Virgin Islands Direct Deposit Form for Employer

Description

How to fill out Direct Deposit Form For Employer?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that you can download or create.

By using the website, you can locate thousands of documents for business and personal use, organized by document type, state, or keywords. You can find the latest forms such as the Virgin Islands Direct Deposit Form for Employer in just a few minutes.

If you already have an account, Log In and download the Virgin Islands Direct Deposit Form for Employer from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded documents from the My documents section of your account.

Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, just visit the My documents section and click on the form you desire.

Access the Virgin Islands Direct Deposit Form for Employer with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the correct form for your city/state. Click the Review button to review the form's content. Check the form summary to confirm that you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and enter your details to create an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

- Make modifications. Fill out, edit, print, and sign the downloaded Virgin Islands Direct Deposit Form for Employer.

Form popularity

FAQ

To give your direct deposit information to your employer, first complete the Virgin Islands Direct Deposit Form for Employer with your banking details. Then, submit the form according to your company's procedures, which may involve handing it in person or sending it via email. Ensure that you keep a copy for your records, and follow up with your HR department to confirm they received your information. This process will help you enjoy the convenience of direct deposits without any hassle.

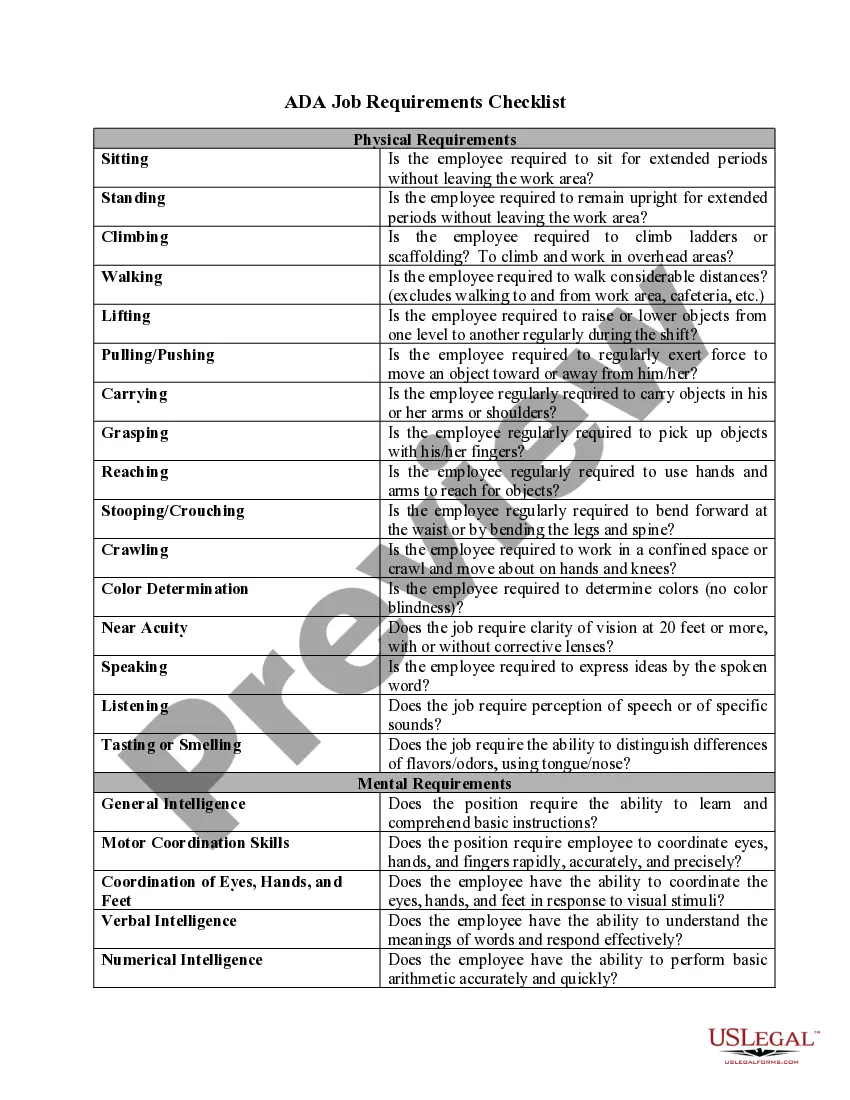

Deposit Types: denotes how a paycheck is split between accounts. Deposit Type ? Amount: denotes that this account will receive a specific amount of your paycheck. Deposit Type ? Percent: denotes that this account will receive a specified percent of your paycheck.

