Virginia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

How to fill out Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

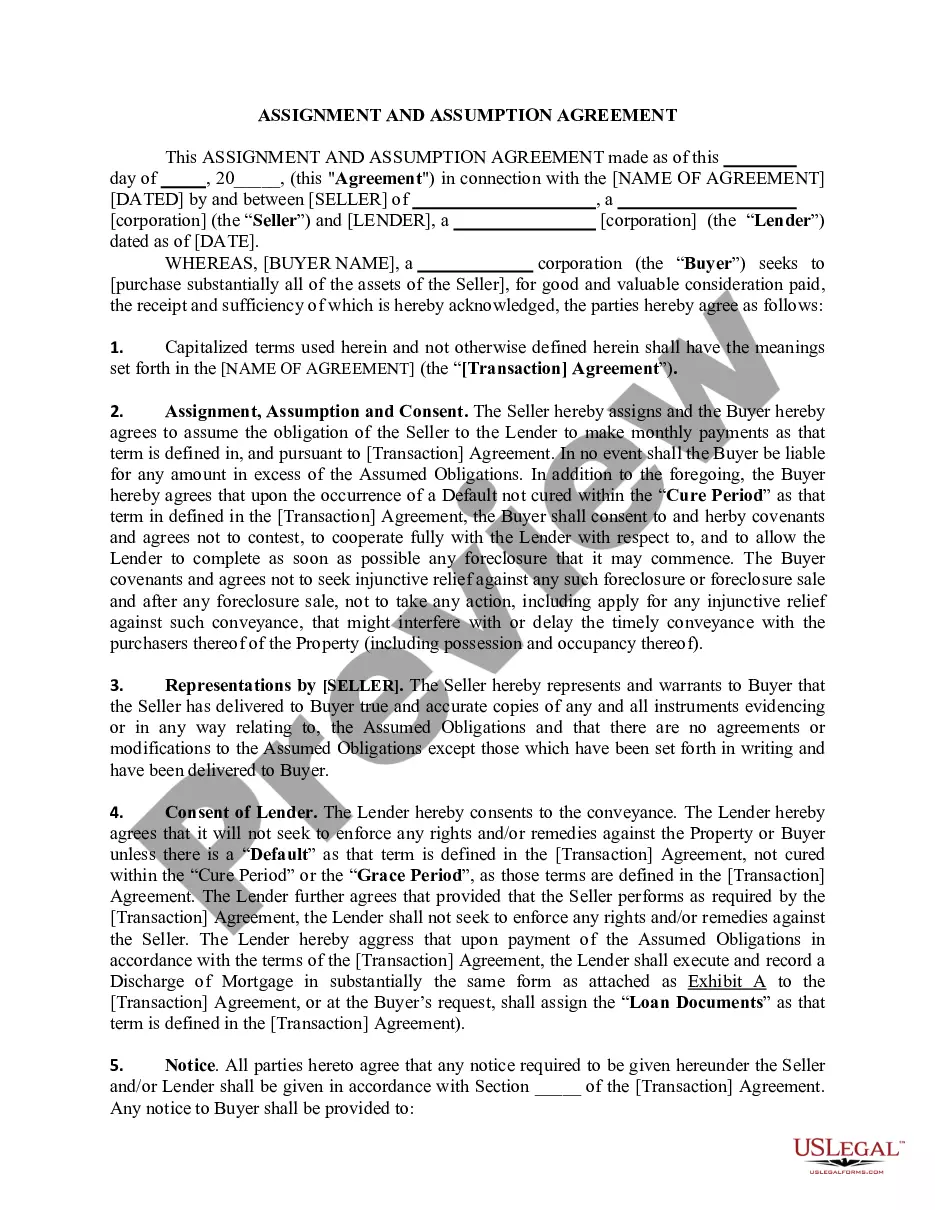

It is possible to invest hours on the Internet trying to find the lawful papers web template which fits the state and federal demands you want. US Legal Forms provides thousands of lawful types which are examined by pros. It is possible to acquire or produce the Virginia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits from my service.

If you have a US Legal Forms bank account, you can log in and click on the Obtain option. Afterward, you can total, edit, produce, or sign the Virginia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits. Every single lawful papers web template you get is your own property permanently. To acquire one more duplicate of any purchased develop, proceed to the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms website for the first time, adhere to the easy guidelines below:

- Initially, make certain you have selected the right papers web template for the county/area of your choice. Look at the develop information to ensure you have selected the right develop. If available, utilize the Review option to appear throughout the papers web template too.

- In order to get one more edition of the develop, utilize the Look for field to discover the web template that suits you and demands.

- When you have located the web template you would like, click Acquire now to carry on.

- Find the rates program you would like, type in your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the purchase. You can use your Visa or Mastercard or PayPal bank account to purchase the lawful develop.

- Find the format of the papers and acquire it to the gadget.

- Make adjustments to the papers if required. It is possible to total, edit and sign and produce Virginia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits.

Obtain and produce thousands of papers layouts while using US Legal Forms site, that offers the most important selection of lawful types. Use expert and status-particular layouts to take on your small business or specific needs.

Form popularity

FAQ

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.