A Virgin Islands Revocable Living Trust for Single Person is a legal document that enables individuals in the Virgin Islands to retain complete control over their assets during their lifetime while also ensuring a smooth transfer of those assets to their chosen beneficiaries upon their death. This type of trust is specifically designed for individuals who are single or do not want to include a spouse or partner in their estate planning. A Revocable Living Trust allows the single person, also known as the granter or settler, to transfer their assets into the trust while maintaining full control and ownership over those assets. The granter can manage and use their assets as they wish during their lifetime and even amend or revoke the trust if their circumstances change. The benefits of establishing a Virgin Islands Revocable Living Trust for a single person include: 1. Probate avoidance: When a single person passes away, their assets typically need to go through the probate process, which can be time-consuming, costly, and open to public scrutiny. However, assets held within a revocable living trust can pass directly to the beneficiaries without going through probate, allowing for a more efficient and private transfer. 2. Incapacity planning: A Revocable Living Trust includes provisions for potential incapacity, ensuring that the granter's assets are properly managed and their personal care is provided for if they become unable to handle their affairs. This can help avoid the need for court-appointed guardianship or conservatorship. 3. Estate tax planning: While the Virgin Islands does not currently impose state estate taxes, a Revocable Living Trust can still be valuable in planning for federal estate taxes. By including specific clauses and provisions, the granter can minimize estate taxes and protect their wealth for future generations. 4. Flexibility and control: The granter has the freedom to manage, invest, and use the assets held within the trust as they see fit. They can also designate successor beneficiaries, trustees, and provide detailed instructions on how their assets should be distributed. Different types of the Virgin Islands Revocable Living Trusts for Single Persons may include: 1. Standard Revocable Living Trust: This is the most common type, where the single person sets up a trust to hold their assets and retains full control over them during their lifetime. 2. Special Needs Trust: For individuals who have a disabled child or dependent, a special needs trust can be established within the Revocable Living Trust to ensure the special needs individual's ongoing care and financial support. 3. Charitable Remainder Trust: This type of trust allows the granter to not only benefit themselves during their lifetime by maintaining control of their assets but also to provide for charitable causes, receiving potential tax benefits. In summary, a Virgin Islands Revocable Living Trust for Single Person offers the opportunity to maintain control and privacy over assets, avoid probate, plan for incapacity, and potentially minimize estate taxes. It is crucial to consult with an attorney specializing in estate planning to create a trust that suits individual needs and complies with Virgin Islands laws.

Virgin Islands Revocable Living Trust for Single Person

Description

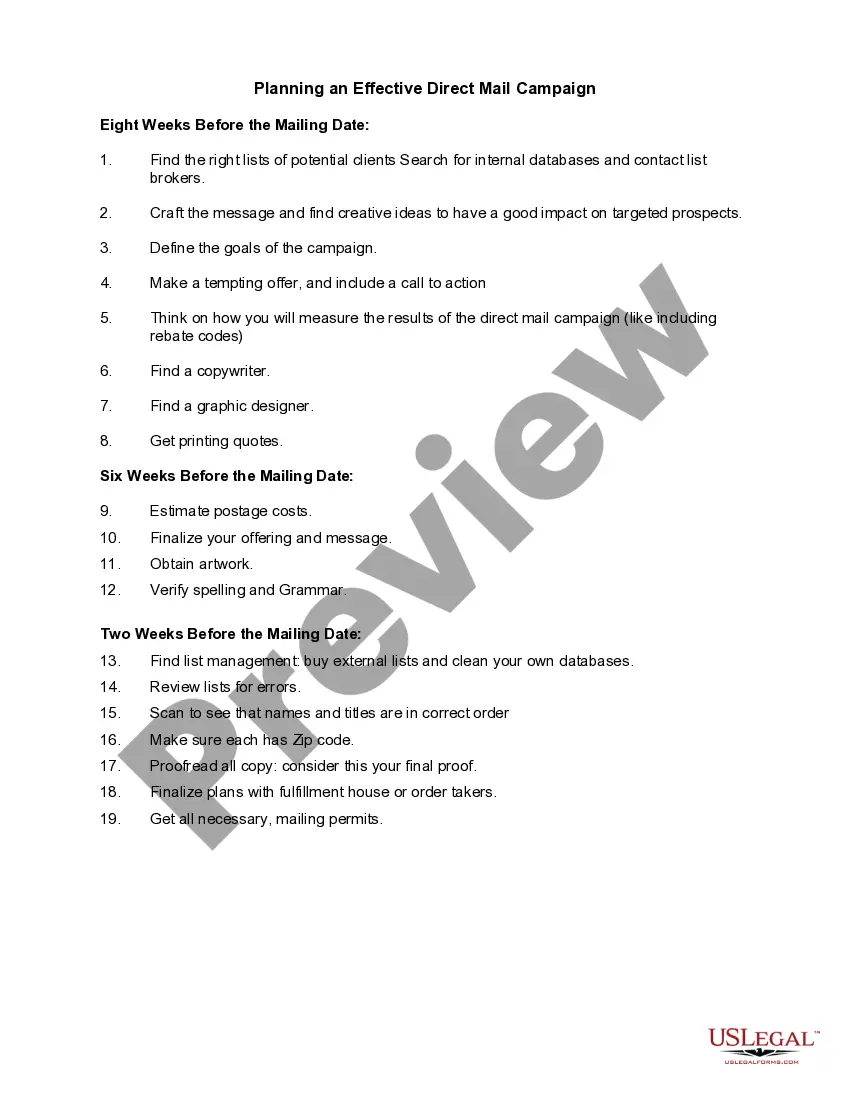

How to fill out Revocable Living Trust For Single Person?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can obtain or print.

