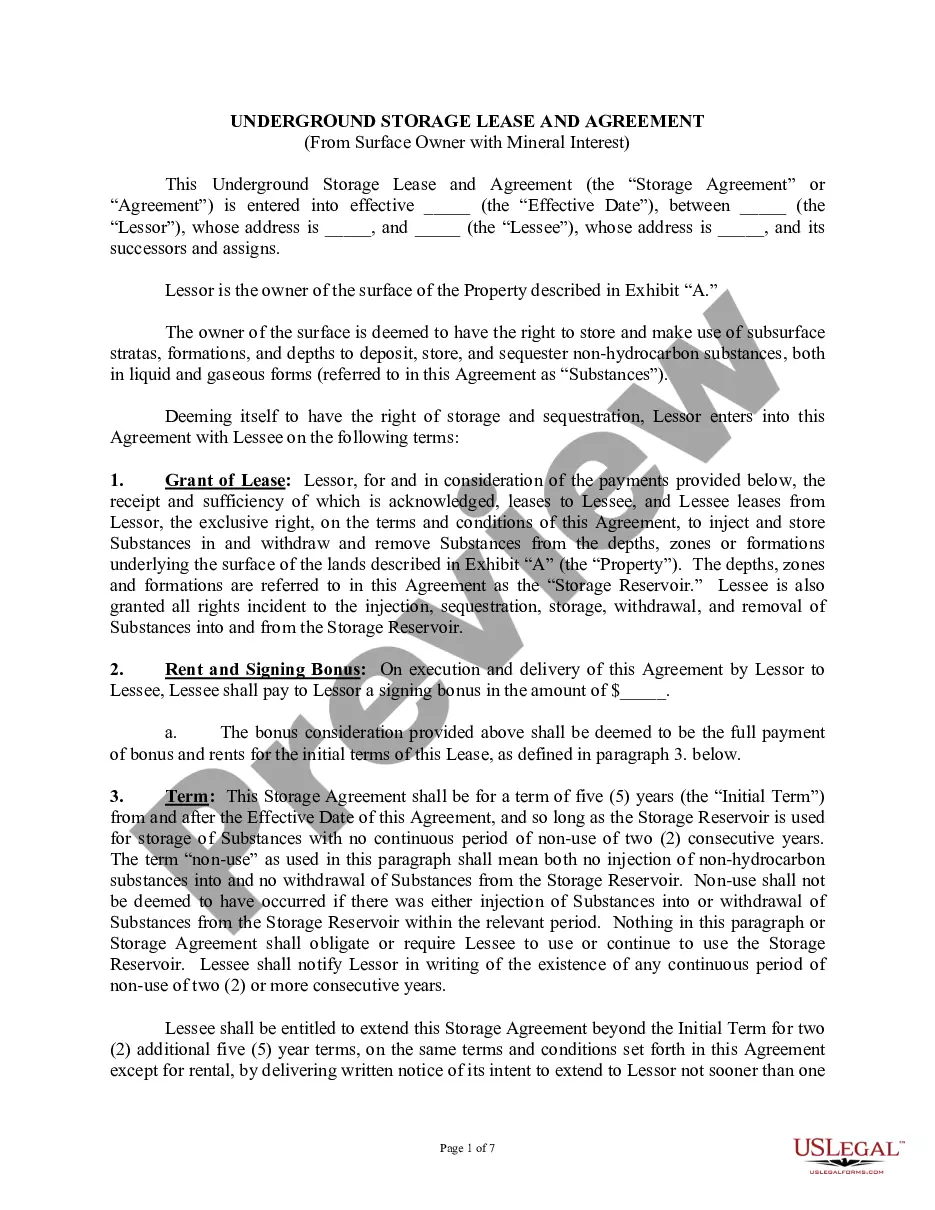

This office lease clause is a more detailed form giving the tenant additional rights and the landlord further obligations as it relates to tax increases.

Virginia Detailed Tax Increase Clause

Description

How to fill out Detailed Tax Increase Clause?

