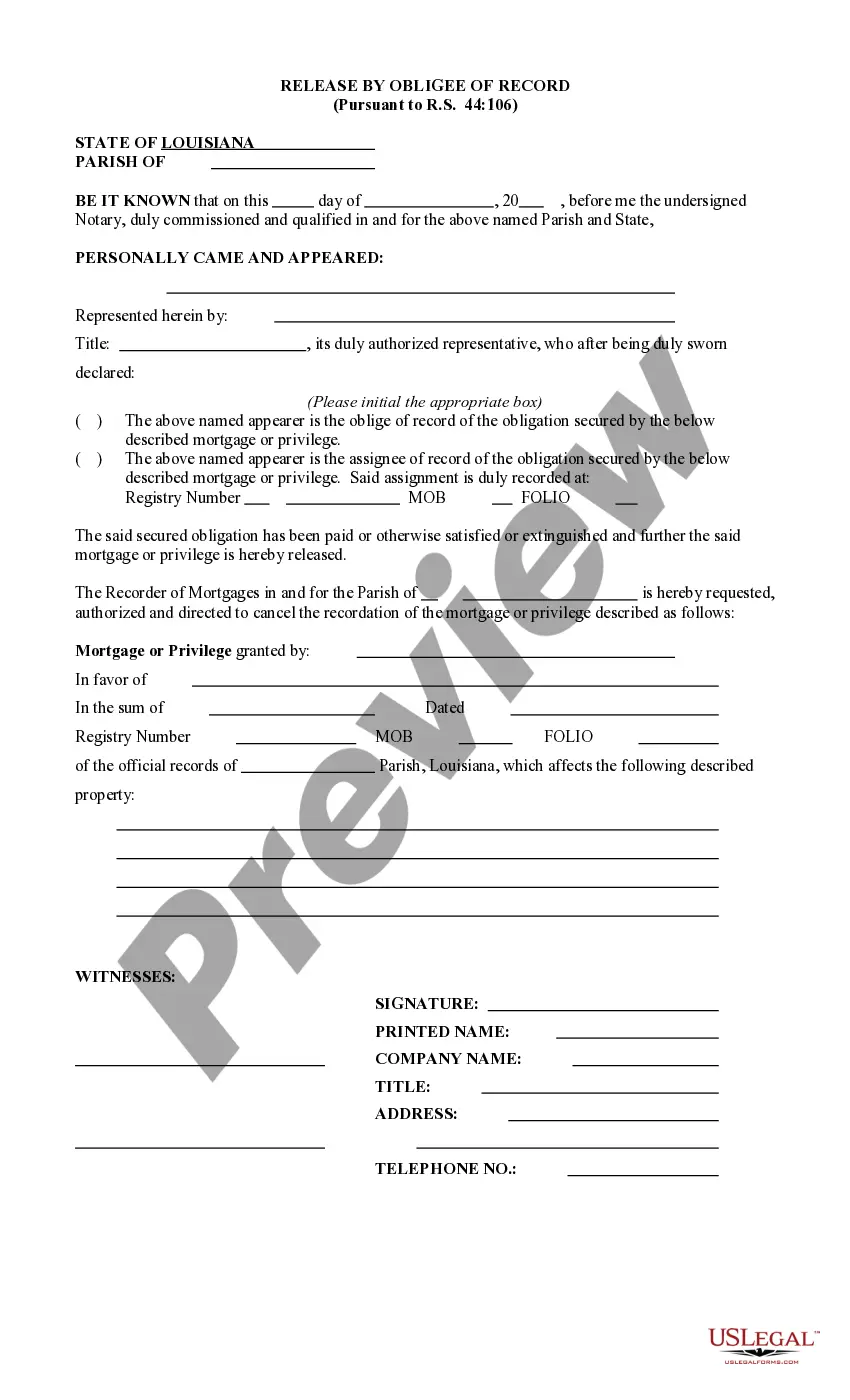

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Virginia Notice of Harassment and Validation of Debt

Description

How to fill out Virginia Notice Of Harassment And Validation Of Debt?

You may commit hours on-line searching for the authorized papers web template that suits the state and federal specifications you will need. US Legal Forms gives thousands of authorized kinds that are examined by experts. It is simple to download or produce the Virginia Notice of Harassment and Validation of Debt from your assistance.

If you already possess a US Legal Forms bank account, it is possible to log in and click on the Down load key. Next, it is possible to total, change, produce, or sign the Virginia Notice of Harassment and Validation of Debt. Each authorized papers web template you purchase is yours permanently. To have another duplicate associated with a obtained type, visit the My Forms tab and click on the related key.

If you are using the US Legal Forms site for the first time, adhere to the easy guidelines listed below:

- First, ensure that you have selected the proper papers web template to the area/town that you pick. Read the type outline to make sure you have chosen the right type. If readily available, use the Preview key to check from the papers web template at the same time.

- If you want to discover another variation of the type, use the Look for area to obtain the web template that suits you and specifications.

- After you have identified the web template you desire, simply click Acquire now to continue.

