Virginia Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Virginia Temporary Worker Agreement - Self-Employed Independent Contractor?

Are you inside a position the place you require paperwork for sometimes company or specific functions nearly every day? There are a variety of lawful document layouts available online, but getting ones you can depend on isn`t easy. US Legal Forms offers 1000s of type layouts, much like the Virginia Temporary Worker Agreement - Self-Employed Independent Contractor, which can be published to satisfy federal and state specifications.

Should you be already familiar with US Legal Forms site and also have your account, merely log in. Next, you can down load the Virginia Temporary Worker Agreement - Self-Employed Independent Contractor web template.

Should you not provide an accounts and wish to begin to use US Legal Forms, follow these steps:

- Obtain the type you need and make sure it is for your correct area/county.

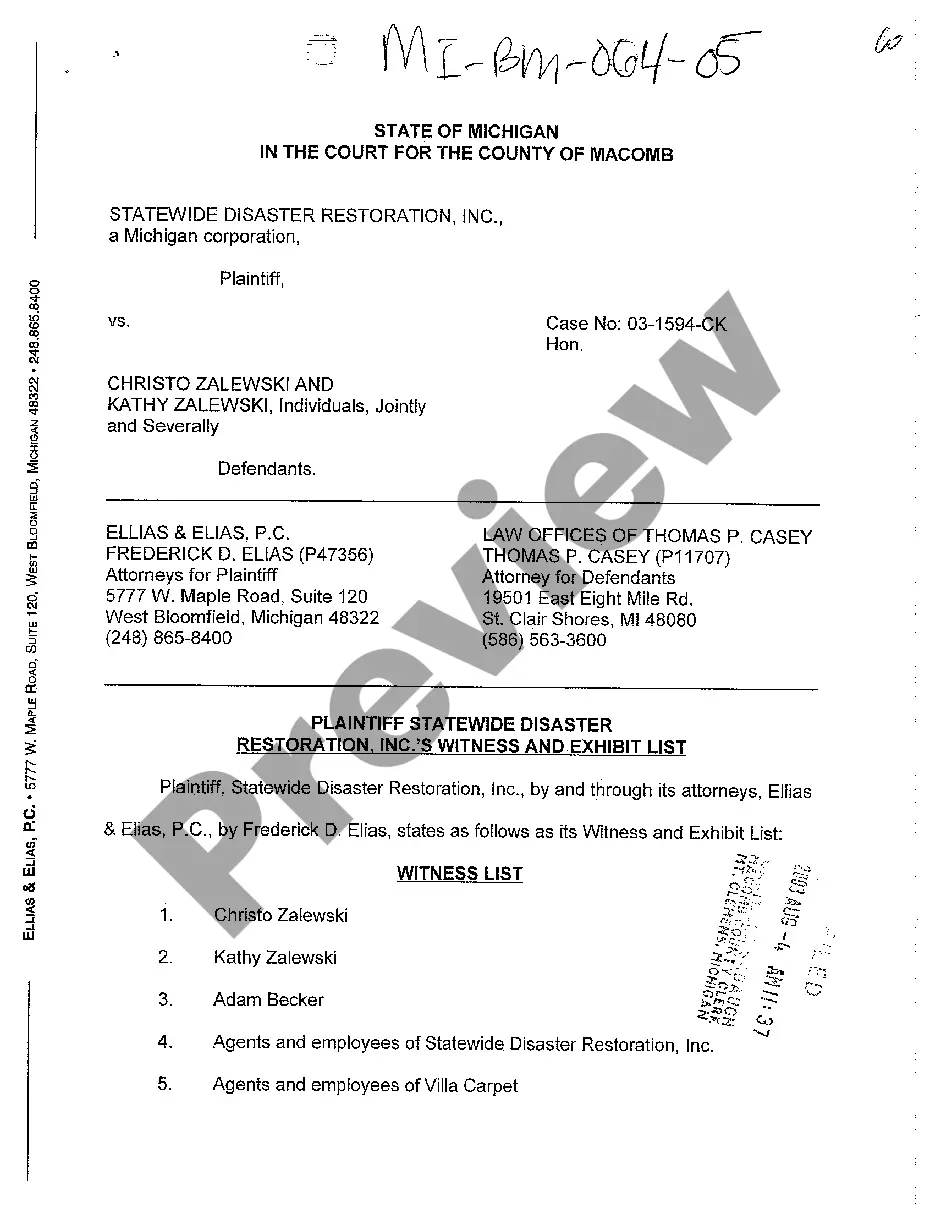

- Make use of the Review switch to check the form.

- Browse the outline to ensure that you have chosen the proper type.

- When the type isn`t what you`re trying to find, take advantage of the Look for area to obtain the type that fits your needs and specifications.

- When you obtain the correct type, click on Acquire now.

- Opt for the rates strategy you would like, fill in the necessary details to make your account, and pay money for the order making use of your PayPal or charge card.

- Pick a practical document format and down load your backup.

Locate all the document layouts you may have purchased in the My Forms menu. You can obtain a further backup of Virginia Temporary Worker Agreement - Self-Employed Independent Contractor any time, if necessary. Just go through the needed type to down load or print out the document web template.

Use US Legal Forms, probably the most substantial selection of lawful forms, in order to save time as well as avoid faults. The assistance offers appropriately made lawful document layouts which you can use for a variety of functions. Create your account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

Do I really need to get a business license in Virginia? Yes! It's true that a lot of self-employed individuals, particularly those who work from home, never get a state or local Virginia business license.

Freelancers, self-employed workers now eligible for unemployment benefits in Virginia. Under the CARES Act, self-employed workers and independent contractors can apply for temporary unemployment benefits.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

You will use the online portal to file the weekly claim or call the interactive voice response number.File Your Weekly Continued Claim by Internet. English. Spanish.File Your Weekly Continued Claim by Telephone: 1-800-897-5630.

To qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic.

More info

ENDS Free Temporary Employment Contract Template Templates — The best part is to make your new template free for everybody!.