A 1031 exchange is a swap of one business or investment asset for another. Although most swaps are taxable as sales, if you come within 1031, you’ll either have no tax or limited tax due at the time of the exchange.

In effect, you can change the form of your investment without (as the IRS sees it) cashing out or recognizing a capital gain. That allows your investment to continue to grow tax deferred. There’s no limit on how many times or how frequently you can do a 1031. You can roll over the gain from one piece of investment real estate to another to another and another. Although you may have a profit on each swap, you avoid tax until you actually sell for cash many years later. Then you’ll hopefully pay only one tax, and that at a long-term capital gain rate .

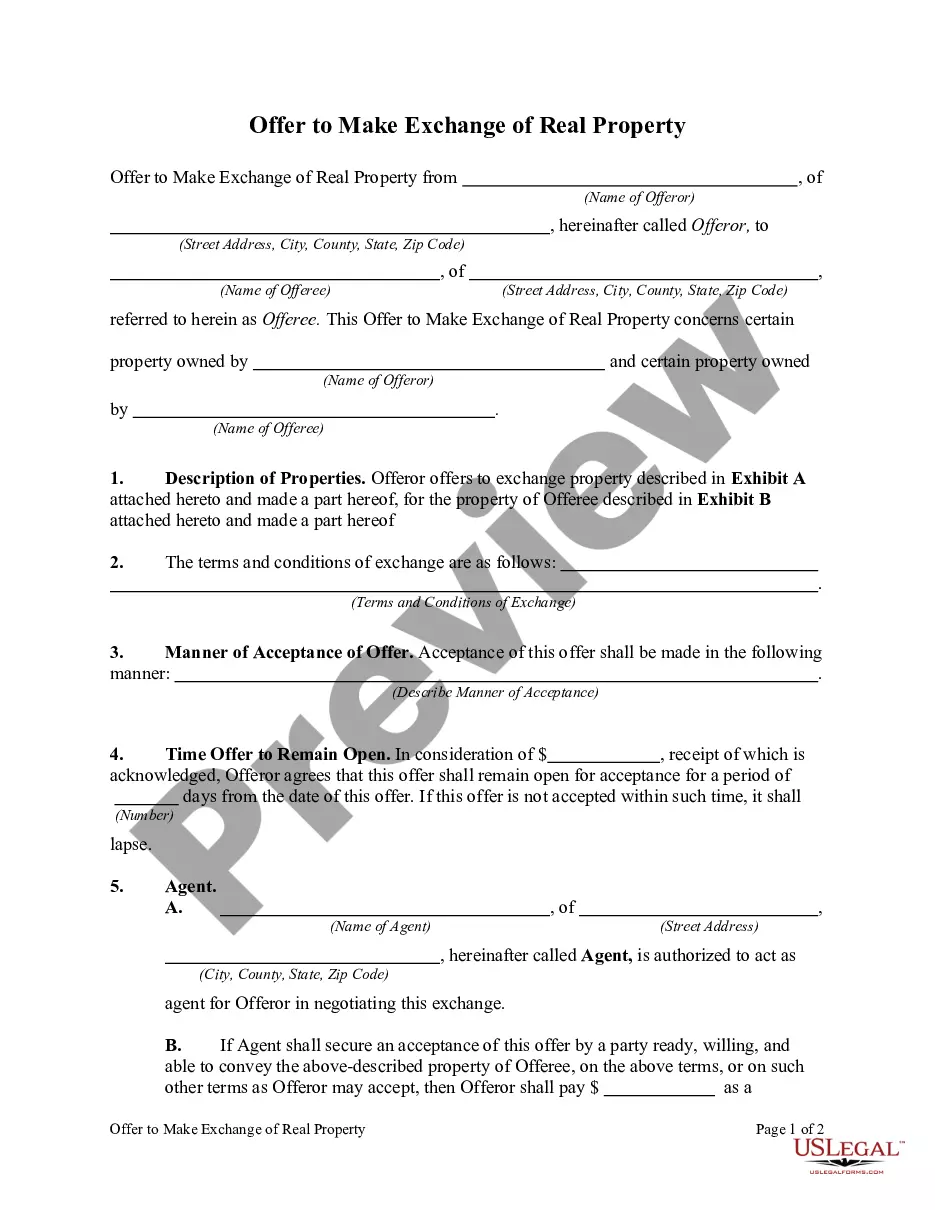

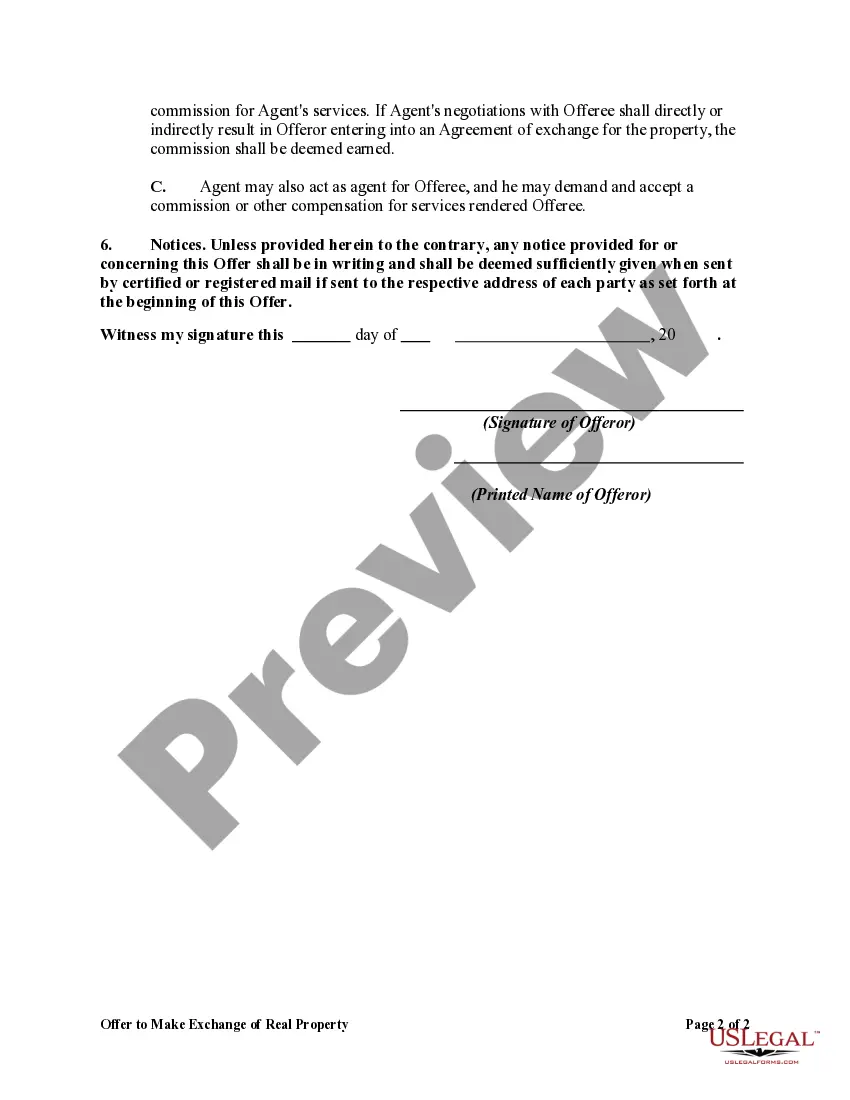

Virgin Islands Offer to Make Exchange of Real Property: A Comprehensive Guide Are you considering engaging in a real estate transaction in the beautiful Virgin Islands? Look no further! In this detailed description, we will provide you with valuable information regarding Virgin Islands offers to make an exchange of real property. We will explore the types of exchanges available, their benefits, and the necessary steps involved. 1. Virgin Islands Offer to Make Exchange of Real Property — Overview: The Virgin Islands Offer to Make Exchange of Real Property refers to a legal agreement where two parties agree to swap their properties, typically to meet specific investment or personal goals. This offer can involve various types of exchanges, each serving a particular purpose. 2. Types of Virgin Islands Offers to Make Exchange of Real Property: a. Simultaneous Exchange: The simultaneous exchange, also known as a "forward exchange," occurs when both parties close on the same day, executing the exchange concurrently. This type of exchange ensures a seamless transfer of properties without any time gap. b. Delayed Exchange: A delayed exchange, commonly referred to as a "Starker exchange" or "1031 exchange," allows property owners to defer capital gains taxes by exchanging one property for another. In this scenario, the relinquished property is sold, and the replacement property is acquired within a specified timeframe. c. Reverse Exchange: The reverse exchange allows property owners to first purchase a replacement property before selling their existing property, offering flexibility in acquiring the desired real estate without the constraints of a traditional sale timeline. 