While utilizing the website, you will find numerous forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Virgin Islands Revocable Living Trust for Single Person in just seconds.

If you already have a subscription, Log In and obtain the Virgin Islands Revocable Living Trust for Single Person from the US Legal Forms catalog. The Download button will appear on every document you view. You can access all previously electronically downloaded forms in the My documents section of your account.

Process the purchase. Use a Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the document to your device. Make modifications. Complete, edit, print, and sign the downloaded Virgin Islands Revocable Living Trust for Single Person. Every template you add to your account does not have an expiration date and is yours permanently. If you wish to download or print another copy, just visit the My documents section and click on the document you need. Access the Virgin Islands Revocable Living Trust for Single Person with US Legal Forms, one of the most extensive collections of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct document for your area/state.

- Click the Review button to examine the content of the form.

- Check the form description to confirm that you have chosen the right document.

- If the document does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the document, verify your choice by clicking the Buy now button.

- Next, choose the pricing plan you wish and provide your details to create an account.

Form popularity

FAQ

A revocable trust is often synonymous with a living trust, as both allow you to manage your assets during your lifetime and outline their distribution after death. The Virgin Islands Revocable Living Trust for Single Person exemplifies this by providing flexibility and control to the grantor. The key difference lies in how they are referred to; typically, 'living trust' emphasizes the active management aspect while 'revocable trust' highlights its adjustable nature.

When one spouse dies, a revocable living trust, including the Virgin Islands Revocable Living Trust for Single Person, often continues to operate but may require adjustments. The surviving spouse generally retains control of the trust and its assets, ensuring their needs are met. It is essential to review the trust documentation to understand how assets will pass on to beneficiaries upon the death of the first spouse.

Yes, a revocable trust, such as the Virgin Islands Revocable Living Trust for Single Person, typically becomes irrevocable upon the death of the grantor. This change ensures that the assets held in the trust will be managed and distributed according to the deceased's wishes as outlined in their trust documents. As a result, beneficiaries can receive their inheritance without the complications of probate.

In the UK, a revocable trust functions similarly to a Virgin Islands Revocable Living Trust for Single Person, allowing the person who created it to retain control over their assets. The trust can be amended or revoked entirely while the grantor is alive. However, it typically pertains to tax and legal implications specific to UK laws, whereas the Virgin Islands trust structure has unique benefits suited for estate planning.

While all trusts serve to manage and distribute assets, a revocable trust, like a Virgin Islands Revocable Living Trust for Single Person, allows the grantor to modify the trust during their lifetime. This flexibility means you can change beneficiaries, alter asset allocations, or even dissolve the trust if needed. In contrast, an irrevocable trust cannot be easily altered, providing more protection from creditors and taxes, but less control.

A single trust, such as a Virgin Islands Revocable Living Trust for Single Person, allows an individual to manage their assets during their lifetime and specify their distribution after death. This type of trust can simplify the estate planning process and help avoid probate. By designating yourself as the trustee, you retain control over your assets while also ensuring your wishes are followed.

When setting up your Virgin Islands Revocable Living Trust for a Single Person, consider including assets that need protection and streamlined management. Typical assets may include your real estate properties, bank accounts, investment accounts, and other valuables. This facilitates easier management during your lifetime and a smoother transfer to your heirs. Make sure to evaluate all your belongings and consult with a specialist or use platforms like US Legal Forms to ensure nothing important is overlooked.

Filling out a Virgin Islands Revocable Living Trust for a Single Person involves a few key steps. First, you will need to identify the trust’s name and define its purpose clearly. Afterwards, you should list all assets you want to include, ensuring you provide accurate descriptions and ownership details. Finally, it is essential to designate trustees and beneficiaries, and consider engaging a platform like US Legal Forms for accessible templates and guidance throughout the process.

In creating a Virgin Islands Revocable Living Trust for a Single Person, you will notice some assets cannot be placed in a trust. Generally, assets like retirement accounts, such as IRAs or 401(k)s, cannot be directly put into a trust without tax implications. Furthermore, a revocable trust does not own any assets intended for another trust or entity, such as business interests stored in a separate limited liability company (LLC). Ensure you consult with professionals to handle such assets appropriately.

When setting up a Virgin Islands Revocable Living Trust for a Single Person, it is important to know that certain assets typically do not go into a revocable trust. For example, items such as your primary home, vehicles, and personal belongings may not be included until you transfer them properly. Additionally, any assets that you hold jointly with someone else generally do not require placement into the trust. Finally, life insurance policies may remain outside unless you specifically name the trust as the beneficiary.

More info

View Sports News Government Budget News Government Economic Policies Government View.