Virginia Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Are you currently in the situation in which you need documents for sometimes enterprise or personal functions almost every day? There are plenty of lawful record layouts available online, but finding types you can rely on is not simple. US Legal Forms delivers thousands of type layouts, such as the Virginia Assignment of Overriding Royalty Interest (No Proportionate Reduction), which can be composed to satisfy state and federal specifications.

If you are presently acquainted with US Legal Forms website and have a free account, basically log in. After that, you may down load the Virginia Assignment of Overriding Royalty Interest (No Proportionate Reduction) web template.

If you do not offer an accounts and would like to begin to use US Legal Forms, follow these steps:

- Find the type you will need and ensure it is for the correct metropolis/state.

- Use the Review switch to examine the shape.

- See the information to ensure that you have chosen the correct type.

- In the event the type is not what you are searching for, utilize the Lookup industry to obtain the type that suits you and specifications.

- If you obtain the correct type, click on Acquire now.

- Select the prices plan you want, fill out the specified info to produce your account, and pay money for your order with your PayPal or bank card.

- Choose a hassle-free file formatting and down load your version.

Discover all the record layouts you possess purchased in the My Forms food list. You may get a additional version of Virginia Assignment of Overriding Royalty Interest (No Proportionate Reduction) anytime, if required. Just select the needed type to down load or produce the record web template.

Use US Legal Forms, by far the most comprehensive selection of lawful varieties, to save lots of time as well as steer clear of errors. The support delivers appropriately made lawful record layouts which can be used for a selection of functions. Produce a free account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

NRA = 40.00 net mineral acres x ([1/5] Lease Royalty Rate / [1/8] Standard Royalty Rate) NRA = 40.00 x (0.20 / 0.125) NRA = 40.00 x 1.60 NRA = 64.00 Net Royalty Acres This mathematical concept can also be used inversely to calculate your net mineral acres in a parcel based on the Net Revenue Interest (NRI) you are ...

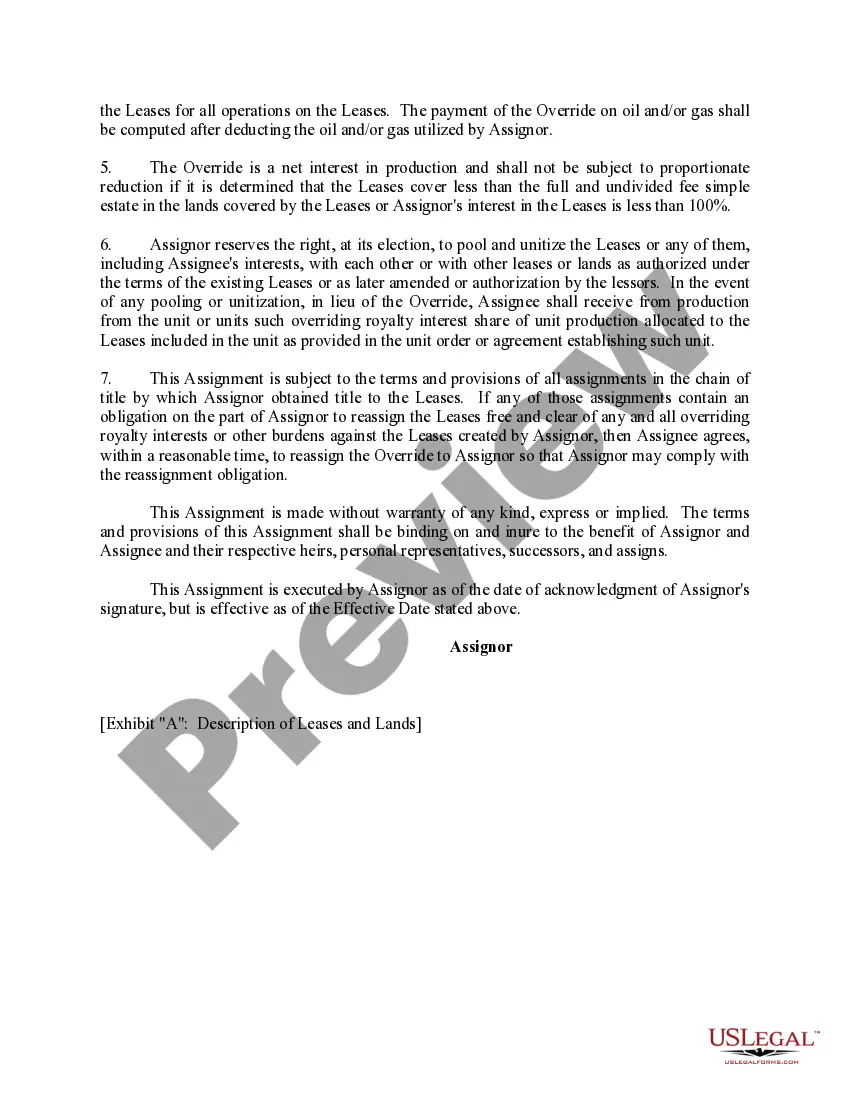

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.