Virgin Islands Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

If you desire to finalize, download, or print legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site’s straightforward and user-friendly search functionality to acquire the documents you require. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Employ US Legal Forms to obtain the Virgin Islands Guaranty of Promissory Note by Individual - Corporate Borrower in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you saved in your account. Select the My documents section and choose a form to print or download again.

Be proactive and download, and print the Virgin Islands Guaranty of Promissory Note by Individual - Corporate Borrower with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Virgin Islands Guaranty of Promissory Note by Individual - Corporate Borrower.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

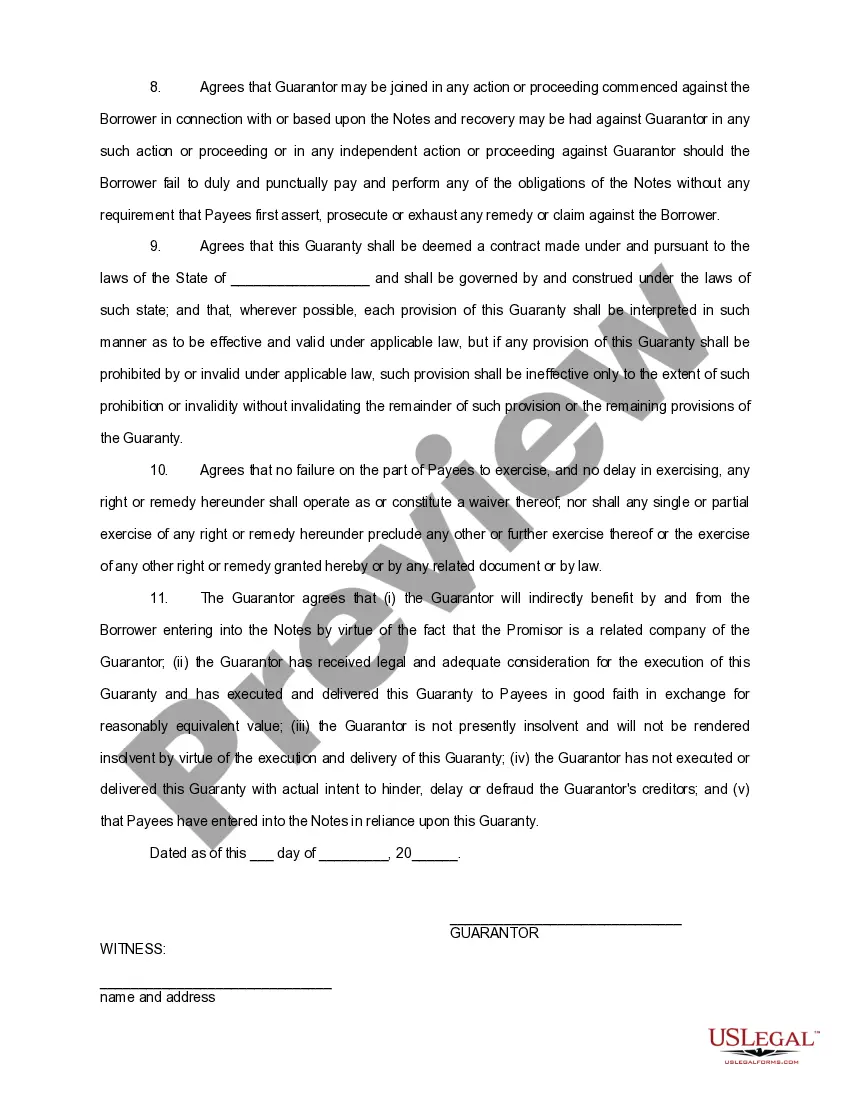

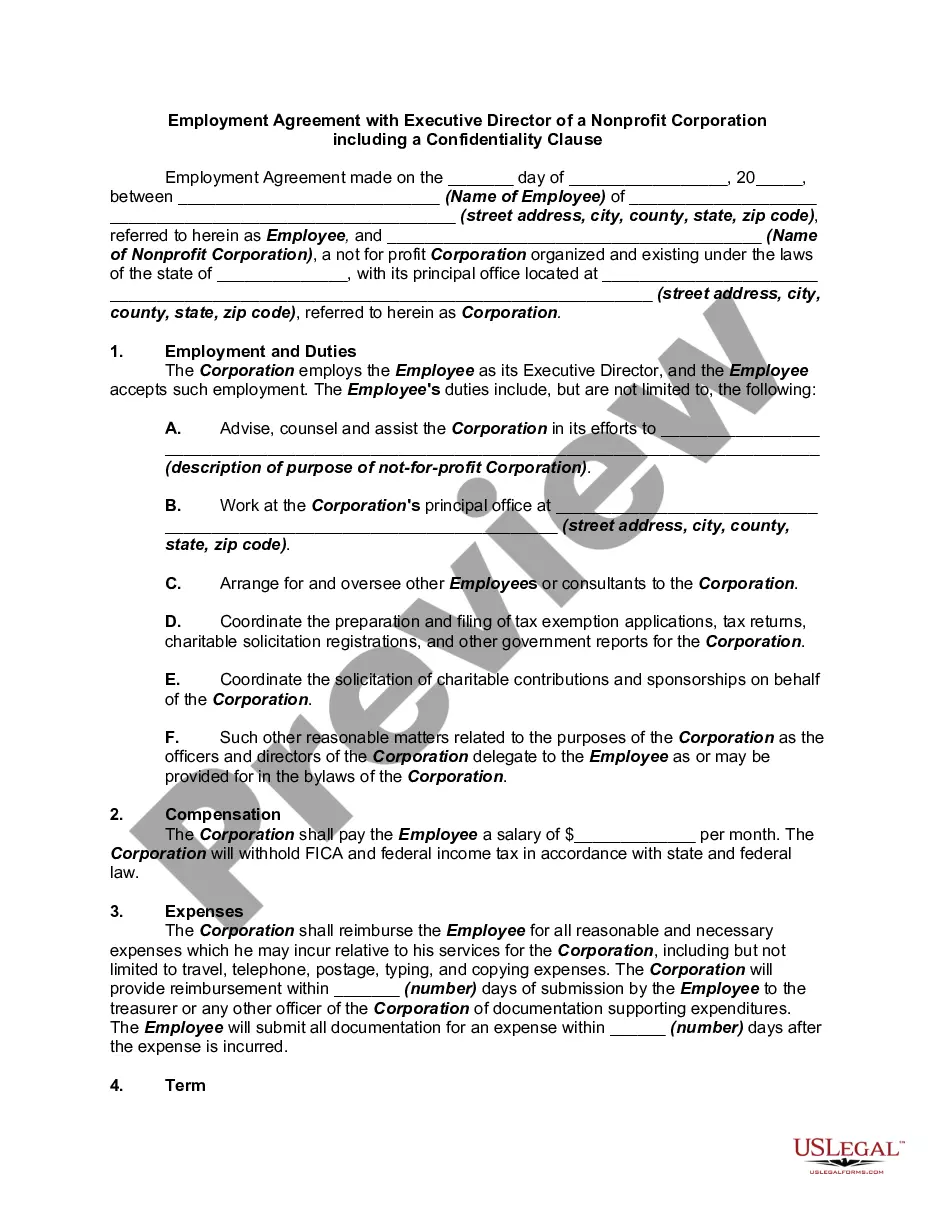

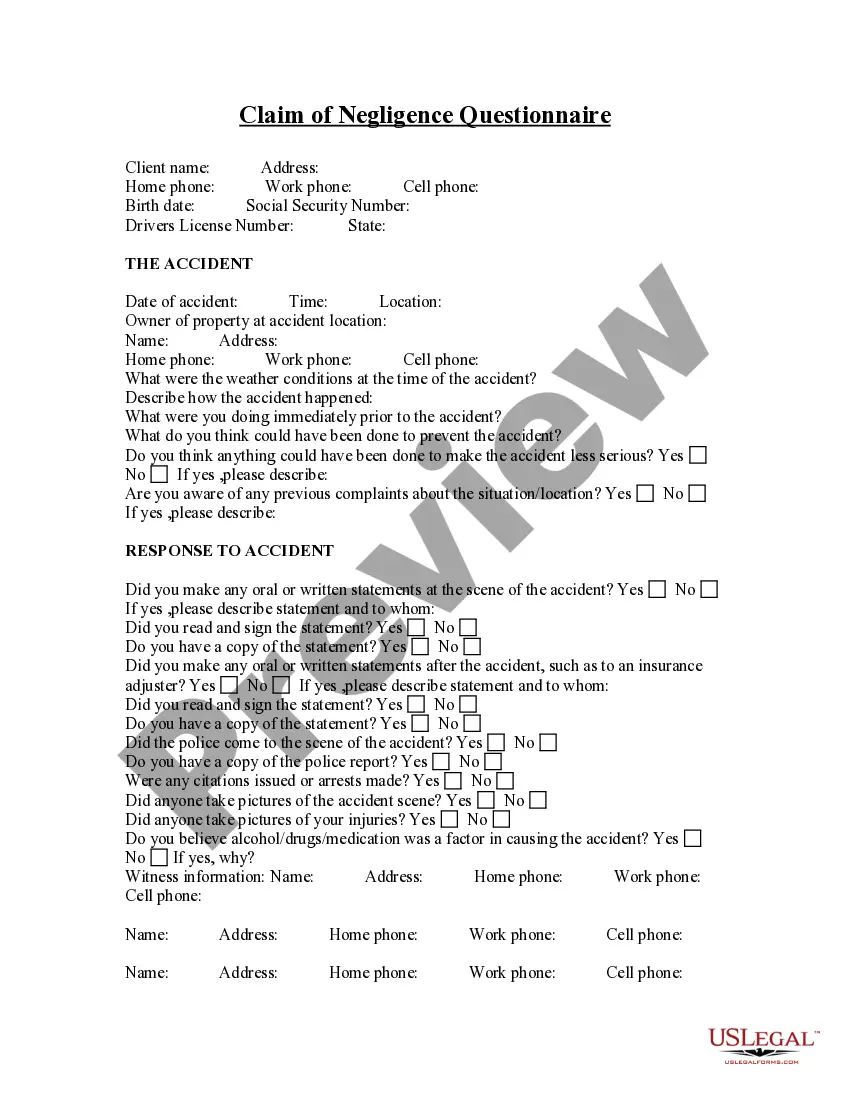

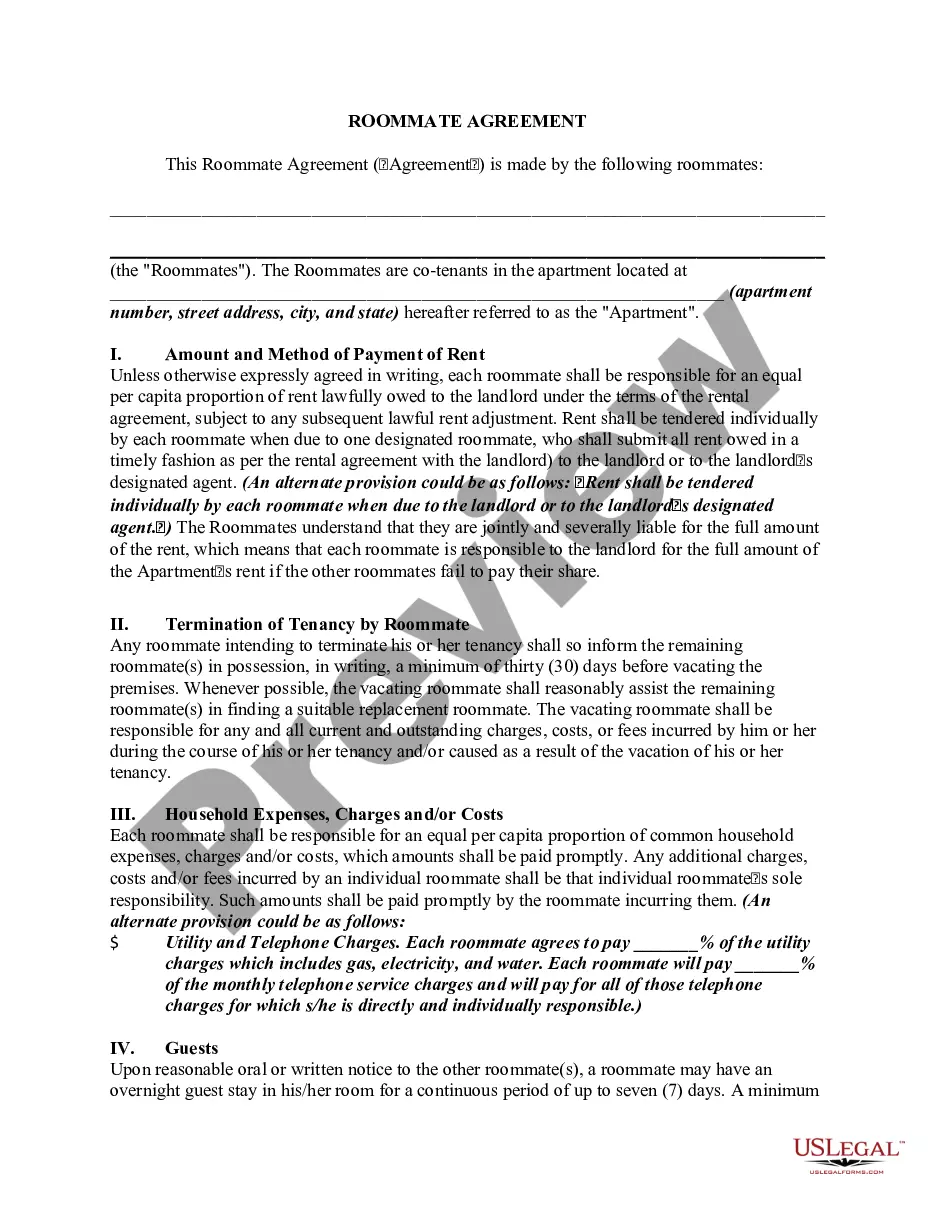

- Step 2. Use the Review option to examine the form’s details. Remember to read through the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After you have found the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Virgin Islands Guaranty of Promissory Note by Individual - Corporate Borrower.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

A promise to pay agreement is a promissory note. It details the amount of debt outstanding, the conditions under which the money will be repaid, the interest rate, and what will happen if the money is not repaid in a timely manner.

Based on all of the elements included in the promissory note, the maturity date or end date of the promissory note must be determined before the borrower and lender can calculate simple interest. This is the date upon which the promissory note needs to be repaid.

The buyer doesn't want to have to pay interest, and the seller feels funny asking for it, so they agree, no interest. Unfortunately, the IRS may impute interest received to the seller, even if the parties agreed to zero interest or a rate below the IRS' published rates.

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

You can create a Promissory Note as a lender or borrower by following these steps:Select the location. Our Promissory Note template will customize your document specifically for the laws of your location.Provide party details.Establish the terms of the loan.Include final details.Sign the document.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.