Virgin Islands Loan Assumption Agreement

Description

How to fill out Loan Assumption Agreement?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad range of legal document templates that you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can locate the most recent forms such as the Virgin Islands Loan Assumption Agreement in just moments.

If you have a monthly subscription, Log In and download the Virgin Islands Loan Assumption Agreement from the US Legal Forms library. The Acquire button will be visible on every form you view. You can access all previously saved forms in the My documents section of your account.

Select the format and download the form to your device. Make adjustments. Fill out, modify, print, and sign the saved Virgin Islands Loan Assumption Agreement.

Every template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Virgin Islands Loan Assumption Agreement with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have chosen the correct form for your city/county. Click the Review button to assess the form's content.

- Read the form description to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select the pricing plan you prefer and provide your details to register for the account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

Form popularity

FAQ

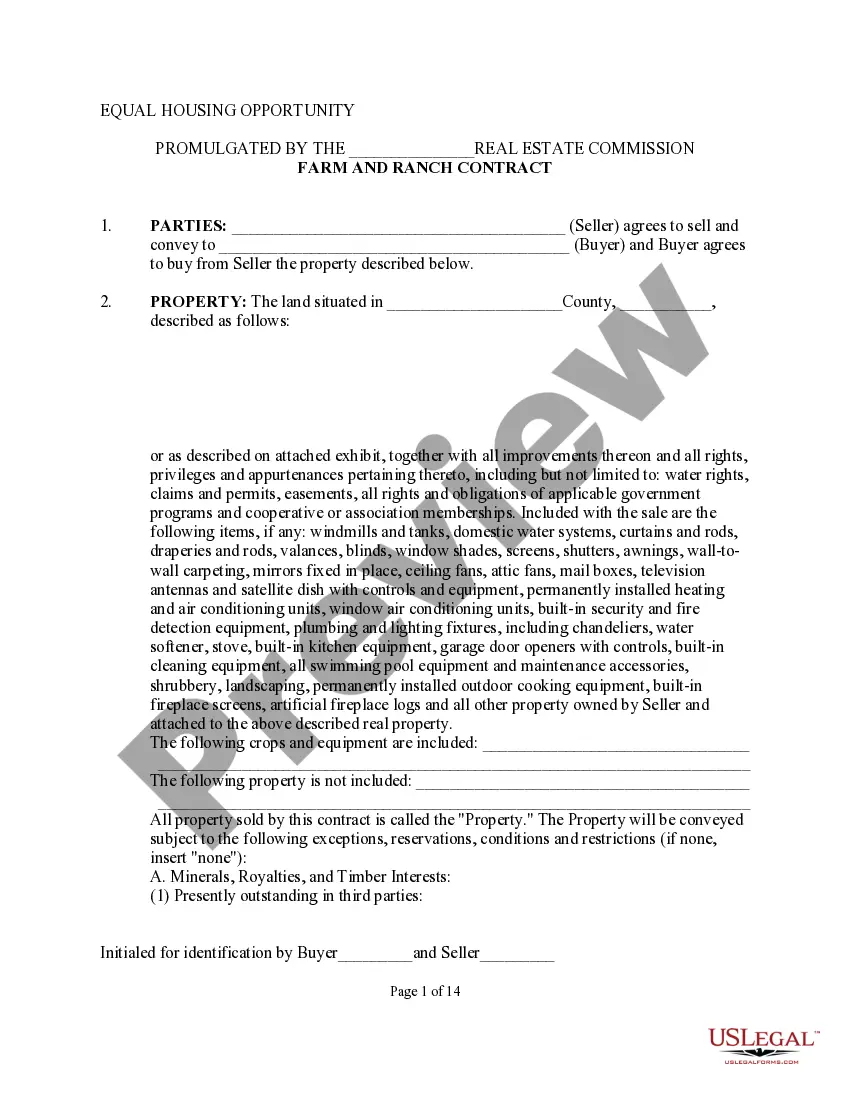

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.

Calculation. The mortgage assumption value can be calculated as the net present value of the sum of the future monthly payment savings due to the assumable loan rate being lower than the prevailing new loan interest rate.

Simple assumption ' This means the buyer takes over making payments on the mortgage without involving the lender. Anyone can do a simple assumption through a purely private arrangement. But these agreements are risky.

