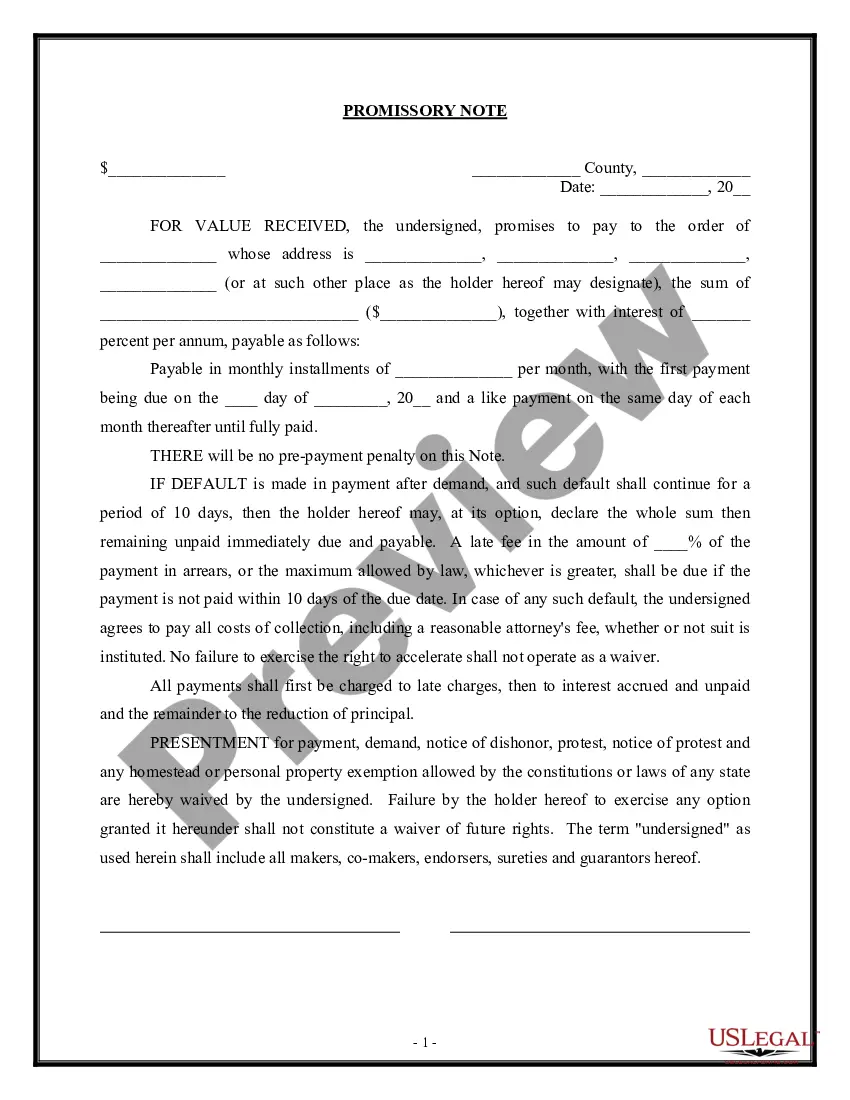

A Virgin Islands Sale of Business — Promissory Not— - Asset Purchase Transaction is a legal agreement established between two parties for the sale of a business, where the buyer promises to pay for the assets acquired over a specified period using a promissory note. This transaction typically involves the transfer of assets, liabilities, and operations from the seller to the buyer. In the Virgin Islands, there may be various types of sales of business transactions using promissory notes and asset purchases. These transactions differ based on factors such as the nature of the business being sold, the industry it belongs to, and specific terms outlined in the agreement. Some examples of different types of Virgin Islands Sale of Business — Promissory Not— - Asset Purchase Transactions include: 1. Retail Business Sale: This type of transaction involves the sale of assets, operational rights, customer databases, inventory, and potentially intellectual property (trademarks, copyrights, etc.) of a retail business. The buyer may pay the purchase price through a promissory note, which outlines the repayment terms, interest rate, and other related details. 2. Manufacturing Business Sale: When a manufacturing business is being sold in the Virgin Islands, a Sale of Business — Promissory Not— - Asset Purchase Transaction can be used. This agreement covers the transfer of manufacturing equipment, raw materials, inventory, contractual agreements, and any other assets related to the manufacturing process. The buyer typically provides a promissory note stating the terms of payment for the purchased assets. 3. Service-Based Business Sale: Service-based businesses, such as consulting firms, marketing agencies, or law practices, can also be sold through a Sale of Business — Promissory Not— - Asset Purchase Transaction. In this case, the buyer acquires the client contracts, goodwill, intellectual property, employee contracts, and other assets necessary to continue the service business's operations. The agreement specifies the payment structure and repayment terms using a promissory note. 4. Franchise Sale: Franchise businesses can be transferred using a Sale of Business — Promissory Not— - Asset Purchase Transaction. Franchise agreements involve the sale of all franchisor assets, including proprietary systems, trademarks, operational manuals, training materials, and existing franchisee contracts. The buyer may utilize a promissory note to outline the payment schedule for the acquired assets. These are just a few examples of the various types of Virgin Islands Sale of Business — Promissory Not— - Asset Purchase Transactions. Each transaction is unique, and the terms and conditions may vary based on the specifics of the business being sold and negotiated between the buyer and seller. It is crucial to consult with legal professionals well-versed in the Virgin Islands business law to ensure compliance with local regulations and draft a comprehensive agreement that protects the interests of all parties involved.

Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Virgin Islands Sale Of Business - Promissory Note - Asset Purchase Transaction?

US Legal Forms - one of the most significant libraries of legal kinds in the States - provides a variety of legal file web templates you may down load or produce. Using the website, you may get thousands of kinds for business and person functions, categorized by groups, states, or search phrases.You will find the most recent models of kinds just like the Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction in seconds.

If you already have a membership, log in and down load Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction in the US Legal Forms collection. The Download button will appear on every form you perspective. You get access to all in the past downloaded kinds in the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, listed below are easy guidelines to help you get began:

- Be sure you have chosen the right form to your area/region. Click on the Preview button to review the form`s content. Look at the form information to actually have selected the proper form.

- If the form does not match your needs, make use of the Research field towards the top of the display to find the one who does.

- When you are content with the form, validate your option by clicking on the Purchase now button. Then, opt for the costs program you favor and offer your credentials to sign up for an accounts.

- Approach the deal. Utilize your credit card or PayPal accounts to accomplish the deal.

- Find the formatting and down load the form on your own device.

- Make adjustments. Fill out, modify and produce and signal the downloaded Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction.

Every template you added to your money lacks an expiration date which is your own forever. So, if you want to down load or produce one more duplicate, just go to the My Forms section and then click in the form you will need.

Get access to the Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction with US Legal Forms, probably the most considerable collection of legal file web templates. Use thousands of expert and state-particular web templates that meet up with your organization or person needs and needs.