Virginia Self-Employed Referee Or Umpire Employment Contract

Description

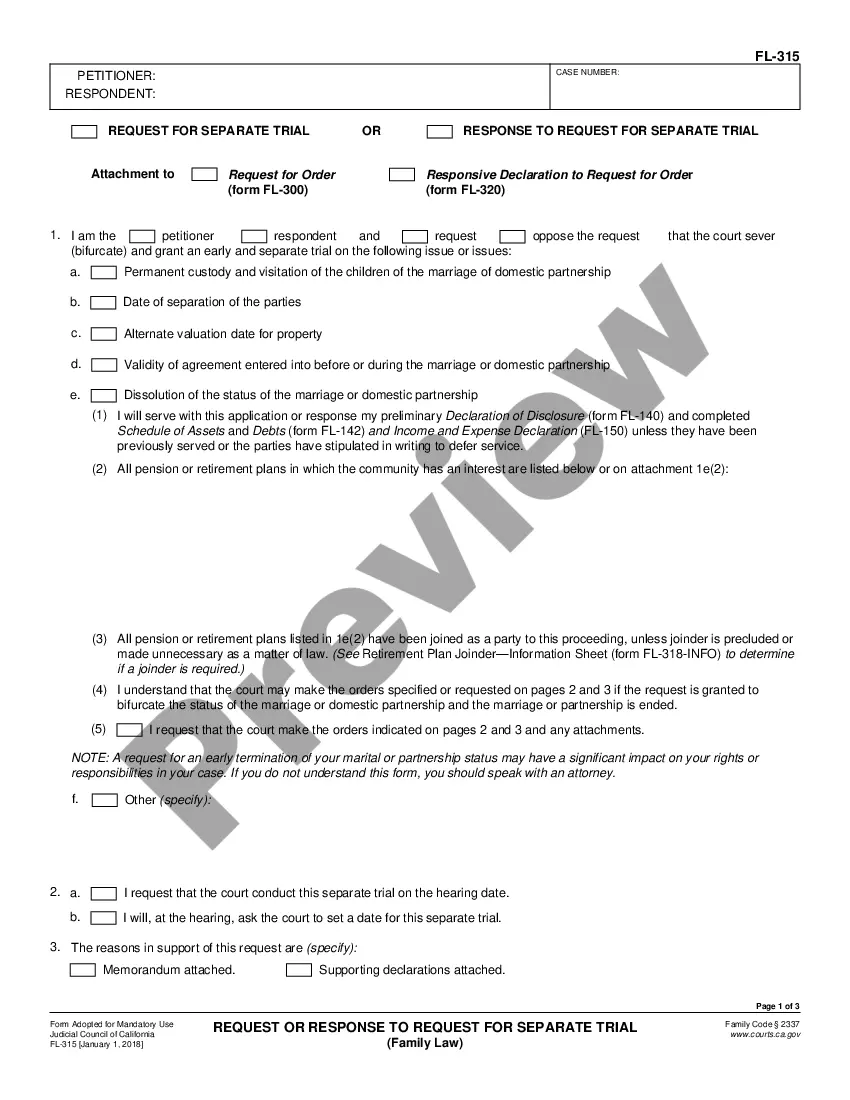

How to fill out Virginia Self-Employed Referee Or Umpire Employment Contract?

It is possible to invest several hours online attempting to find the lawful file format that meets the federal and state needs you require. US Legal Forms supplies thousands of lawful varieties that are analyzed by specialists. It is possible to down load or printing the Virginia Self-Employed Referee Or Umpire Employment Contract from our support.

If you have a US Legal Forms profile, you may log in and click on the Download option. Next, you may total, revise, printing, or indicator the Virginia Self-Employed Referee Or Umpire Employment Contract. Every single lawful file format you purchase is yours for a long time. To have one more duplicate for any purchased develop, go to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms web site initially, adhere to the straightforward directions below:

- First, ensure that you have chosen the right file format to the county/city that you pick. Browse the develop outline to make sure you have picked the proper develop. If available, take advantage of the Preview option to check with the file format at the same time.

- If you would like locate one more edition of the develop, take advantage of the Look for discipline to find the format that suits you and needs.

- After you have discovered the format you want, click Purchase now to carry on.

- Select the costs program you want, key in your references, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal profile to fund the lawful develop.

- Select the structure of the file and down load it for your gadget.

- Make modifications for your file if required. It is possible to total, revise and indicator and printing Virginia Self-Employed Referee Or Umpire Employment Contract.

Download and printing thousands of file templates using the US Legal Forms website, that provides the most important assortment of lawful varieties. Use skilled and express-certain templates to tackle your small business or individual requirements.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Also, officiating requires skill and expertise (criteria 4); the officials provide their own equipment (criteria 5); and the intentions of the parties regarding their relationship as reflected in the contracts signed by officials, the Officials' Manual, and the PIAA Constitution and Bylaws are that referees are

According to a report from 2019, it is estimated that the average NFL official makes about $205,000 a year. Each official's pay will depend on the position they have on the crew, as well as how long they have been in the league. Officials are considered to be part-time employees of the NFL.

On June 14, 2019, the D.C. Court of Appeals issued its decision in PIAA v.

Employers cannot force an employee to participate in direct deposit of his or her wages or any other payment system which does not allow for the employee to receive cash or a check made payable to him or her.

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

An athlete is an employee or an independent contractor depending upon the sport involved and the terms of the contract under which he/she performs. In team sports, such as football and baseball, where the player competes under the direction and control of a coach or manager, he/she is an employee.

On June 14, 2019, the D.C. Court of Appeals issued its decision in PIAA v.

Job Summary:The Umpire will maintain standards of play at sporting events, ensure rules are followed, and determine penalties for infractions according to established regulations.

Direct deposit.Employers cannot require the direct deposit of paychecks. However, if an employee who is hired after January 1, 2010, fails to designate an account for the receipt of direct deposits, the employer may pay wages or salaries to the employee by credit to a prepaid debit card or card account.