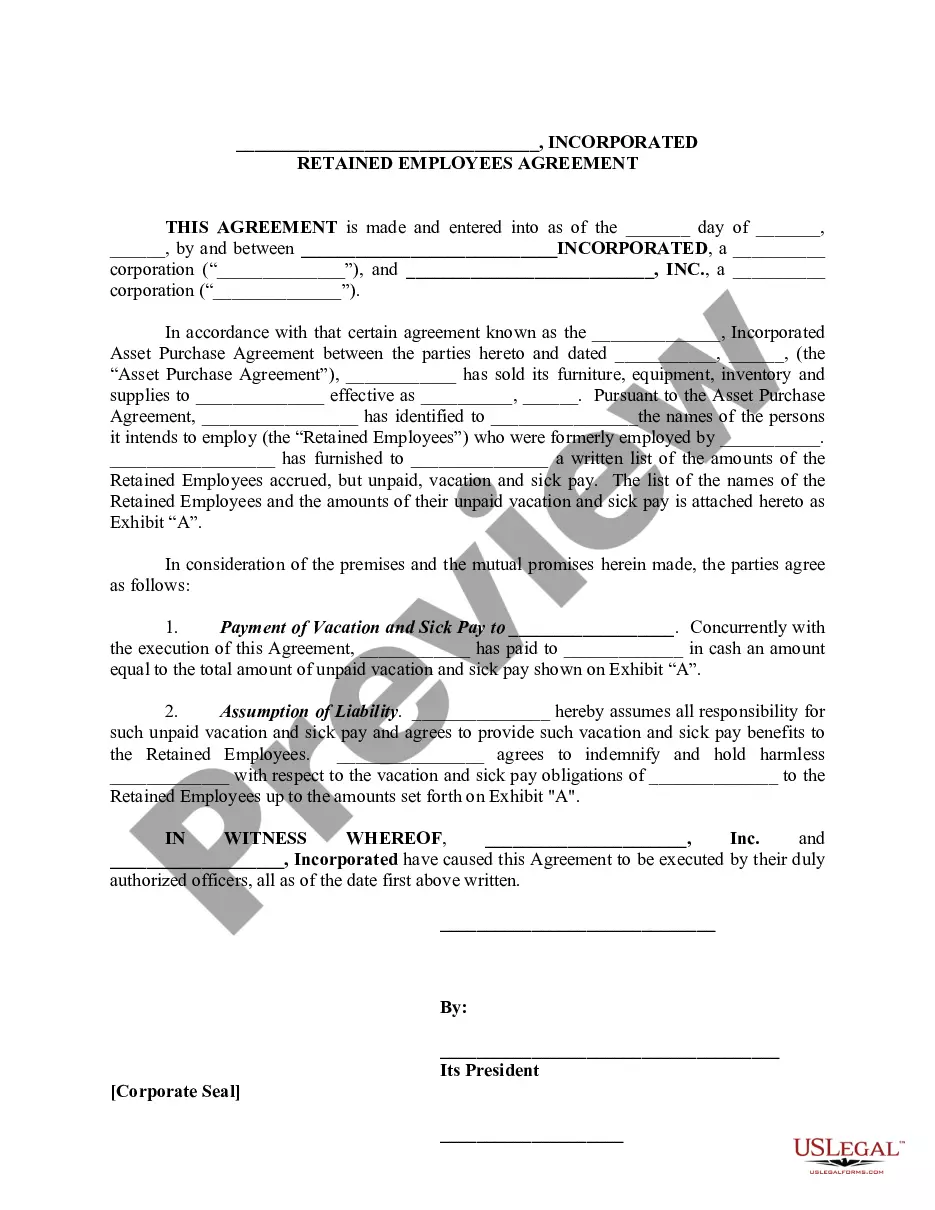

I hereby voluntarily authorize the Company named above (hereafter ?Employer?), either directly or through its payroll service provider, to deposit any amounts owed me, by initiating credit entries to my account (s) at the financial institution (s) of my choice (hereinafter ?Bank?) indicated on this form.

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account.

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. Typically, an employer requesting authorization will require a voided check to ensure that the account is valid.

Get a direct deposit form from your employer. Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks and credit unions, including the Capital One and Bank of America direct deposit forms.

Get a direct deposit form from your employer. Fill in account information. Confirm the deposit amount. Attach a voided check or deposit slip, if required. Submit the form.

Steps on How to Set Up Direct Deposit for Your Employees Decide on a payroll provider. If you don't have one set up already, you'll need a payroll provider that offers direct deposit services. ... Connect with your bank. ... Collect information from your employees. ... Create a payroll schedule. ... Run payroll.

Direct Deposit Authorization Form Company Information. Employee Information. Bank Account Information. ?I hereby authorize?? Statement. Employee Signature and Date. Space for Attached Physical Check (Optional)