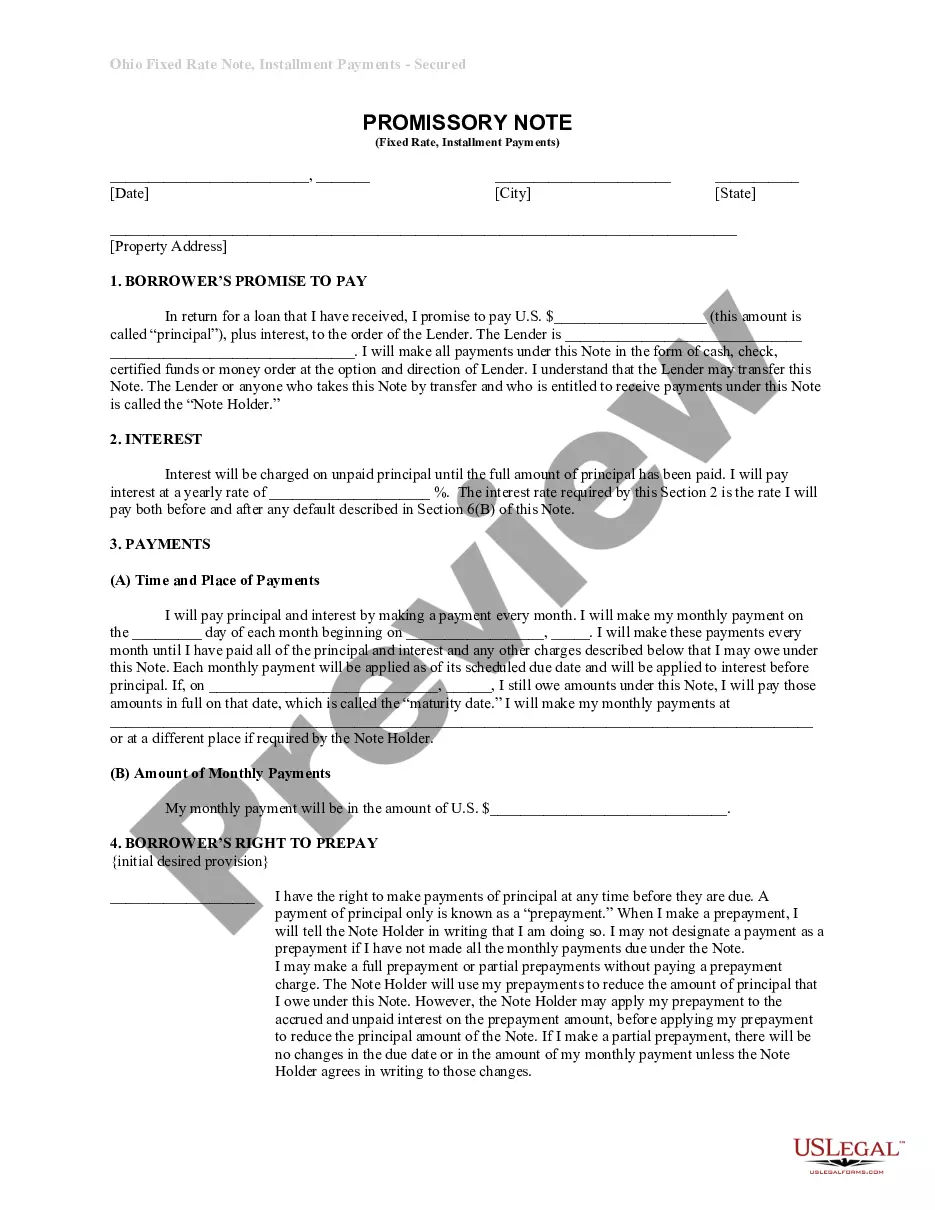

This form expresses the intent of the assignor in this assignment to assign and convey to assignee, subject to all the stated reservations and conditions in this assignment, all of assignor's rights, title, and interests on the Effective Date, in and to the oil and gas leases and lands that are the subject of this assignment, regardless, as to the descriptions, of the omission of any lease or leases, errors in description, any incorrect or misspelled names or any transcribed or incorrect recording references.

