A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

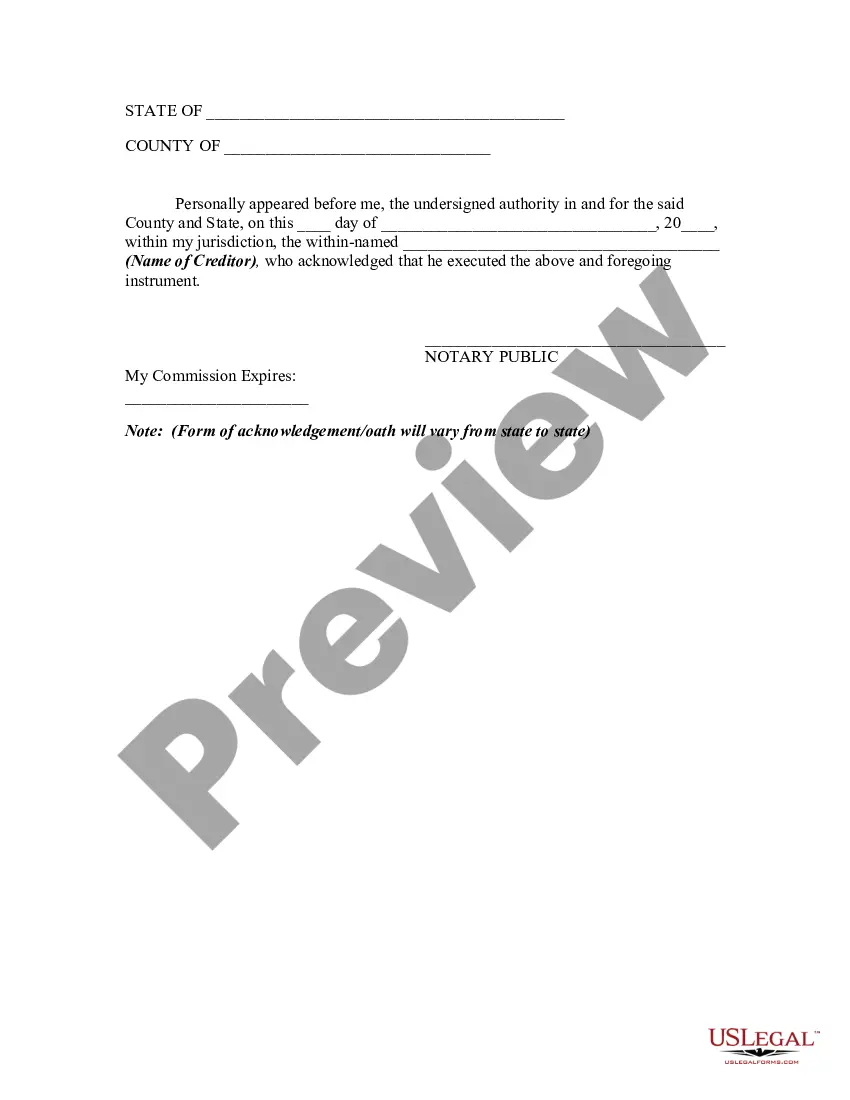

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Virgin Islands Release of Claims Against an Estate By Creditor is a legal document that allows a creditor to formally release their claims against an estate in the Virgin Islands. When an individual passes away, their assets and debts are generally transferred to their estate. Creditors who are owed money by the deceased individual may seek repayment from the assets held within the estate. However, in certain situations, a creditor may decide to release their claims against the estate. This can happen for several reasons, such as: 1. Settlement: The creditor and the estate may reach a settlement agreement, where the estate agrees to pay the creditor a reduced amount or in a different form (such as through installment payments). In exchange for this agreement, the creditor releases their claims against the remaining assets of the estate. 2. Insufficient Assets: If the estate does not have sufficient assets to fully satisfy the creditor's claim, the creditor may choose to release their claims and write off the debt, recognizing that pursuing further legal action might not be fruitful. 3. Time Constraints: Pursuing a claim against an estate can be a lengthy and complex process. Some creditors may choose to release their claims if they believe the time and effort required to pursue the claim outweigh the potential benefits. It is essential to note that there might be different types of Virgin Islands Release of Claims Against an Estate By Creditor, depending on the specific circumstances or agreements reached between the creditor and the estate. These variations may include: 1. Full Release: This type of release completely absolves the estate from any obligations towards the creditor, effectively ending the creditor's claims against the estate. 2. Partial Release: In some cases, a creditor may agree to release only a portion of their claim against the estate. This agreement may arise from negotiations or compromise between the creditor and the estate. 3. Conditional Release: A creditor may release their claims against the estate only under certain conditions, such as receiving payment from a specific source or obtaining approval from a court. A Virgin Islands Release of Claims Against an Estate By Creditor is a significant legal document that protects both the creditor's rights and the estate's assets. It helps to formalize the agreement between the creditor and the estate, providing a clear record of the release and preventing any future disputes regarding the creditor's claims.A Virgin Islands Release of Claims Against an Estate By Creditor is a legal document that allows a creditor to formally release their claims against an estate in the Virgin Islands. When an individual passes away, their assets and debts are generally transferred to their estate. Creditors who are owed money by the deceased individual may seek repayment from the assets held within the estate. However, in certain situations, a creditor may decide to release their claims against the estate. This can happen for several reasons, such as: 1. Settlement: The creditor and the estate may reach a settlement agreement, where the estate agrees to pay the creditor a reduced amount or in a different form (such as through installment payments). In exchange for this agreement, the creditor releases their claims against the remaining assets of the estate. 2. Insufficient Assets: If the estate does not have sufficient assets to fully satisfy the creditor's claim, the creditor may choose to release their claims and write off the debt, recognizing that pursuing further legal action might not be fruitful. 3. Time Constraints: Pursuing a claim against an estate can be a lengthy and complex process. Some creditors may choose to release their claims if they believe the time and effort required to pursue the claim outweigh the potential benefits. It is essential to note that there might be different types of Virgin Islands Release of Claims Against an Estate By Creditor, depending on the specific circumstances or agreements reached between the creditor and the estate. These variations may include: 1. Full Release: This type of release completely absolves the estate from any obligations towards the creditor, effectively ending the creditor's claims against the estate. 2. Partial Release: In some cases, a creditor may agree to release only a portion of their claim against the estate. This agreement may arise from negotiations or compromise between the creditor and the estate. 3. Conditional Release: A creditor may release their claims against the estate only under certain conditions, such as receiving payment from a specific source or obtaining approval from a court. A Virgin Islands Release of Claims Against an Estate By Creditor is a significant legal document that protects both the creditor's rights and the estate's assets. It helps to formalize the agreement between the creditor and the estate, providing a clear record of the release and preventing any future disputes regarding the creditor's claims.