Virgin Islands Sample Letter for Claim Settlement Against Decedent's Estate

Description

How to fill out Sample Letter For Claim Settlement Against Decedent's Estate?

Are you in a situation where you need documents for either professional or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers thousands of form templates, including the Virgin Islands Sample Letter for Claim Settlement Against Decedent's Estate, which are designed to comply with state and federal regulations.

Select the pricing plan you prefer, complete the necessary information to create your account, and process the payment using your PayPal or credit card.

Choose a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can obtain another copy of the Virgin Islands Sample Letter for Claim Settlement Against Decedent's Estate at any time if needed. Simply select the required form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The service provides professionally created legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virgin Islands Sample Letter for Claim Settlement Against Decedent's Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

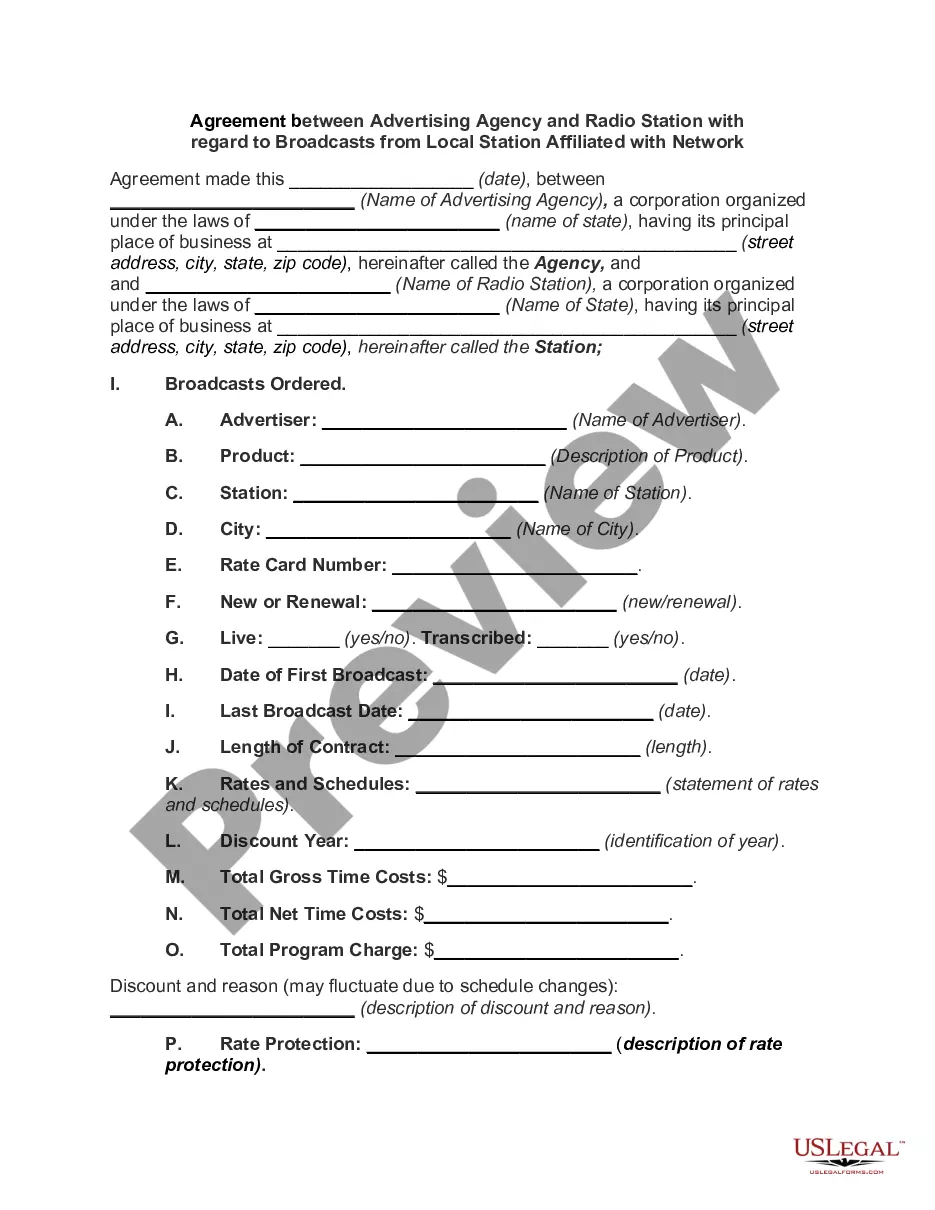

- Use the Preview button to review the form.

- Read the details to ensure you have selected the right form.

- If the form isn't what you are looking for, utilize the Search box to find the form that meets your needs.

- Once you have the correct form, click Purchase now.

Form popularity

FAQ

Probate is the legal process that you must follow to transfer or inherit property after the person who owned the property has passed away.

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.

Probate is the process completed when a decedent leaves assets to distribute, such as bank accounts, real estate, and financial investments. Probate is the general administration of a deceased person's will or the estate of a deceased person without a will.

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of ...

Section 3392 states that all creditor claims shall be paid in the following order: (1) the costs of administering the decedent's estate, which includes any probate fees, attorneys' fees, or personal representative commissions; (2) the family exemption, which is $3,500.00 for each family member who resided with the ...

Estate Settlement Overview. The settling of an estate is essentially the administrative process of settling someone's financial affairs after he or she is deceased. Settling an estate will vary based on the state laws where property was owned and whether there was a Will.

Probate is the court proceeding that validates a Will. Keep in mind, not all estates will need to go through probate - probate laws can vary significantly depending on what state you're in and the size of the estate.