Virgin Islands Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor: An Overview In the Virgin Islands, an Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions of engagement between an individual contractor and a company as an independent sales representative. This agreement is tailored for individuals in the sales industry who work on a commission-based structure rather than a fixed salary. Key Components of the Agreement: 1. Parties Involved: The agreement identifies the involved parties, including the contractor (the self-employed individual) and the company hiring the contractor's services. 2. Scope of Engagement: The agreement explicitly defines the nature of the contractor's work, such as selling products or services on behalf of the company. 3. Commission Structure: The agreement outlines the percentage or rate at which the contractor will earn their commission based on the sales generated. This may vary depending on the product or service being sold. 4. Sales Targets: Companies often set specific sales targets for their contractors to achieve. The agreement may specify these targets and outline the consequences or benefits associated with meeting or exceeding them. 5. Termination Clause: This section details the conditions under which either party can terminate the agreement, such as breach of contract, non-performance, or voluntary resignation, and the notice period required. 6. Confidentiality and Non-Disclosure: To protect the company's trade secrets, the agreement may include clauses related to confidentiality and non-disclosure of proprietary information. 7. Independent Contractor Status: It explicitly emphasizes that the contractor is not considered an employee of the company and is responsible for their own taxes, insurance, benefits, and other business expenses. 8. Governing Law: The agreement identifies the applicable laws of the Virgin Islands that govern the agreement in case of any disputes. Types of Virgin Islands Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor: 1. Retail Sales Representative Agreement: Primarily used in the retail sector, this agreement governs the engagement between a self-employed contractor and a retail company, wherein the contractor sells the company's products to customers. 2. Real Estate Sales Agent Agreement: In the Virgin Islands, real estate agencies often enter into agreements with self-employed independent contractors, commonly known as sales agents, who earn a percentage of the sales they generate for the agency. 3. Service-Based Sales Representative Agreement: This agreement is used when a contractor provides sales services for a company offering services rather than tangible products. Examples include insurance sales agents, software sales representatives, or consultants. 4. Franchise Sales Representative Agreement: In the realm of franchising, this type of agreement enables self-employed independent contractors to sell products or services on behalf of a franchisor in the Virgin Islands. Remember, it is essential to consult with legal professionals who specialize in employment law or contract law in the Virgin Islands to tailor the agreement to specific circumstances and ensure its compliance with local regulations.

Virgin Islands Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

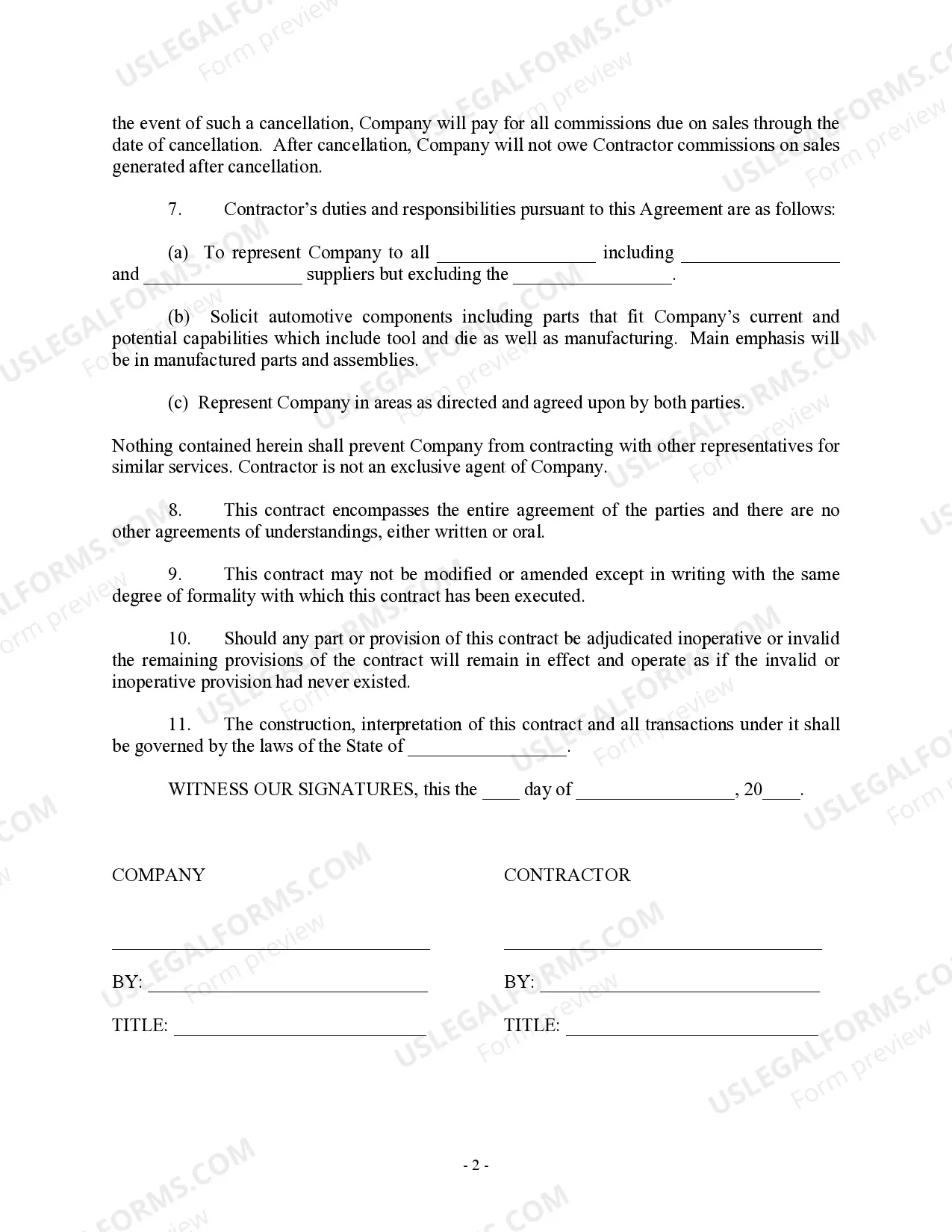

How to fill out Virgin Islands Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

Have you been in the placement the place you require papers for both business or specific purposes almost every time? There are a variety of legal papers layouts accessible on the Internet, but discovering kinds you can rely on is not effortless. US Legal Forms offers a large number of type layouts, like the Virgin Islands Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, that happen to be composed to fulfill federal and state requirements.

If you are presently familiar with US Legal Forms internet site and have your account, just log in. Next, it is possible to download the Virgin Islands Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor format.

Unless you offer an accounts and need to start using US Legal Forms, abide by these steps:

- Get the type you will need and make sure it is for your proper metropolis/area.

- Use the Preview key to review the form.

- See the description to actually have chosen the correct type.

- When the type is not what you`re seeking, use the Research area to find the type that meets your needs and requirements.

- When you obtain the proper type, just click Buy now.

- Choose the costs strategy you want, fill out the desired information and facts to create your bank account, and buy an order utilizing your PayPal or Visa or Mastercard.

- Pick a convenient data file format and download your copy.

Locate all of the papers layouts you might have purchased in the My Forms food list. You can get a further copy of Virgin Islands Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor at any time, if needed. Just go through the needed type to download or print the papers format.

Use US Legal Forms, the most substantial collection of legal types, to conserve time and avoid blunders. The support offers professionally manufactured legal papers layouts that can be used for a selection of purposes. Make your account on US Legal Forms and initiate generating your lifestyle easier.