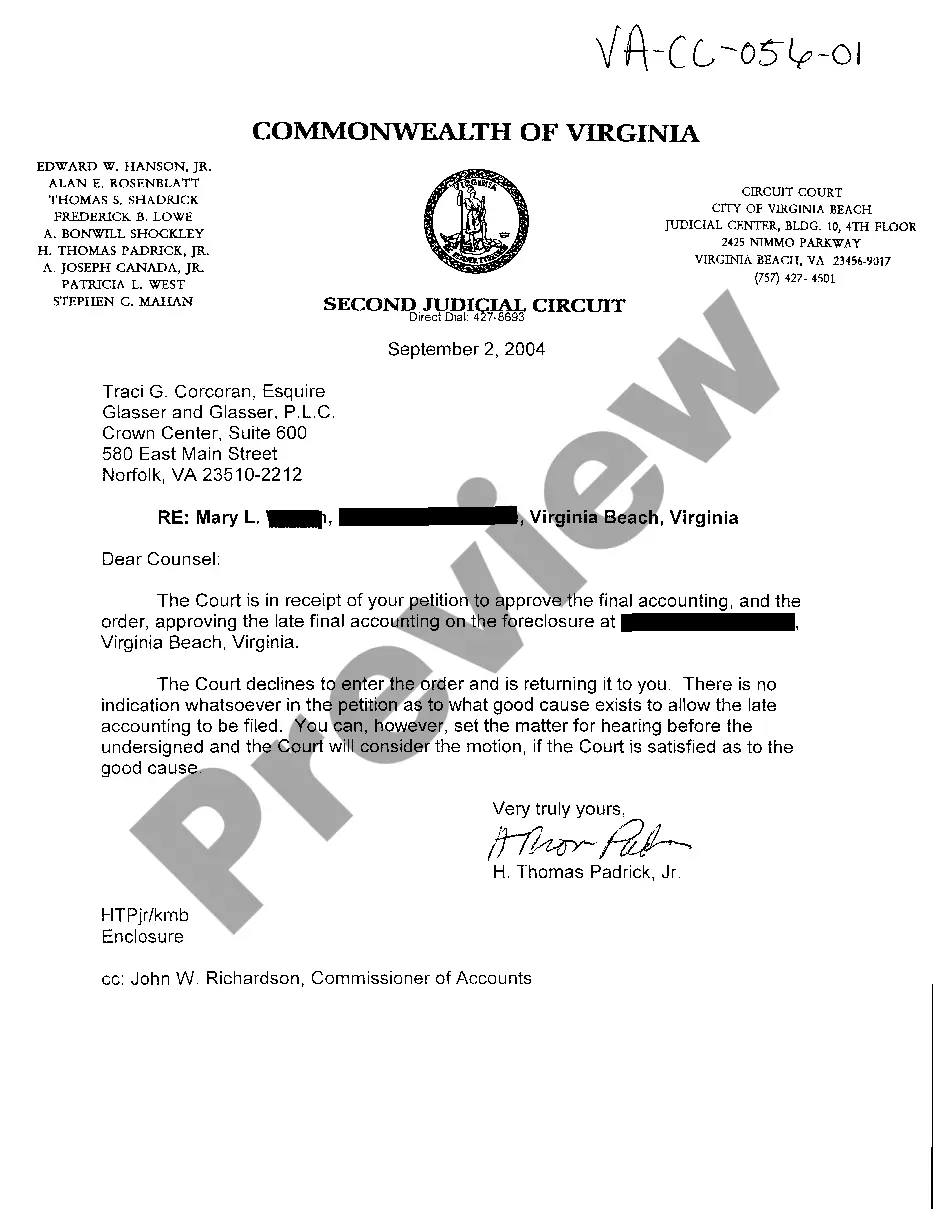

Virginia Entire Interest Assigned refers to the process of transferring the complete ownership rights or ownership interest in a property or real estate located in the state of Virginia from one party to another. This type of assignment is commonly used in real estate transactions to convey the entire interest, including both legal and equitable rights, from the assignor (original owner) to the assignee (new owner). The term "entire interest" signifies that the transfer encompasses the whole bundle of rights associated with the property, such as the right to possess, use, sell, lease, or encumber the property. It includes all tangible and intangible aspects of ownership, including the land, buildings, improvements, and any attached or appurtenant rights. Through the Virginia Entire Interest Assigned, the assignee acquires full control and ownership of the property, assuming all responsibilities and benefits associated with it. In Virginia, there are various types of Virginia Entire Interest Assigned, depending on the specific circumstances and needs of the parties involved in the transaction. Some common types include: 1. Residential Entire Interest Assigned: This involves the transfer of ownership of single-family homes, townhouses, condominiums, or other residential properties in Virginia. 2. Commercial Entire Interest Assigned: This refers to the transfer of ownership of commercial properties such as office buildings, retail spaces, industrial facilities, or warehouses in the state. 3. Vacant Land Entire Interest Assigned: This type of assignment involves the transfer of ownership of undeveloped or vacant land in Virginia. It may include agricultural land, vacant lots, or land designated for future development. 4. Investment Property Entire Interest Assigned: This involves the transfer of ownership of properties intended for investment purposes, such as rental properties or properties held for future resale. 5. Partial Interest Assigned: While not strictly falling under the Virginia Entire Interest Assigned, sometimes, partial ownership interests in properties can be assigned. In such cases, only a portion of the ownership rights is transferred from the assignor to the assignee. Overall, the Virginia Entire Interest Assigned plays a critical role in real estate transactions by facilitating the transfer of complete ownership rights from one party to another. It ensures a seamless transfer of ownership, protects the interests of both parties, and allows for clear and unambiguous property rights. Whether it involves residential, commercial, vacant land, or investment properties, the Virginia Entire Interest Assigned allows for a comprehensive transfer of the entire bundle of rights associated with the property.