The Virginia State of Delaware Limited Partnership Tax Notice serves as an essential document for limited partnerships operating under Delaware law but having nexus in Virginia. This notice outlines the tax obligations and requirements these partnerships must adhere to in order to maintain compliance with Virginia tax laws. Limited partnerships in Delaware, doing business in Virginia, are subject to taxation based on the portion of their income derived from Virginia. This tax notice highlights the specific rules and regulations that govern the taxation process for Virginia state income tax purposes. The content of the Virginia State of Delaware Limited Partnership Tax Notice includes details such as: 1. Taxation Basics: The notice provides a comprehensive overview of how limited partnerships are taxed in Virginia. It outlines the criteria for determining nexus and the factors that determine whether income is sourced to Virginia. 2. Filing Obligations: The notice clarifies the deadlines and requirements for filing Virginia tax returns, including Form 502B or 502LU, which are specifically designed for limited partnerships. It also addresses any necessary payments, estimated tax requirements, and extensions. 3. Apportionment and Allocation: The notice explains the apportionment formula used to determine the Virginia taxable income of limited partnerships. It outlines the criteria for determining how income, sales, and property are allocated between Virginia and other jurisdictions where the partnership operates. 4. Reporting Income and Deductions: The notice provides guidelines on reporting taxable income and deductions on the Virginia tax return. It covers items such as gross receipts, deductions, credits, and exemptions that may impact the partnership's tax liability. 5. Penalties and Interest: The notice highlights the potential penalties and interest charges imposed for failure to comply with Virginia tax laws. It details the consequences of late filing, underpayment, or negligence in fulfilling tax obligations. 6. Record keeping Requirements: The notice emphasizes the importance of maintaining proper books and records that support the partnership's Virginia tax return. It specifies the retention period and the types of documents that should be preserved for inspection upon request. Different types of Virginia State of Delaware Limited Partnership Tax Notices may be issued depending on specific circumstances. For instance, separate notices may exist for partnerships engaged in specific industries or with particular characteristics that warrant further tax considerations. Additionally, the notice may be updated periodically to reflect changes in tax laws or regulations. In conclusion, the Virginia State of Delaware Limited Partnership Tax Notice is a vital resource for limited partnerships conducting business activities in Virginia. It provides clear guidance on the tax obligations, filing requirements, and compliance measures necessary to fulfill the partnership's Virginia tax responsibilities.

