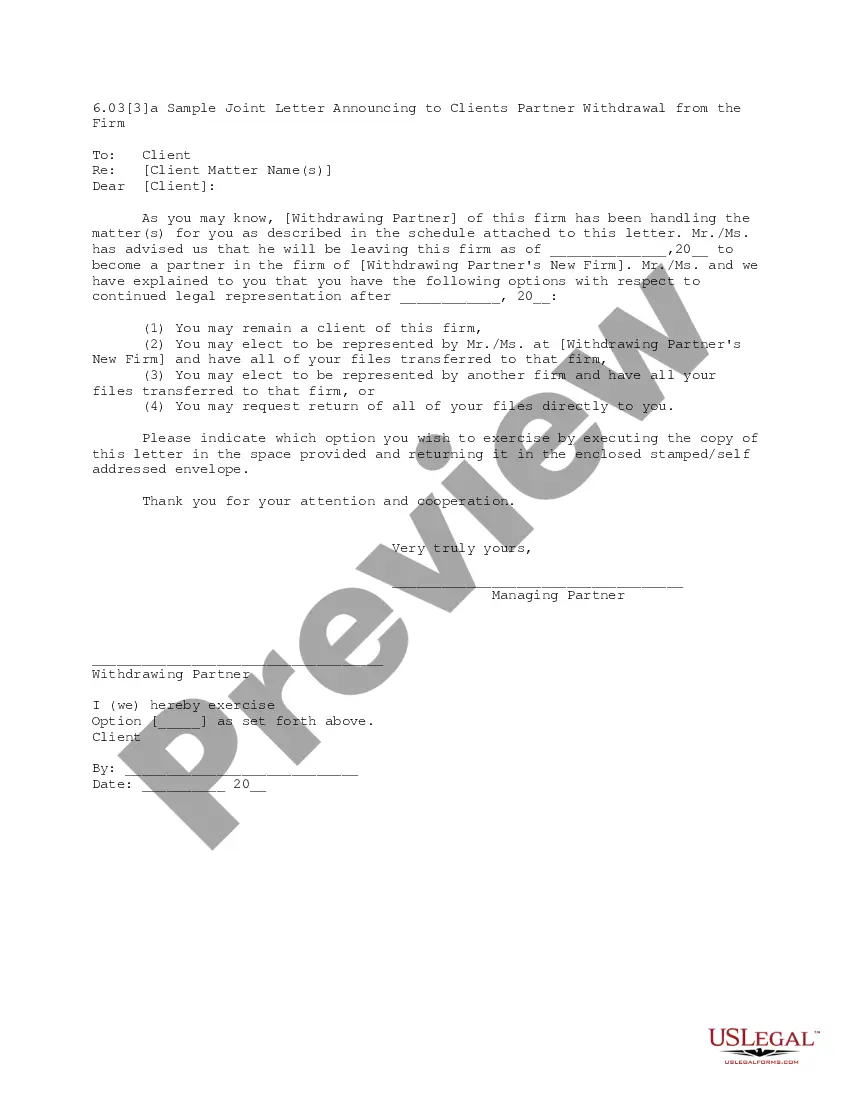

This is a letter from a withdrawing partner to the clients he has represented at his former firm. The letter is also mailed with an enclosure that gives the clients the options of transferring their files with the withdrawing attorney, remaining with the same firm, or choosing another firm to represent them. This letter includes an example of the enclosure with the file transfer options.

Virginia Letter from Individual Partner to Clients

Description

How to fill out Letter From Individual Partner To Clients?

If you have to complete, acquire, or printing lawful document themes, use US Legal Forms, the most important selection of lawful types, that can be found on the Internet. Make use of the site`s simple and easy handy research to get the papers you want. Different themes for organization and individual reasons are categorized by categories and suggests, or search phrases. Use US Legal Forms to get the Virginia Letter from Individual Partner to Clients within a handful of mouse clicks.

When you are presently a US Legal Forms customer, log in to your account and click on the Down load key to find the Virginia Letter from Individual Partner to Clients. You can even access types you in the past delivered electronically inside the My Forms tab of your own account.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form to the right metropolis/country.

- Step 2. Use the Review option to look through the form`s content material. Don`t forget to read through the outline.

- Step 3. When you are not happy together with the develop, make use of the Lookup industry on top of the monitor to locate other types of your lawful develop template.

- Step 4. When you have identified the form you want, go through the Buy now key. Opt for the prices prepare you prefer and put your qualifications to sign up on an account.

- Step 5. Process the purchase. You may use your Мisa or Ьastercard or PayPal account to perform the purchase.

- Step 6. Pick the format of your lawful develop and acquire it in your product.

- Step 7. Full, change and printing or signal the Virginia Letter from Individual Partner to Clients.

Each lawful document template you buy is your own property eternally. You may have acces to each develop you delivered electronically with your acccount. Go through the My Forms portion and choose a develop to printing or acquire again.

Remain competitive and acquire, and printing the Virginia Letter from Individual Partner to Clients with US Legal Forms. There are thousands of expert and status-certain types you may use for the organization or individual needs.

Form popularity

FAQ

Form 502PTET will allow qualifying pass-through entities to pay Virginia tax at a rate of 5.75% on behalf of their owners at the pass-through entity level rather than the owners paying the tax at the individual level, consequently avoiding the state and local tax cap on Schedule A of Form 1040.

Beginning January 1, 2020, Employee's Withholding Allowance Certificate (Form W-4) from the Internal Revenue Service (IRS) will be used for federal income tax withholding only. You must file the state form Employee's Withholding Allowance Certificate (DE 4) to determine the appropriate California PIT withholding.

How to fill out the updated W-4 tax form - YouTube YouTube Start of suggested clip End of suggested clip And sign. For some people that will be it steps. 2 through 4 are optional but completing them willMoreAnd sign. For some people that will be it steps. 2 through 4 are optional but completing them will help you make your withholdings more accurate.

Virginia Code § 58.1-332 A allows Virginia residents a credit on their Virginia individual income tax return for income taxes paid to another state provided the income is either earned or business income or gain from the sale of a capital asset, derived from sources outside Virginia, and subject to Virginia's income ...

The Form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding requirements (e.g., the nonresident corporate owners of the PTE) and (2) attach Schedules VK-1 to Form 502 only for such ineligible owners.

Sole proprietorships, general partnerships, limited partnerships, limited liability partnerships, limited liability companies, and S Corporations are all pass-through entities.

During the 2022 Session, the Virginia General Assembly enacted House Bill 1121 (2022 Acts of Assembly, Chapter 690) and Senate Bill 692 (2022 Acts of Assembly, Chapter 689), which permit a qualifying pass-through entity (?PTE?) to make an annual election to pay an elective income tax at a rate of 5.75 percent at the ...

Electing PTEs are taxed at a rate of 5.75%. Eligible owners of a PTE are: natural persons who are subject to Virginia income tax, or.