sales and use tax. However, services provided in connection with sales of tangible personal property are taxable.

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property.

The Tax Commissioner agreed that separately stated repair or installation charges are exempt from the tax but also stated that separately stated mileage, road service and similar charges are part of the taxable sales price of tangible personal property transferred to customers in repair transactions.

Legal methods you can use to avoid paying taxes include things such as tax-advantaged accounts (401(k)s and IRAs), as well as claiming 1099 deductions and tax credits. Being a freelancer or an independent contractor comes with various 1099 benefits, such as the freedom to set your own hours and be your own boss.

Sales of tangible personal property are subject to New York sales tax unless they are specifically exempt. Sales of services are generally exempt from New York sales tax unless they are specifically taxable.

Virginia law generally treats businesses that sell and install tangible personal property that becomes real property upon installation as contractors. As contractors, such businesses must pay the tax on the purchase price of the materials and not charge sales tax to their customers.