Virginia Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

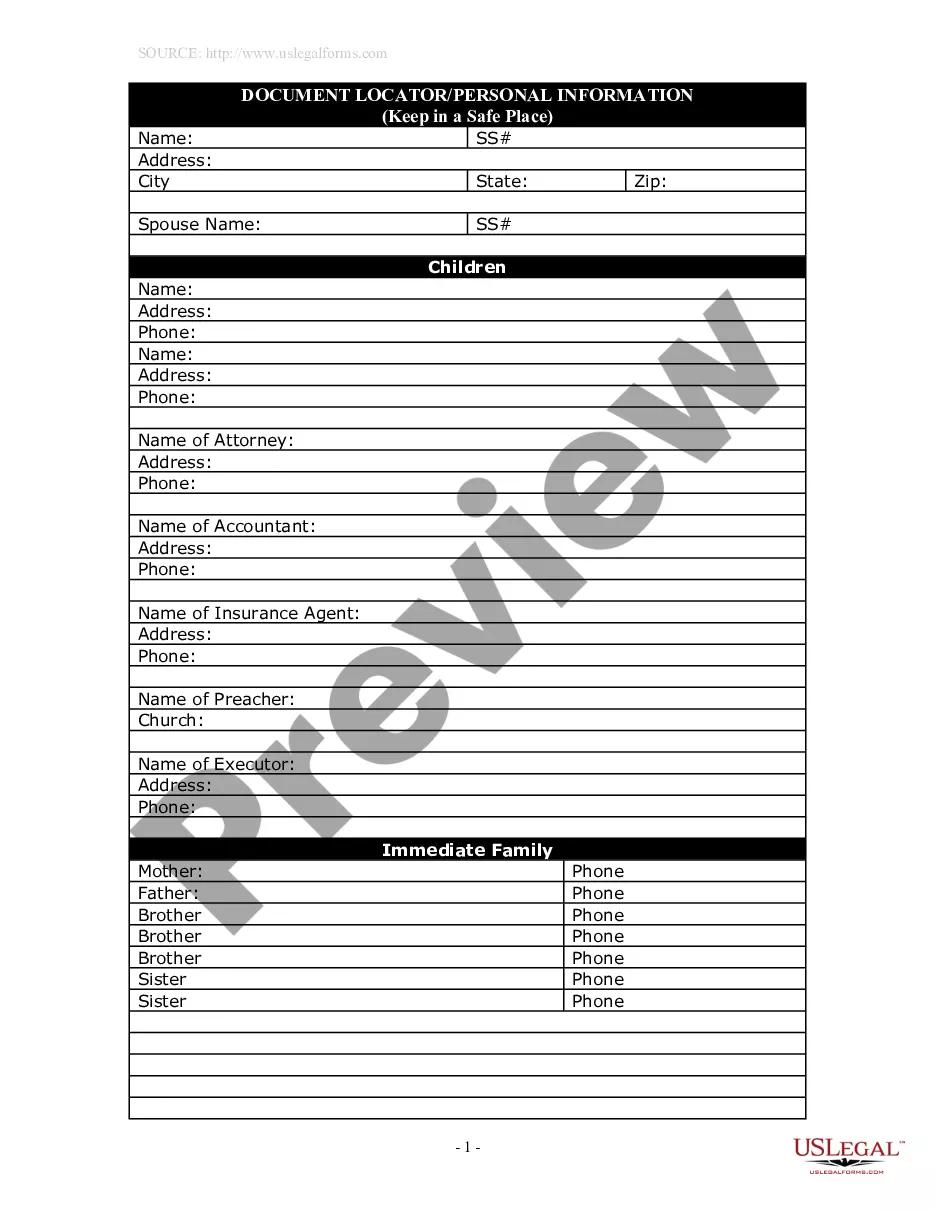

How to fill out Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

US Legal Forms - among the greatest libraries of authorized forms in America - gives an array of authorized record themes you can obtain or print. Using the site, you can find thousands of forms for enterprise and person purposes, sorted by types, states, or search phrases.You will find the most recent models of forms much like the Virginia Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer within minutes.

If you currently have a monthly subscription, log in and obtain Virginia Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer from your US Legal Forms library. The Down load key can look on each and every kind you see. You gain access to all earlier acquired forms from the My Forms tab of your respective bank account.

If you wish to use US Legal Forms the first time, allow me to share basic guidelines to obtain started:

- Be sure you have picked the correct kind to your area/region. Go through the Preview key to analyze the form`s information. Read the kind description to ensure that you have selected the proper kind.

- If the kind doesn`t satisfy your needs, make use of the Look for area towards the top of the monitor to get the one which does.

- If you are pleased with the form, validate your selection by clicking the Purchase now key. Then, pick the prices prepare you favor and supply your credentials to sign up to have an bank account.

- Approach the transaction. Make use of your bank card or PayPal bank account to accomplish the transaction.

- Pick the structure and obtain the form on your own product.

- Make adjustments. Load, edit and print and sign the acquired Virginia Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer.

Each and every web template you added to your bank account lacks an expiry date and it is the one you have eternally. So, if you want to obtain or print one more version, just check out the My Forms portion and click on in the kind you will need.

Get access to the Virginia Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer with US Legal Forms, one of the most considerable library of authorized record themes. Use thousands of specialist and status-distinct themes that satisfy your small business or person requirements and needs.

Form popularity

FAQ

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

In general terms, the executive right holder is the party who has the right to take or authorize actions which affect the exploration and development of the mineral estate, including the right to execute oil and gas leases. Non-executive mineral interest owners do not have the power to lease the minerals.

Taxes: The #1 reason for selling mineral rights is taxes. If you inherited mineral rights and then sold them for $100,000, you could pay only $5,250 in taxes and keep $94,750. If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.