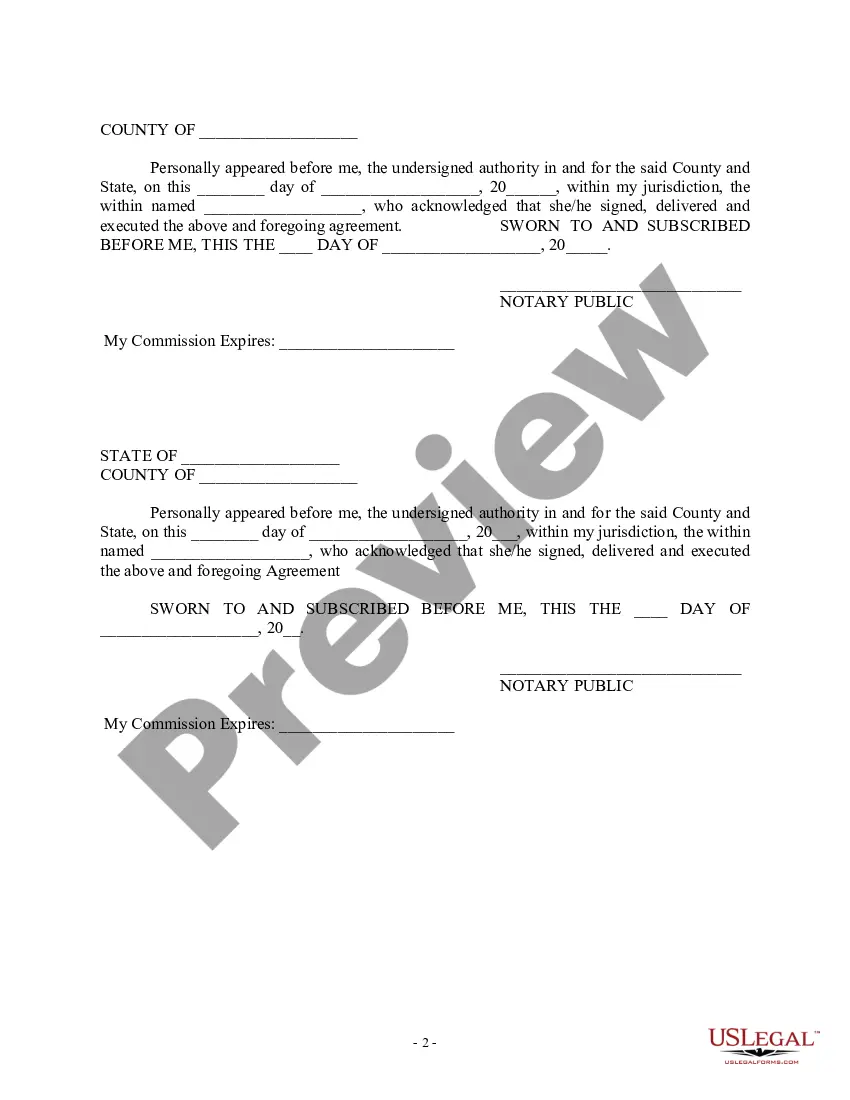

The most important document in the loan assumption process is the deed of trust, which adds your name to the mortgage and absolves the original borrower of any obligations under the agreement, assuming a novation. All parties will be required to sign the final documents.

The effective date of this Assumption Agreement shall be the date the Memorandum of Assumption Agreement is recorded in the Official Records.

Most fixed-rate mortgages can be assumed. Variable-rate mortgages and home equity lines of credit can't. The lender must approve the buyer who wants to assume the mortgage. If approved, the buyer takes over the remaining mortgage payments to the lender.

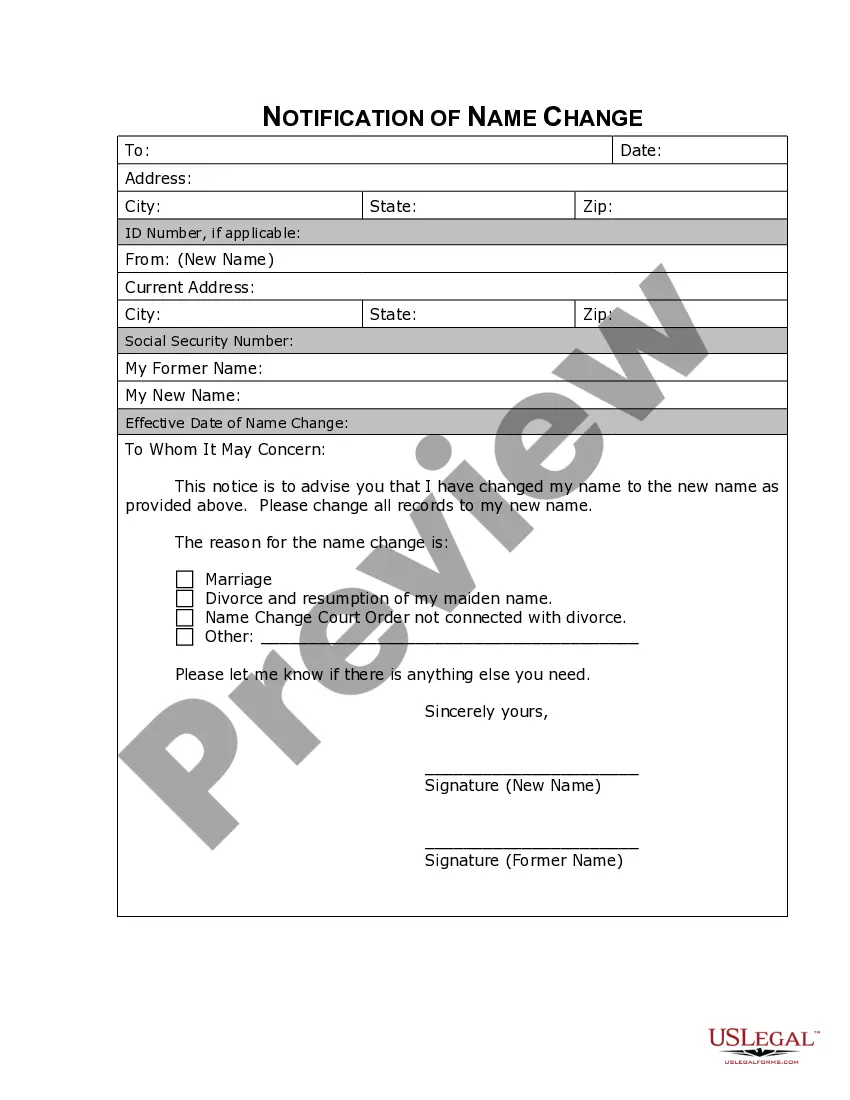

Updated March 7, 2022. In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.