A Virgin Islands Contract of Sale and Leaseback of an Apartment Building with Purchaser Assuming an Outstanding Note Secured by a Mortgage or Deed of Trust is a legal agreement that involves the sale and subsequent leasing back of an apartment building by the seller, with the purchaser assuming the responsibility for an existing mortgage or deed of trust. This type of contract enables property owners to access immediate liquidity while still maintaining control and occupancy of their apartment building. By entering into this agreement, the seller can unlock the property's value by selling it to a purchaser who assumes the existing mortgage or deed of trust, relieving the seller from the financial burden of repayment. The Virgin Islands Contract of Sale and Leaseback of an Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust offers several advantages for both parties involved. For the seller, it provides an opportunity to access capital without having to sell the property outright. This allows them to continue operating the apartment building, collect rent, and benefit from any potential appreciation in property value. On the other hand, the purchaser gains ownership of an income-generating property with an existing stream of rental income. By assuming the outstanding note secured by a mortgage or deed of trust, the purchaser can leverage the property's existing cash flow and potential future growth. This arrangement also minimizes the risks associated with underwriting a new loan. It's important to note that there may be various variations or types of Virgin Islands Contracts of Sale and Leaseback of Apartment Buildings with Purchaser Assuming Outstanding Notes Secured by a Mortgage or Deed of Trust. These variations could include specific terms related to the duration of the leaseback, the purchase price, the responsibilities of each party in terms of property maintenance and repairs, and any potential buyback or repurchase provisions. Furthermore, the contract may specify whether the purchaser assumes the existing mortgage or deed of trust as is, or if they have the option to renegotiate the terms with the lender. Additionally, the contract may outline the process for transferring ownership and title of the property to the purchaser, and any potential remedies or dispute resolution mechanisms in case of non-compliance with the agreement. In conclusion, a Virgin Islands Contract of Sale and Leaseback of an Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust provides a flexible and mutually beneficial arrangement for property owners and purchasers alike. It offers the seller immediate capital injection while retaining control and occupancy of the property, while the purchaser acquires an income-generating asset with existing financing in place.

Virgin Islands Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust

Description

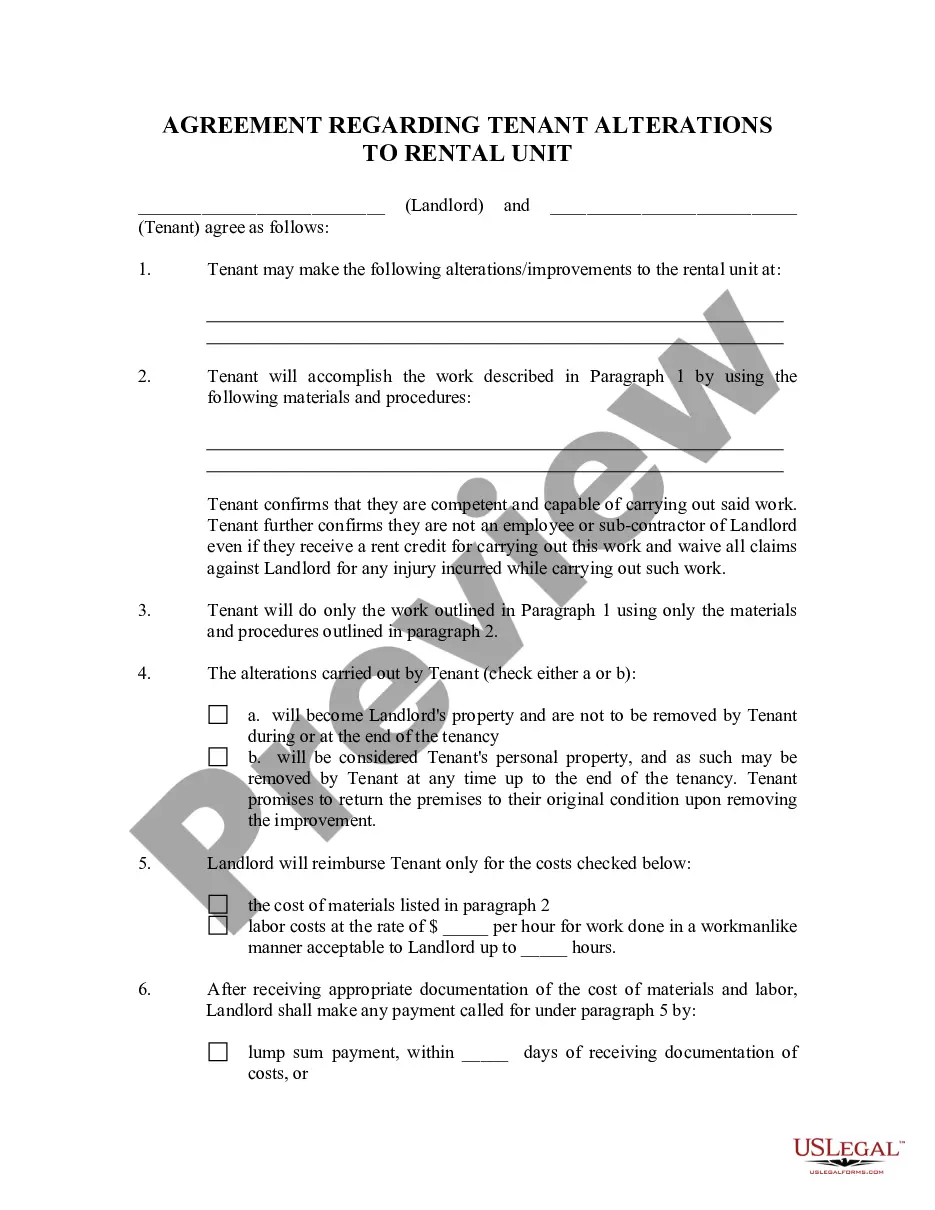

How to fill out Virgin Islands Contract Of Sale And Leaseback Of Apartment Building With Purchaser Assuming Outstanding Note Secured By A Mortgage Or Deed Of Trust?

US Legal Forms - one of several most significant libraries of lawful varieties in the States - gives a wide array of lawful papers web templates it is possible to obtain or print. Using the site, you will get a large number of varieties for business and specific functions, categorized by categories, says, or search phrases.You will find the most recent variations of varieties just like the Virgin Islands Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust in seconds.

If you already have a registration, log in and obtain Virgin Islands Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust from your US Legal Forms catalogue. The Down load key will appear on every develop you view. You have accessibility to all formerly acquired varieties inside the My Forms tab of the accounts.

If you would like use US Legal Forms the first time, listed here are easy recommendations to help you began:

- Ensure you have picked the correct develop for the metropolis/area. Click the Preview key to examine the form`s content material. Read the develop explanation to actually have chosen the appropriate develop.

- If the develop does not suit your requirements, use the Lookup discipline on top of the monitor to find the the one that does.

- Should you be pleased with the shape, confirm your decision by visiting the Acquire now key. Then, select the prices prepare you want and give your credentials to sign up for an accounts.

- Approach the purchase. Make use of bank card or PayPal accounts to perform the purchase.

- Choose the format and obtain the shape in your product.

- Make changes. Fill up, change and print and indicator the acquired Virgin Islands Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust.

Every web template you included with your money lacks an expiration particular date and it is your own permanently. So, in order to obtain or print one more backup, just check out the My Forms portion and then click around the develop you require.

Gain access to the Virgin Islands Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust with US Legal Forms, the most substantial catalogue of lawful papers web templates. Use a large number of specialist and condition-certain web templates that fulfill your company or specific requires and requirements.