Title: Virgin Islands Letter to Other Entities Notifying Them of Identity Theft Introduction: In the Virgin Islands, victims of identity theft may need to notify various entities about the incident to protect their personal information and prevent further fraud. To aid individuals in this process, a Virgin Islands Letter to Other Entities Notifying Them of Identity Theft can be used. This letter serves as a formal communication to inform organizations, such as financial institutions, credit bureaus, government agencies, and service providers, about the identity theft incident. By promptly sending such a letter, victims can report the unauthorized use of their personal information and take appropriate actions to mitigate the consequences. Types of Virgin Islands Letters to Other Entities Notifying Them of Identity Theft: 1. Financial Institutions: When an individual discovers unauthorized financial transactions or suspects fraudulent activity, it is crucial to immediately notify banks, credit unions, or any other financial institution involved. The Virgin Islands Letter to Financial Institutions Notifying Them of Identity Theft emphasizes the need to freeze or close affected accounts, request fraud alerts, and collaborate with authorities to investigate the incident. 2. Credit Bureaus: To prevent potential harm to their credit report and ensure accuracy, victims must notify credit bureaus about the identity theft. The Virgin Islands Letter to Credit Bureaus Notifying Them of Identity Theft highlights the importance of placing fraud alerts, obtaining free credit reports, requesting fraudulent entries' removal, and initiating an extended fraud victim statement. 3. Government Agencies: Identity theft incidents should also be reported to relevant government agencies in the Virgin Islands. A Virgin Islands Letter to Government Agencies Notifying Them of Identity Theft can be sent to local law enforcement, the Office of the Attorney General, or other authorities. The letter briefly describes the situation, requests assistance in investigating the matter, and seeks guidance on filing police reports or initiating criminal proceedings. 4. Service Providers: Victims of identity theft should inform service providers, such as utility companies, telecom providers, insurance agencies, or online retailers, if their accounts or services have been compromised. A Virgin Islands Letter to Service Providers Notifying Them of Identity Theft outlines the unauthorized account access, requests account closures, and advises service providers to remain vigilant for any suspicious activities. Important Keywords: — Virgin Island— - Letter - Entities - Identity Theft — Frau— - Unauthorized Transactions - Financial Institutions — Credit Bureau— - Government Agencies - Service Providers — Fraud Alert— - Freezing Accounts - Fraudulent Entry Removal — Fraud VictiStatementen— - Law Enforcement — Office of the Attorney Genera— - Criminal Proceedings — Police Report— - Account Closures - Vigilance

Virgin Islands Letter to Other Entities Notifying Them of Identity Theft

Description

How to fill out Virgin Islands Letter To Other Entities Notifying Them Of Identity Theft?

Are you presently inside a position the place you need papers for sometimes business or person purposes just about every day? There are a lot of legitimate record themes available online, but discovering types you can trust is not easy. US Legal Forms provides a large number of kind themes, like the Virgin Islands Letter to Other Entities Notifying Them of Identity Theft, that happen to be written to satisfy state and federal requirements.

Should you be previously familiar with US Legal Forms website and have a merchant account, just log in. Following that, it is possible to down load the Virgin Islands Letter to Other Entities Notifying Them of Identity Theft template.

If you do not offer an accounts and would like to start using US Legal Forms, abide by these steps:

- Find the kind you want and make sure it is for the right city/state.

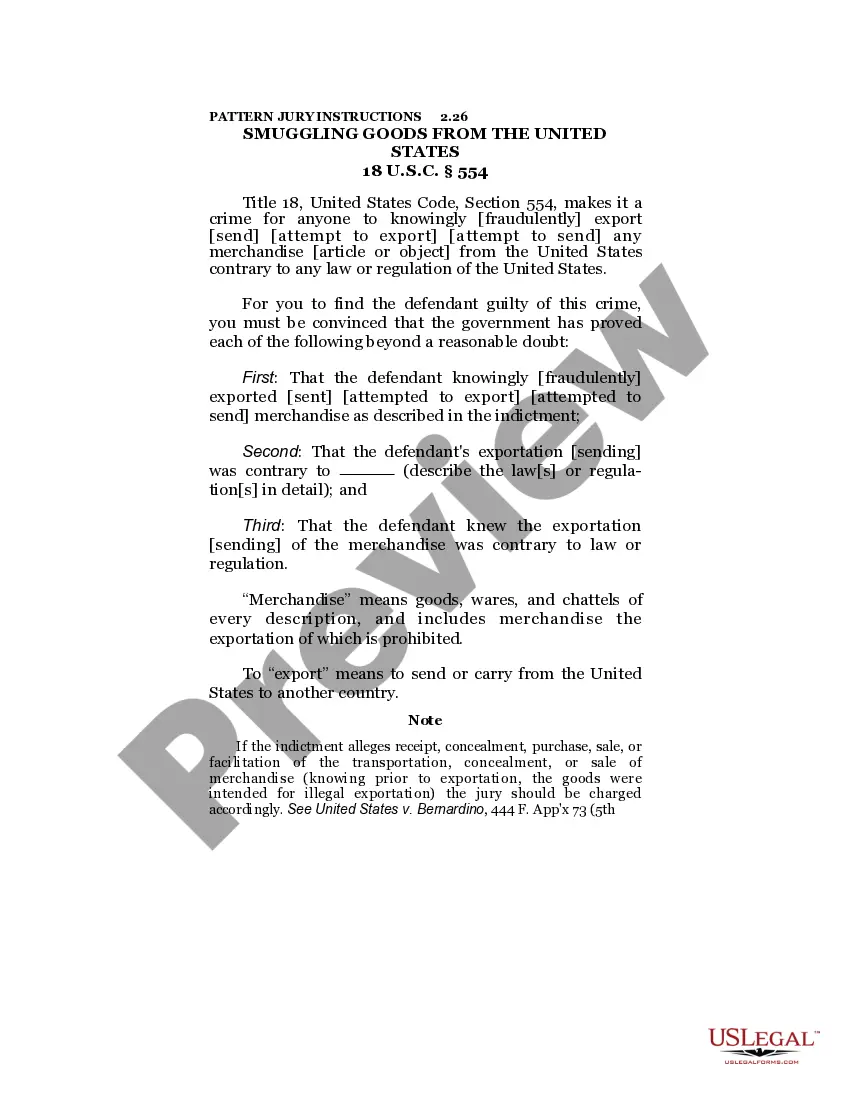

- Utilize the Review key to examine the shape.

- See the outline to ensure that you have chosen the proper kind.

- In the event the kind is not what you`re looking for, make use of the Search field to discover the kind that suits you and requirements.

- When you get the right kind, just click Acquire now.

- Select the prices plan you desire, complete the desired details to create your account, and pay money for an order using your PayPal or bank card.

- Decide on a handy paper structure and down load your duplicate.

Discover every one of the record themes you possess purchased in the My Forms food list. You may get a additional duplicate of Virgin Islands Letter to Other Entities Notifying Them of Identity Theft anytime, if possible. Just click the necessary kind to down load or print the record template.

Use US Legal Forms, one of the most considerable assortment of legitimate varieties, in order to save time and stay away from mistakes. The support provides expertly produced legitimate record themes that you can use for an array of purposes. Generate a merchant account on US Legal Forms and begin producing your lifestyle easier.