Virginia State of Delaware Limited Partnership Tax Notice

Description

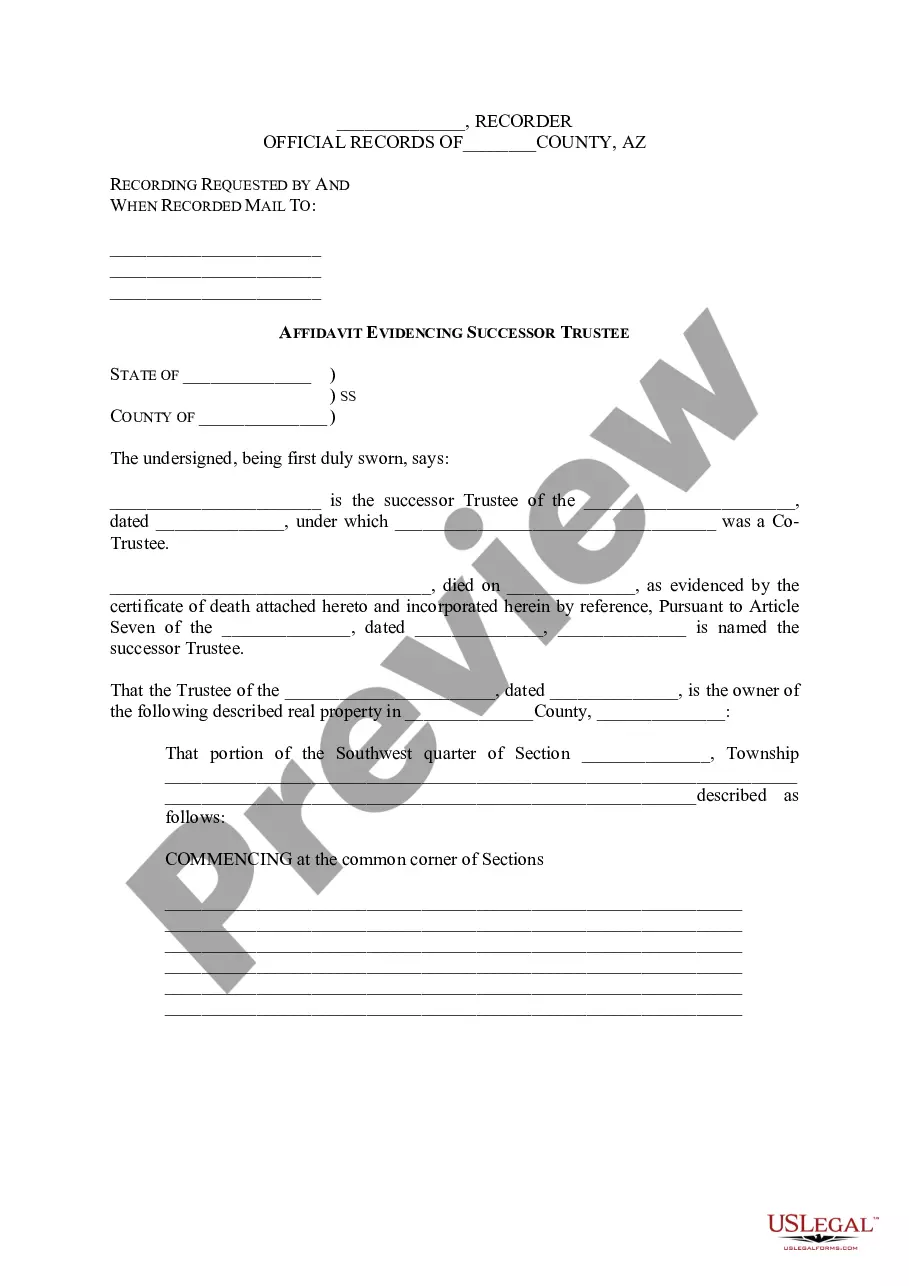

How to fill out State Of Delaware Limited Partnership Tax Notice?

If you want to complete, down load, or produce authorized papers layouts, use US Legal Forms, the greatest variety of authorized varieties, which can be found on the web. Make use of the site`s simple and convenient look for to obtain the files you want. Different layouts for business and person uses are sorted by types and states, or search phrases. Use US Legal Forms to obtain the Virginia State of Delaware Limited Partnership Tax Notice within a few clicks.

Should you be previously a US Legal Forms client, log in to the bank account and then click the Download key to have the Virginia State of Delaware Limited Partnership Tax Notice. You can also access varieties you in the past downloaded within the My Forms tab of the bank account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the proper metropolis/nation.

- Step 2. Use the Review method to examine the form`s content material. Never forget to read the explanation.

- Step 3. Should you be not satisfied using the type, take advantage of the Lookup area on top of the screen to locate other versions of the authorized type template.

- Step 4. When you have located the shape you want, select the Purchase now key. Select the pricing strategy you choose and include your credentials to register on an bank account.

- Step 5. Process the financial transaction. You may use your bank card or PayPal bank account to finish the financial transaction.

- Step 6. Choose the format of the authorized type and down load it on the system.

- Step 7. Complete, edit and produce or indicator the Virginia State of Delaware Limited Partnership Tax Notice.

Each and every authorized papers template you get is yours for a long time. You have acces to every type you downloaded within your acccount. Click the My Forms portion and pick a type to produce or down load once more.

Remain competitive and down load, and produce the Virginia State of Delaware Limited Partnership Tax Notice with US Legal Forms. There are many skilled and state-certain varieties you can use for your personal business or person requires.

Form popularity

FAQ

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax.

Income from intangible personal property, including annuities, dividends, interest, royalties and gains from the disposition of intangible personal property to the extent that such income is from property employed by the taxpayer in a business, trade, profession, or occupation carried on in Virginia.

Virginia Code § 58.1-332 A allows Virginia residents a credit on their Virginia individual income tax return for income taxes paid to another state provided the income is either earned or business income or gain from the sale of a capital asset, derived from sources outside Virginia, and subject to Virginia's income ...

The Virginia taxable income of a resident individual means his federal adjusted gross income for the taxable year, which excludes combat pay for certain members of the Armed Forces of the United States as provided in § 112 of the Internal Revenue Code, as amended, and with the modifications specified in §§ 58.1-322.01 ...

The Virginia taxable income of a nonresident individual, partner or beneficiary shall be an amount bearing the same proportion to his Virginia taxable income, computed as though he were a resident, as the net amount of his income, gain, loss and deductions from Virginia sources bears to the net amount of his income, ...

Electing PTEs should file the 502PTET form, reporting only the pro rata share of income, gain, loss, or deductions attributable to eligible owners of the PTE in the computation on Page 2,Section 1 of the form. The 502PTET form must be filed electronically. Find a list of approved software products here.

Note: While most partnerships in Delaware are not subject to income taxes, they are required to file yearly state income tax returns and are required to pay an annual tax to the Secretary of State.

Virginia Code § 58.1-332 A allows Virginia residents a credit on their Virginia individual income tax return for income taxes paid to another state provided the income is either earned or business income or gain from the sale of a capital asset, derived from sources outside Virginia, and subject to Virginia's income ...