Virginia Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Virginia Account Executive Agreement - Self-Employed Independent Contractor?

Are you currently inside a position where you will need files for possibly organization or personal purposes just about every working day? There are a variety of legal file web templates accessible on the Internet, but finding versions you can rely is not simple. US Legal Forms delivers a large number of type web templates, much like the Virginia Account Executive Agreement - Self-Employed Independent Contractor, that are published to fulfill federal and state demands.

Should you be already informed about US Legal Forms web site and possess an account, simply log in. After that, you may down load the Virginia Account Executive Agreement - Self-Employed Independent Contractor template.

Should you not have an accounts and need to start using US Legal Forms, adopt these measures:

- Discover the type you require and make sure it is to the appropriate city/county.

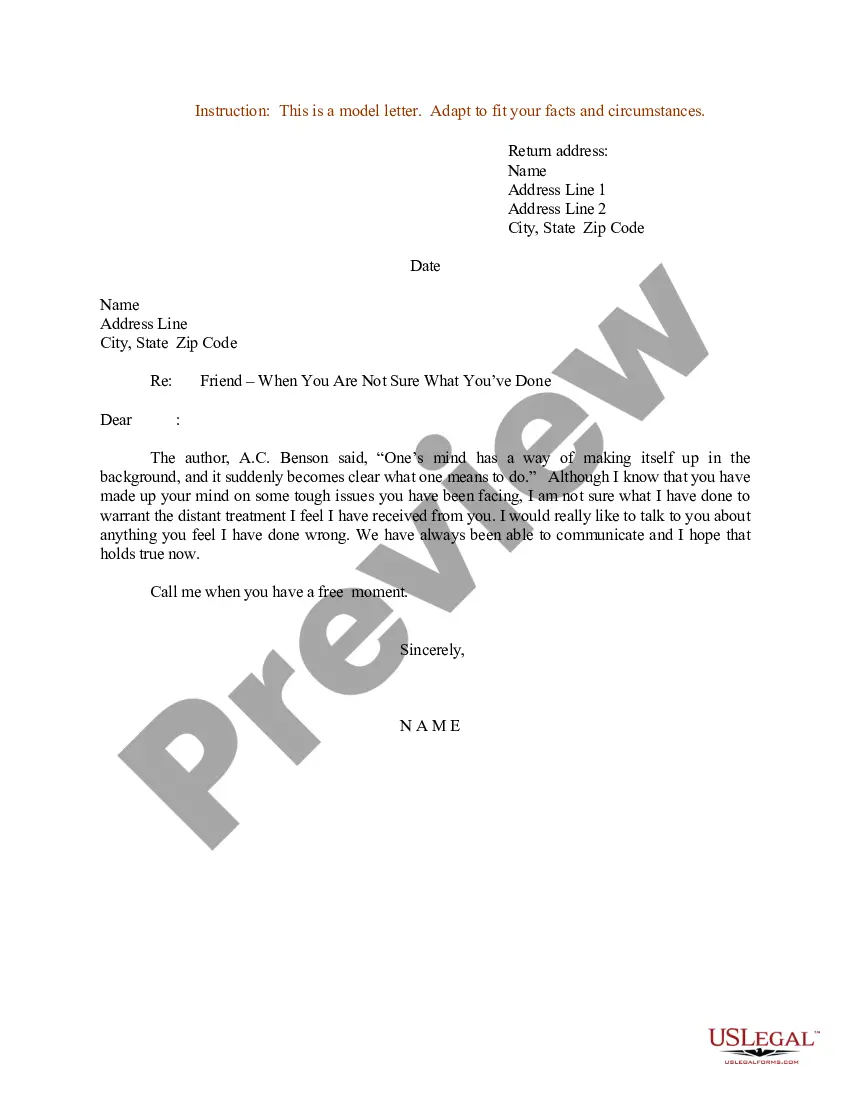

- Utilize the Review key to examine the shape.

- Browse the information to actually have chosen the right type.

- In case the type is not what you are searching for, take advantage of the Look for field to find the type that fits your needs and demands.

- When you find the appropriate type, just click Purchase now.

- Pick the pricing prepare you desire, complete the required details to create your money, and pay for the transaction using your PayPal or credit card.

- Select a convenient paper formatting and down load your duplicate.

Find all of the file web templates you may have bought in the My Forms menu. You can obtain a more duplicate of Virginia Account Executive Agreement - Self-Employed Independent Contractor any time, if possible. Just select the required type to down load or print out the file template.

Use US Legal Forms, the most extensive collection of legal types, to conserve time and stay away from mistakes. The service delivers professionally created legal file web templates that can be used for an array of purposes. Produce an account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Here is a list of some of the things you can write off on your 1099 if you are self-employed:Mileage and Car Expenses.Home Office Deductions.Internet and Phone Bills.Health Insurance.Travel Expenses.Meals.Interest on Loans.Subscriptions.More items...?

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Accrual Method Accounting When you operate a business providing services as an independent contractor, you have the option of using the accrual method of accounting for your contractor earnings and expenses while reporting your personal income and deductions using the cash method.