Virgin Islands Escrow Agreement - Long Form

Description

How to fill out Escrow Agreement - Long Form?

Have you ever found yourself in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legitimate template documents accessible online, but locating ones you can depend on is challenging.

US Legal Forms provides thousands of form templates, such as the Virgin Islands Escrow Agreement - Long Form, designed to comply with state and federal regulations.

Select a suitable file format and download your copy.

Locate all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Virgin Islands Escrow Agreement - Long Form at any time, if needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Virgin Islands Escrow Agreement - Long Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

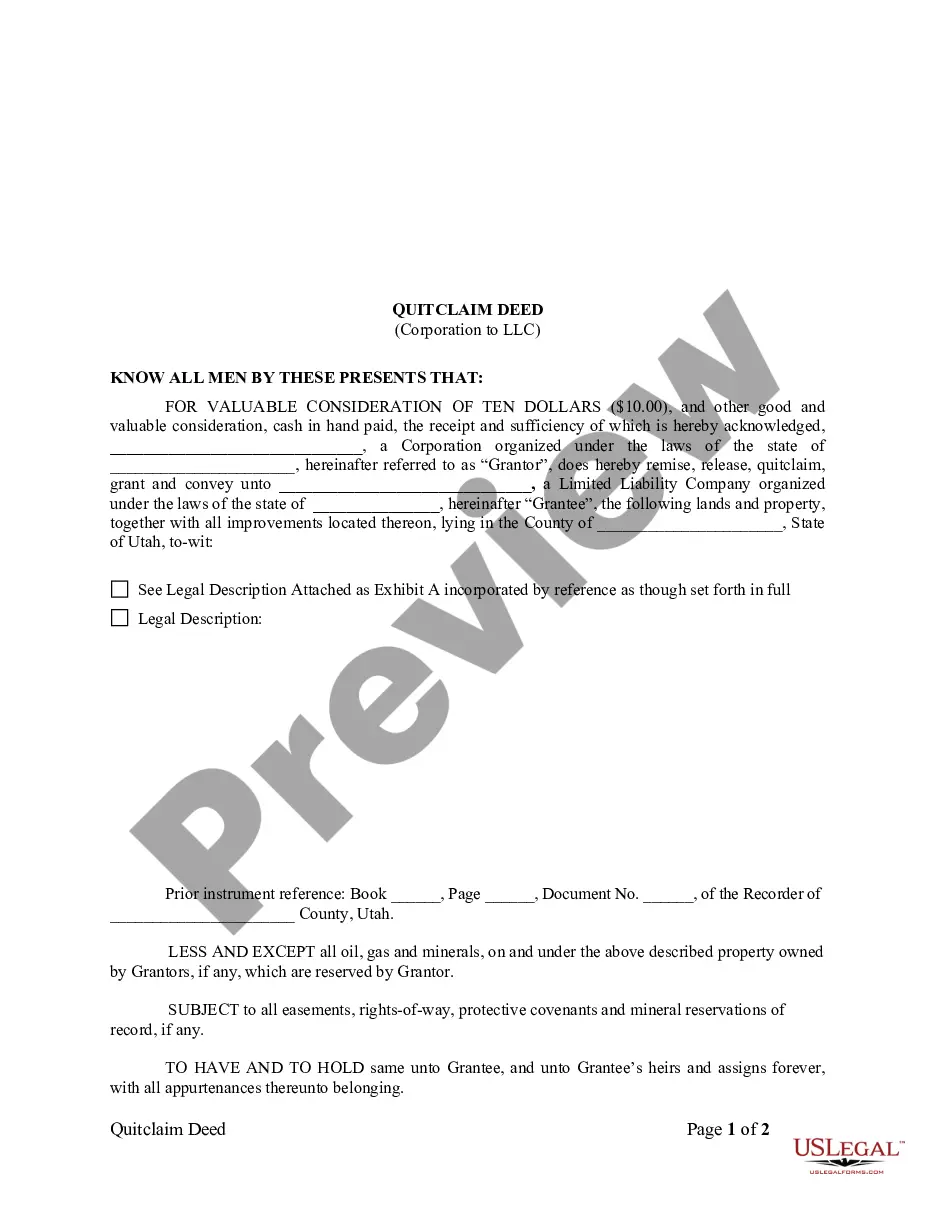

- Utilize the Review button to check the form.

- Read the details to ensure you have selected the right form.

- If the form isn't what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you have the correct form, click Purchase now.

- Choose the pricing plan you prefer, enter the necessary information to create your payment account, and complete the transaction using PayPal or a credit card.

Form popularity

FAQ

Creating an escrow involves two primary requirements in a Virgin Islands Escrow Agreement - Long Form. First, you need to have a clear understanding of the parties involved, including their names and roles. Second, you must define the terms of the escrow agreement, such as the conditions for release and the specific assets being held. With uslegalforms, you can access customizable templates to help ensure that all necessary details are addressed.

Yes, you can set up your own escrow account when using a Virgin Islands Escrow Agreement - Long Form. To do this, you will need to choose a reliable escrow agent or financial institution, ensuring that they meet all legal requirements. It's essential to include specific terms regarding the funds and the conditions under which they will be released. Consider using uslegalforms for templates that can guide you through creating a comprehensive agreement.

The primary elements of the escrow rule in a Virgin Islands Escrow Agreement - Long Form include the roles of the escrow agent, the defined terms of the agreement, and the conditions for release of funds or property. It is crucial that the parties know their rights and obligations. Adhering to these rules helps ensure smooth transactions and prevents misunderstandings.

A Virgin Islands Escrow Agreement - Long Form typically includes three essential components: the escrow agent, the parties involved, and the specific terms of the transaction. The escrow agent is responsible for securely holding funds or documents until all obligations are met. Moreover, the agreement must detail the conditions under which assets will be transferred, ensuring all parties understand their responsibilities.

When reviewing a Virgin Islands Escrow Agreement - Long Form, focus on the clarity of terms. Ensure it outlines the duties of the escrow agent, the conditions for releasing funds, and any fees involved. Transparency is key; any hidden fees or vague language can lead to disputes later. Additionally, confirm that the agreement complies with local laws to protect your interests.

To draft an escrow agreement, start by clearly defining the parties involved, the asset or payment to be held in escrow, and the conditions for release. Ensure that all instructions are simple and legally enforceable, allowing the escrow agent to act without confusion. A Virgin Islands Escrow Agreement - Long Form can help provide a structured format, ensuring you cover all necessary details.

The escrow agreement is a legal document that outlines the terms and conditions under which an escrow agent holds the funds or assets. This agreement protects the interests of both parties until all specified conditions are met. By utilizing a Virgin Islands Escrow Agreement - Long Form, you can ensure that your transaction is legally sound and well-managed.

Three key requirements for a valid escrow include mutual agreement between the parties, clear instructions for the escrow agent, and the presence of a neutral third-party escrow agent. These components secure the transaction according to a Virgin Islands Escrow Agreement - Long Form. Ensuring you meet these requirements results in a smoother transaction process.

When reviewing an escrow agreement, focus on clarity regarding terms, conditions, and parties involved. Ensure it specifies the items held in escrow, how funds will be disbursed, and what conditions must be met for release. A well-drafted Virgin Islands Escrow Agreement - Long Form addresses these elements effectively.

A typical escrow agreement specifies the items or funds held in escrow and the conditions for their release. It includes details about the transaction, the involved parties, and any deadlines or requirements. By utilizing a Virgin Islands Escrow Agreement - Long Form, you ensure clarity and legal compliance throughout your agreement.