- Choose the prices prepare you desire, type in your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal bank account to pay for the authorized type.

- Choose the format of the papers and download it to the gadget.

- Make adjustments to the papers if necessary. You may total, change and sign and produce Virginia Notice of Harassment and Validation of Debt.

Down load and produce thousands of papers web templates using the US Legal Forms Internet site, which offers the largest collection of authorized kinds. Use skilled and status-distinct web templates to deal with your organization or personal requires.

Form popularity

FAQ

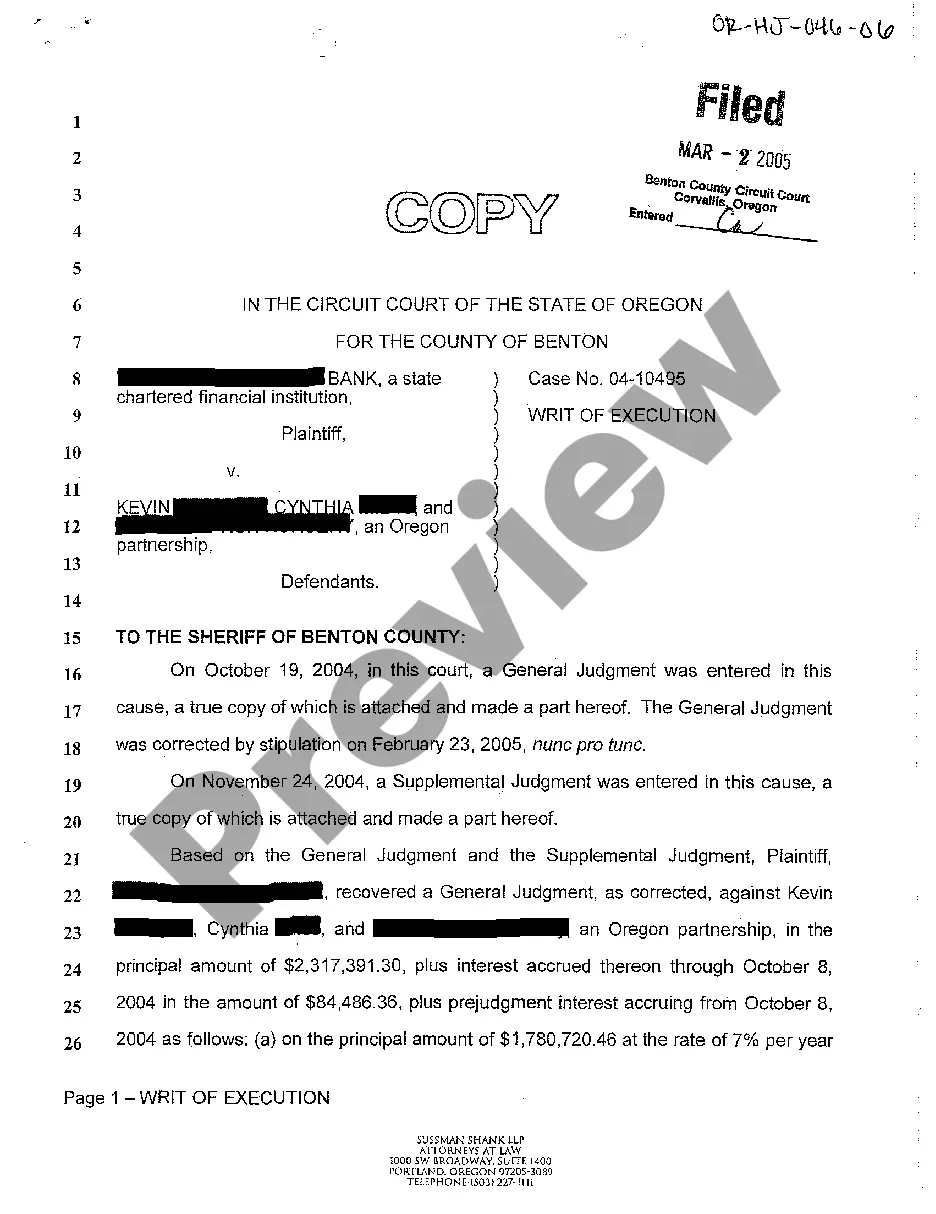

No execution shall be issued and no action brought on a judgment, including a judgment in favor of the Commonwealth and a judgment rendered in another state or country, after 20 years from the date of such judgment or domestication of such judgment, unless the period is extended as provided in this section.

This finite period of time is known as the statute of limitations. In Virginia, the applicable statute of limitations for credit card debts, mortgage debts, and medical debts is five years.

According to the above FDCPA Section, Debt Validation is defined as the debt collector contacting the original creditor to affirm the debt amount being requested is correct. It is highly doubtful the debt collector ever contacts the original creditor for any debt validation purposes.

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

A debt verification letter doesn't have to say anything fancy. Just state that you're responding to a collection effort, you don't recognize the debt, you are demanding they prove you owe it and, if they can't, to stop contacting you. That's it.