3. Benefits of the Virgin Islands Offer to Make Exchange of Real Property: a. Tax Advantages: Engaging in a Virgin Islands offer to make an exchange of real property allows participants to defer paying capital gains taxes, providing significant tax benefits and potential reinvestment opportunities. b. Portfolio Diversification: Exchanging properties enables investors to diversify their real estate portfolios by acquiring assets in the Virgin Islands, known for their stunning beaches, vibrant culture, and thriving tourism industry. c. Enhanced Cash Flow: By exchanging a lower-performing property for one with the potential for higher returns, individuals can enjoy increased rental income or capital appreciation, subsequently boosting their cash flow. 4. Steps Involved in the Virgin Islands Offer to Make Exchange of Real Property: a. Identify Qualified Intermediary: Select a qualified intermediary familiar with the Virgin Islands real estate laws and the exchange process, ensuring compliance with Internal Revenue Service (IRS) regulations. b. Establish Exchange Agreement: Draft a legally binding exchange agreement detailing the terms, conditions, and timeline of the property exchange. This agreement should protect the interests of both parties involved. c. Find Replacement Property: Search for suitable replacement property within the Virgin Islands, considering location, market potential, and personal preferences. d. Conduct Due Diligence: Thoroughly inspect the replacement property, conduct property value assessments, review legal documents, and verify any necessary permits or licenses required for ownership transfer. e. Close the Exchange: Coordinate with all involved parties, finalize paperwork, and proceed with the exchange closing, ensuring a smooth transfer of properties. In conclusion, a Virgin Islands Offer to Make Exchange of Real Property offers an attractive proposition for individuals looking to invest in or relocate to this breathtaking Caribbean destination. Understanding the various exchange types, benefits, and steps involved will enable you to navigate the process with confidence, ensuring a successful and rewarding real estate transaction.