Virgin Islands Revocable Living Trust for Real Estate

Description

How to fill out Revocable Living Trust For Real Estate?

If you require exhaustive, obtain, or produce sanctioned document templates, utilize US Legal Forms, the largest selection of official forms available online.

Leverage the site`s straightforward and user-friendly search to locate the forms you need. Various templates for business and personal applications are categorized by types and jurisdictions, or keywords.

Employ US Legal Forms to find the Virgin Islands Revocable Living Trust for Real Estate in just a few clicks.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Virgin Islands Revocable Living Trust for Real Estate. Each legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

- If you are already a US Legal Forms user, sign in to your account and click on the Acquire button to obtain the Virgin Islands Revocable Living Trust for Real Estate.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for your correct city/region.

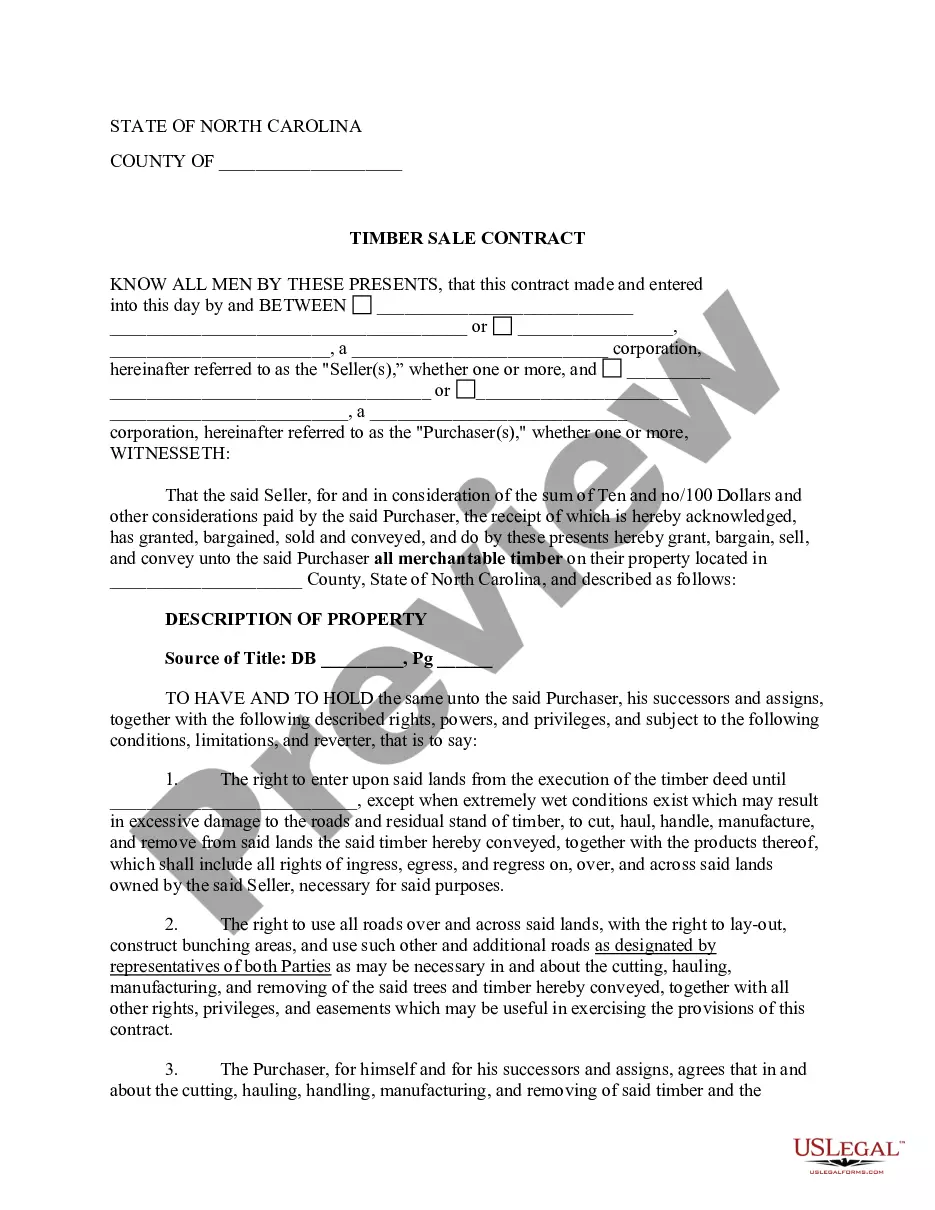

- Step 2. Utilize the Preview option to review the form`s details. Remember to read the description.

- Step 3. If you are unsatisfied with the form, use the Search area at the top of the screen to find alternative types of your legal form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Suze Orman advocates for revocable trusts as valuable estate planning tools. She highlights that a Virgin Islands Revocable Living Trust for Real Estate enables individuals to manage their assets and avoid probate, which can streamlines the process for heirs. However, she advises that people should carefully assess their unique needs before establishing a trust, as they are not one-size-fits-all solutions. Considering your personal situation and goals is essential in this process.

It's crucial to be selective about the assets placed in a revocable trust. Assets such as vehicles, business interests, or personal property titles may not benefit significantly from being in a Virgin Islands Revocable Living Trust for Real Estate. Furthermore, some assets with specific transfer rules may complicate matters. Assess your situation carefully to maximize the purpose of your trust.

Certain assets may not be ideal for a Virgin Islands Revocable Living Trust for Real Estate. Generally, life insurance policies and retirement accounts, like IRAs or 401(k)s, should not be placed in the trust, as they can change the intended tax implications. Instead, consider naming beneficiaries directly for these assets. Always evaluate each asset's structure to determine the most advantageous placement.

