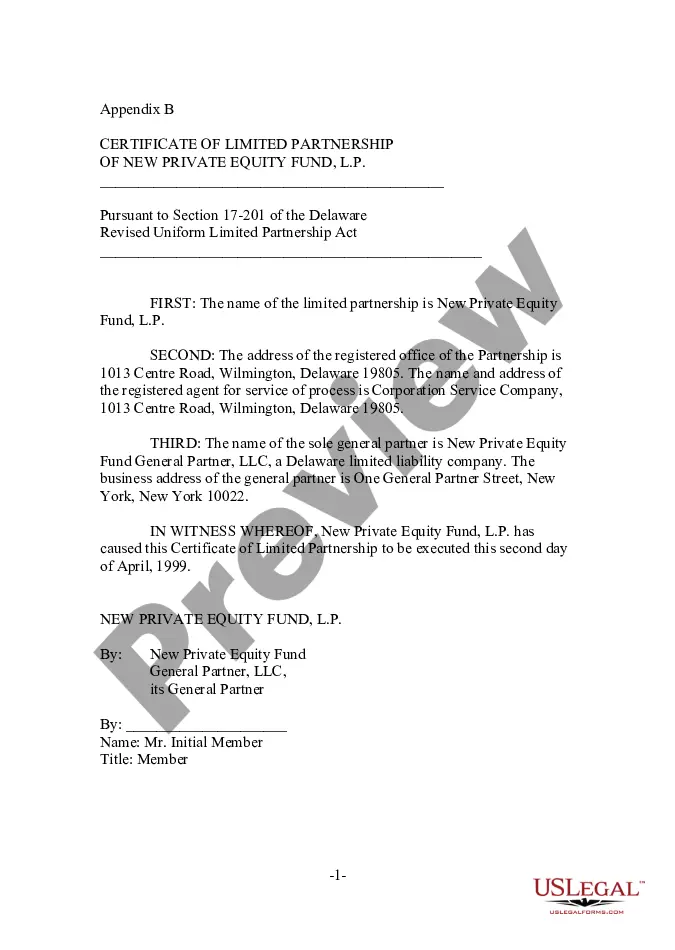

The Virginia Certificate of Limited Partnership of a New Private Equity Fund is a crucial document that establishes the formation and legal status of a private equity fund in the state of Virginia. This certificate serves as proof of its existence and outlines the fundamental characteristics and structure of the limited partnership. Keywords: Virginia, Certificate of Limited Partnership, New Private Equity Fund The Virginia Certificate of Limited Partnership of a New Private Equity Fund includes the following key details: 1. Formation: The certificate provides evidence that the limited partnership has been duly formed in accordance with Virginia's laws governing such entities. 2. Name: The certificate states the official name of the limited partnership. It is important to choose a unique and distinguishable name that complies with state regulations. 3. Partners: The certificate identifies the general partners and limited partners involved in the private equity fund. General partners typically manage the fund's operations and bear unlimited liability, while limited partners contribute capital and have limited liability. 4. Duration: The certificate specifies the duration of the limited partnership, indicating whether it will continue indefinitely or has a specific termination date. 5. Principal Office: The certificate discloses the registered office address of the limited partnership within Virginia. This is the official address to which legal documents and communications must be sent. 6. Registered Agent: The certificate provides the name and address of a registered agent, an individual or entity responsible for receiving legal notifications and other official communications on behalf of the limited partnership. 7. Purpose: The certificate states the principal business activities or investment objectives of the private equity fund. This may include investing in various asset classes, acquiring businesses, or providing growth capital to portfolio companies. 8. Financial Contributions: The certificate outlines the capital contributions made by each partner, specifying the total amount of capital committed to the fund and any subsequent contributions required. 9. Distribution of Profits and Losses: The certificate describes the distribution of profits and losses among the partners, typically based on their ownership interests, as determined by the partnership agreement. 10. Amendments: The certificate establishes the ability to amend or modify the partnership agreement in the future, allowing for flexibility as circumstances change. Different types of Virginia Certificates of Limited Partnership may exist depending on the specific characteristics and industry focus of the private equity fund. Some variations may include: 1. Virginia Certificate of Limited Partnership for Venture Capital Fund: This certificate would be tailored for a private equity fund that primarily invests in early-stage or high-growth companies with significant growth potential. 2. Virginia Certificate of Limited Partnership for Real Estate Private Equity Fund: This certificate would cater to a private equity fund focused on investing in real estate assets, such as residential or commercial properties, real estate development projects, or mortgage-backed securities. 3. Virginia Certificate of Limited Partnership for Energy Private Equity Fund: This certificate would be specific to a private equity fund concentrating on investments in the energy sector, including renewable energy projects, oil and gas ventures, or infrastructure development. 4. Virginia Certificate of Limited Partnership for Private Equity Fund of Funds: This certificate would pertain to a private equity fund that primarily invests in other private equity funds, providing diversification and exposure to various investment strategies and asset classes. In summary, the Virginia Certificate of Limited Partnership of a New Private Equity Fund is a critical legal document outlining the formation, structure, and essential details of a private equity fund established in Virginia. Depending on the fund's specific focus, variations of this certificate may exist, such as those tailored for venture capital, real estate, energy, or fund of funds strategies.

Virginia Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Virginia Certificate Of Limited Partnership Of New Private Equity Fund?

Discovering the right legal file design could be a battle. Obviously, there are tons of web templates accessible on the Internet, but how would you discover the legal form you want? Make use of the US Legal Forms web site. The support offers a large number of web templates, for example the Virginia Certificate of Limited Partnership of New Private Equity Fund, which you can use for organization and personal requires. All the kinds are checked out by experts and meet up with federal and state specifications.

Should you be already signed up, log in to your bank account and click the Down load switch to get the Virginia Certificate of Limited Partnership of New Private Equity Fund. Make use of your bank account to search from the legal kinds you might have ordered previously. Proceed to the My Forms tab of your bank account and obtain one more backup of your file you want.

Should you be a new consumer of US Legal Forms, listed here are straightforward instructions so that you can comply with:

- First, ensure you have selected the right form for your town/county. It is possible to look over the form while using Review switch and look at the form description to make certain it is the best for you.

- When the form fails to meet up with your needs, use the Seach industry to obtain the right form.

- Once you are sure that the form is acceptable, go through the Acquire now switch to get the form.

- Pick the costs plan you would like and enter in the needed details. Build your bank account and buy the order using your PayPal bank account or charge card.

- Opt for the file format and obtain the legal file design to your system.

- Total, edit and printing and sign the acquired Virginia Certificate of Limited Partnership of New Private Equity Fund.

US Legal Forms is the most significant catalogue of legal kinds where you can find a variety of file web templates. Make use of the company to obtain expertly-produced documents that comply with status specifications.