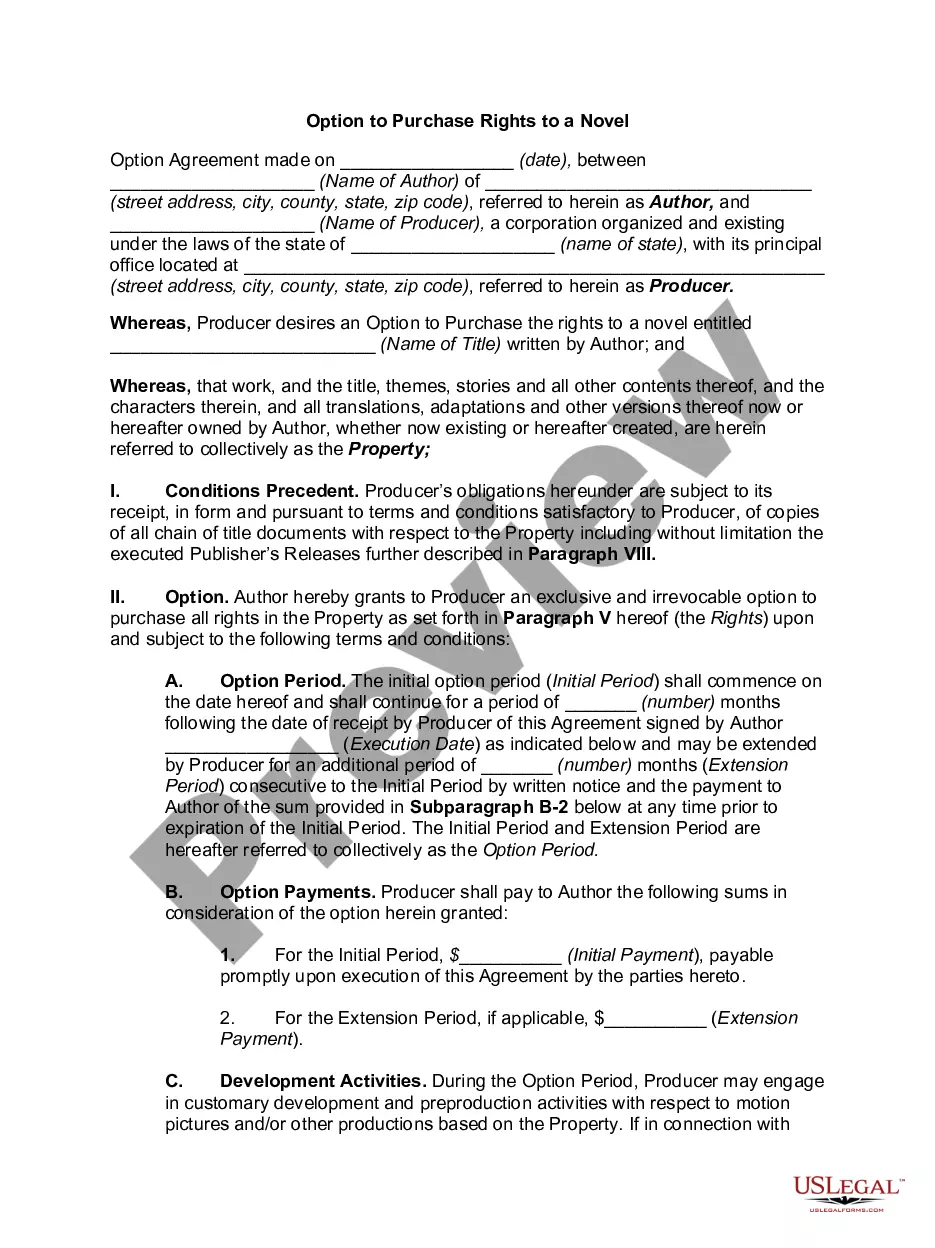

Choosing the right authorized document template could be a battle. Of course, there are a variety of templates available on the net, but how will you get the authorized develop you will need? Make use of the US Legal Forms site. The services provides a large number of templates, including the Virginia Detailed Tax Increase Clause, which can be used for enterprise and personal needs. All the varieties are inspected by professionals and meet state and federal specifications.

When you are already authorized, log in to the bank account and then click the Acquire button to obtain the Virginia Detailed Tax Increase Clause. Utilize your bank account to check through the authorized varieties you might have ordered formerly. Go to the My Forms tab of your own bank account and have one more backup from the document you will need.

When you are a whole new consumer of US Legal Forms, here are easy directions that you should stick to:

- First, make certain you have selected the correct develop for the city/region. You can look through the form using the Review button and study the form information to ensure this is basically the best for you.

- If the develop will not meet your needs, make use of the Seach field to find the appropriate develop.

- Once you are certain that the form is proper, click the Get now button to obtain the develop.

- Opt for the costs plan you desire and type in the needed information and facts. Create your bank account and buy an order using your PayPal bank account or charge card.

- Opt for the file structure and obtain the authorized document template to the gadget.

- Complete, revise and produce and signal the received Virginia Detailed Tax Increase Clause.

US Legal Forms will be the largest collection of authorized varieties for which you can find a variety of document templates. Make use of the company to obtain expertly-manufactured documents that stick to state specifications.

Form popularity

FAQ

Virginia Code § 58.1-332 A allows Virginia residents a credit on their Virginia individual income tax return for income taxes paid to another state provided the income is either earned or business income or gain from the sale of a capital asset, derived from sources outside Virginia, and subject to Virginia's income ...

2023 tax brackets (for taxes due April 2024 or October 2024 with an extension) Tax rateSingleHead of household10%$0 to $11,000$0 to $15,70012%$11,001 to $44,725$15,701 to $59,85022%$44,726 to $95,375$59,851 to $95,35024%$95,376 to $182,100$95,351 to $182,1003 more rows ? 1 day ago

The bill increases the subtraction for disallowed business interest deductions under Internal Revenue Code Section 163(j) and the individual standard deduction, adds a new individual income tax rebate, removes the age limitation for military benefits, reinstates the annual sales tax holiday, and adds limitations to the ...

Standard deduction increase: For tax year 2023, the standard deduction increased to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: Income tax brackets went up in 2023 to account for inflation.

Grocery Tax Reduced to 1% Beginning Jan. 1, 2023 | Virginia Tax.

Under Virginia law, pass-through entities (PTEs) can choose to pay Virginia income tax at the entity level, and eligible owners of the PTE can receive corresponding credits. The general effect of this is to transfer the Virginia income tax liability on the PTE's income from the PTE's eligible owners to the PTE itself.

Virginia is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.00%.

When any annual assessment, biennial assessment, or general reassessment of real property by a county, city, or town would result in an increase of one percent or more in the total real property tax levied, such county, city, or town shall reduce its rate of levy for the forthcoming tax year so as to cause such rate of ...