While placing your house in a Virgin Islands Revocable Living Trust for Real Estate offers benefits, there are disadvantages to consider. One potential drawback is that transferring your home into the trust requires paperwork and may involve fees, which could be cumbersome. Additionally, because revocable trusts do not offer tax benefits during your lifetime, you might not see immediate savings. Understanding these factors can help you make an informed decision.

Reporting income from a revocable trust is straightforward. Since the trust is revocable, the income generated is typically reported on your personal tax return, as you retain control over the assets within the trust. You would simply include income from the Virgin Islands Revocable Living Trust for Real Estate on Schedule B if it generates interest or dividends. It's wise to consult a tax professional to navigate specific situations regarding your trust.

One of the main downsides to a revocable trust is that it does not provide asset protection from creditors. This means your assets held within a Virgin Islands revocable living trust for real estate could still be reachable by creditors if you face financial difficulties. Additionally, creating and maintaining a trust can involve upfront costs and ongoing management. It's essential to weigh these factors against the benefits it provides.

While there are several options, many individuals favor the US Virgin Islands for a revocable trust due to its advantageous tax treatments. The location allows for flexible administration and unique asset protection strategies. States like Delaware and Nevada are also popular, but opting for the US Virgin Islands offers a distinctive approach, especially for real estate investment and management.

A revocable trust and a living trust are actually the same thing; both terms refer to a trust that can be altered or revoked during the grantor's lifetime. With a Virgin Islands revocable living trust for real estate, you maintain control over your assets, which can be transferred seamlessly to your beneficiaries upon your passing. This flexibility can be beneficial for estate planning. Understanding the nuances can help you manage your estate effectively.

Yes, Americans can own property in the US Virgin Islands without any special restrictions. This opportunity allows them to benefit from a Virgin Islands revocable living trust for real estate, providing significant estate planning advantages. Notably, property ownership here can offer a blend of investment potential and personal enjoyment. It's wise to consult with legal professionals to navigate the local property laws.

Selecting the right place to open a trust account can significantly affect your trust's performance. Many people find that using a local bank or credit union within the Virgin Islands is advantageous, as they understand the local regulations. Alternatively, you can also consider national banks with robust trust services. Always ensure the financial institution you choose has a solid reputation for managing trust accounts.