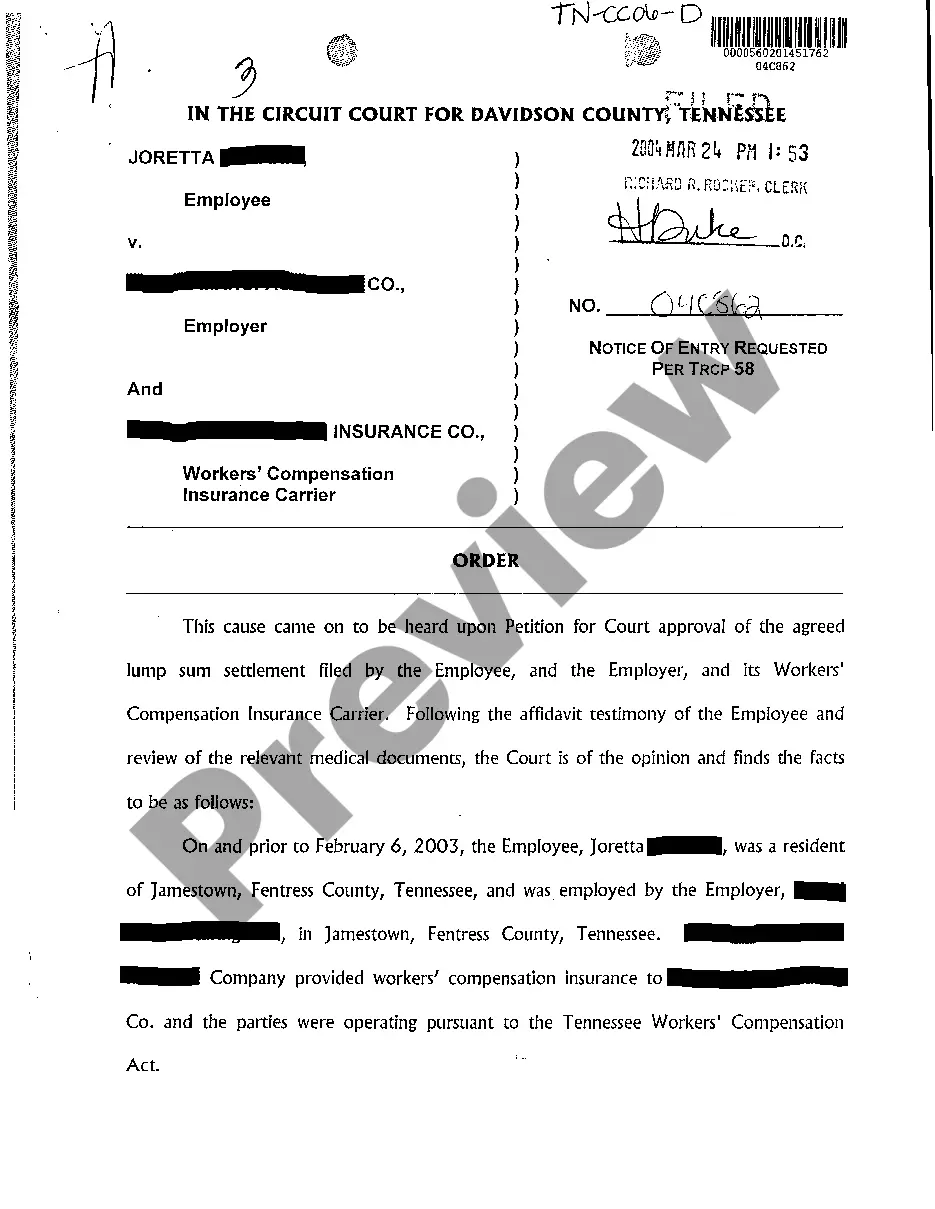

Keywords: Virginia, Wage and Income Loss Statement, types The Virginia Wage and Income Loss Statement is an official document used to report and calculate the financial damages incurred due to wage and income loss in the state of Virginia. It serves as evidence in legal proceedings, insurance claims, or when seeking compensation for industrial accidents, personal injury, or wrongful termination cases. This statement outlines the financial impact suffered by an individual as a result of their inability to work, reduction in working hours, or any other factor that affects their income. It is a crucial tool for individuals and authorities to assess the extent of economic damages and determine appropriate compensation. There are different types of Virginia Wage and Income Loss Statements, each catering to specific circumstances: 1. Occupational Injury or Illness: This statement is used when an employee suffers from work-related injuries or illnesses that render them unable to work temporarily or permanently. It includes details about the type of injury or illness, medical treatment received, duration of lost wages, and any potential future income loss. 2. Personal Injury: When an individual is involved in an accident or incident caused by someone else's negligence and suffers wage and income loss as a result, this statement is prepared. It encompasses the financial losses incurred during the recovery period, including lost wages from missed work, reduced earning capacity, and potential future income loss. 3. Wrongful Termination: In cases where an employee is wrongfully terminated, this statement is used to quantify the wages and income lost due to the termination. It includes details such as the employee's salary, benefits, anticipated career growth, and potential future income loss resulting from the wrongful termination. 4. Workers' Compensation: This statement is specific to employees who file for workers' compensation benefits due to work-related injuries or illnesses. It accurately reflects the lost wages and income during the recovery period, including medical treatments, rehabilitation, and additional expenses incurred due to the injury. In conclusion, the Virginia Wage and Income Loss Statement is a comprehensive document used to accurately assess the extent of financial damages incurred by individuals who have experienced wage and income loss. It aids in legal proceedings, insurance claims, and compensation negotiations, providing detailed information about the specific type of loss suffered.

Keywords: Virginia, Wage and Income Loss Statement, types The Virginia Wage and Income Loss Statement is an official document used to report and calculate the financial damages incurred due to wage and income loss in the state of Virginia. It serves as evidence in legal proceedings, insurance claims, or when seeking compensation for industrial accidents, personal injury, or wrongful termination cases. This statement outlines the financial impact suffered by an individual as a result of their inability to work, reduction in working hours, or any other factor that affects their income. It is a crucial tool for individuals and authorities to assess the extent of economic damages and determine appropriate compensation. There are different types of Virginia Wage and Income Loss Statements, each catering to specific circumstances: 1. Occupational Injury or Illness: This statement is used when an employee suffers from work-related injuries or illnesses that render them unable to work temporarily or permanently. It includes details about the type of injury or illness, medical treatment received, duration of lost wages, and any potential future income loss. 2. Personal Injury: When an individual is involved in an accident or incident caused by someone else's negligence and suffers wage and income loss as a result, this statement is prepared. It encompasses the financial losses incurred during the recovery period, including lost wages from missed work, reduced earning capacity, and potential future income loss. 3. Wrongful Termination: In cases where an employee is wrongfully terminated, this statement is used to quantify the wages and income lost due to the termination. It includes details such as the employee's salary, benefits, anticipated career growth, and potential future income loss resulting from the wrongful termination. 4. Workers' Compensation: This statement is specific to employees who file for workers' compensation benefits due to work-related injuries or illnesses. It accurately reflects the lost wages and income during the recovery period, including medical treatments, rehabilitation, and additional expenses incurred due to the injury. In conclusion, the Virginia Wage and Income Loss Statement is a comprehensive document used to accurately assess the extent of financial damages incurred by individuals who have experienced wage and income loss. It aids in legal proceedings, insurance claims, and compensation negotiations, providing detailed information about the specific type of loss suffered.