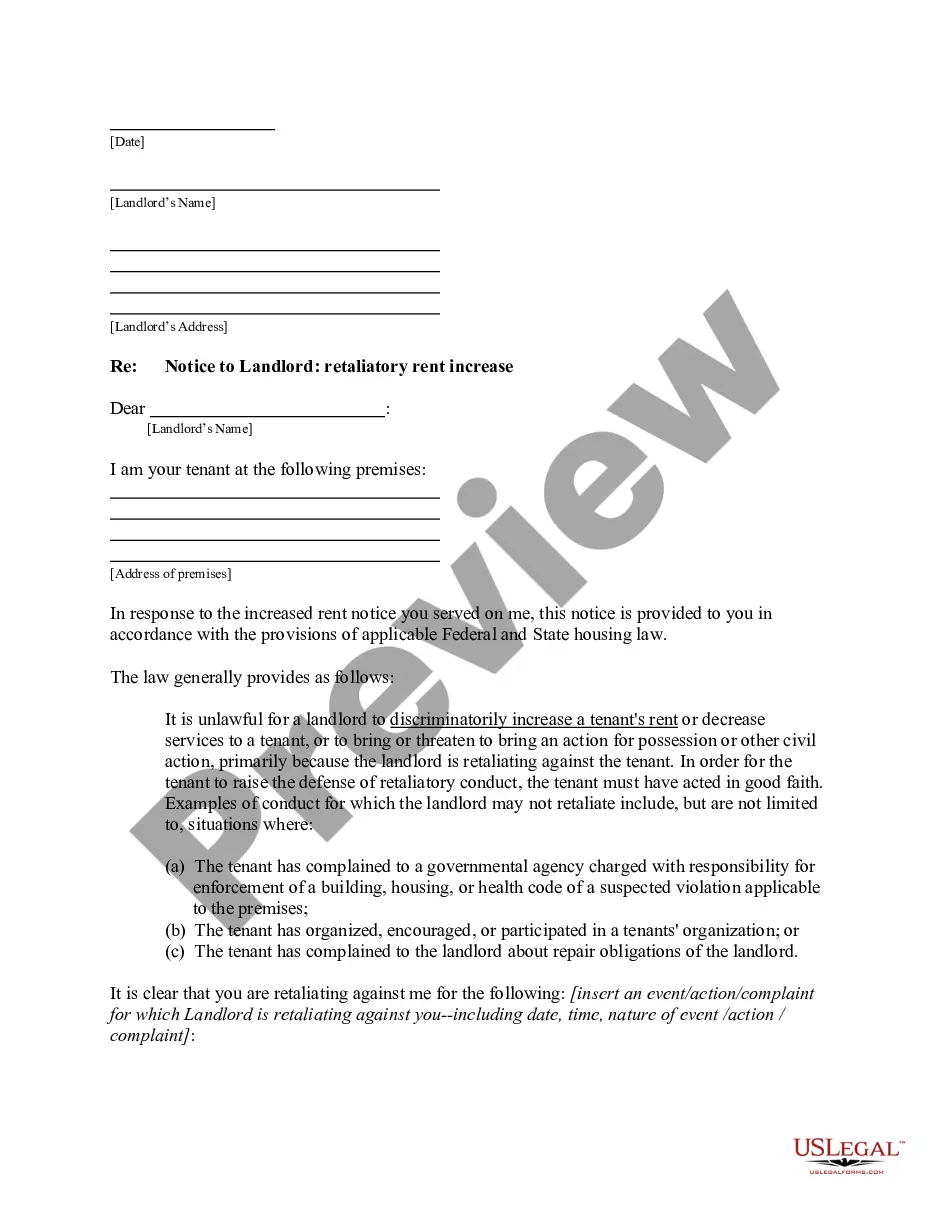

Title: Protecting Your Identity in the Virgin Islands: Sample Letter to Credit Reporting Bureau or Agency Introduction: Identity theft is a growing concern globally, and residents of the Virgin Islands must also be vigilant in safeguarding their personal information. One effective tool to prevent identity theft is to write a letter to a credit reporting bureau or agency notifying them of the potential risk. This article provides a detailed description of what the Virgin Islands sample letter to a credit reporting bureau should contain, along with relevant keywords to assist you in creating an impactful communication. Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft: [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Credit Reporting Bureau/Agency Name] [Address] [City, State, ZIP] Subject: Request to Initiate Fraud Alert for Potential Identity Theft Dear [Credit Reporting Bureau/Agency Name], I am writing to bring to your attention a potential risk of identity theft and to request your immediate assistance to safeguard my personal information. As a resident of the Virgin Islands, I believe it is crucial to take proactive measures to prevent any unauthorized use of my credit information or any other related fraudulent activities. I have noticed some suspicious activity on my accounts, including [mention specific incidents such as unauthorized credit inquiries, unfamiliar accounts or charges, etc.]. These troubling occurrences have raised concerns regarding the security of my personal information. It is vital that we take immediate action to protect my credit profile from further unauthorized activities. In light of these events, I kindly request that you initiate a Fraud Alert on my credit file and take the necessary steps to ensure that any attempts to open new accounts or make changes to existing ones are subjected to enhanced scrutiny. Specifically, I request the following actions: 1. Place an initial Fraud Alert: — Temporarily add a fraud alert to my credit file for a period of 90 days. — Ensure that any potential creditors are required to verify my identity before granting credit. 2. Review and Monitor: — Conduct a thorough review of my credit profile, statements, and transactions for any irregularities or unauthorized activities. — Provide me with a detailed credit report promptly. 3. Provide Fraud Victim Assistance: — Guide me through potential steps to mitigate identity theft consequences. — Assist in initiating a report with local law enforcement for necessary legal actions. I trust that you understand the severity of this situation and will take immediate action to address my concerns. Your cooperation and prompt attention to this matter will greatly assist in preventing any further compromise of my personal information and financial well-being. Please provide confirmation once the necessary actions have been taken to secure my credit profile. You can reach me at the contact information provided above if any additional details or clarifications are necessary. Thank you for your immediate attention to this matter. Sincerely, [Your Name] Keywords: Virgin Islands, sample letter, credit reporting bureau, agency, prevent identity theft, fraud alert, suspicious activity, unauthorized credit inquiries, unauthorized accounts or charges, protect personal information, enhanced scrutiny, initial Fraud Alert, review and monitor, credit report, fraud victim assistance, mitigate identity theft, local law enforcement, financial well-being, confirmation. Note: The provided sample letter can be customized as per individual requirements and the specific circumstances involved.

Virgin Islands Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft

Description

How to fill out Virgin Islands Sample Letter To Credit Reporting Bureau Or Agency To Help Prevent Identity Theft?

US Legal Forms - one of many most significant libraries of authorized types in the States - delivers a wide array of authorized document themes you may down load or print. While using internet site, you will get thousands of types for organization and individual uses, categorized by categories, says, or search phrases.You will find the most up-to-date versions of types much like the Virgin Islands Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft within minutes.

If you already have a membership, log in and down load Virgin Islands Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft from the US Legal Forms catalogue. The Obtain key can look on every form you view. You get access to all in the past downloaded types from the My Forms tab of your respective accounts.

If you would like use US Legal Forms the very first time, here are straightforward recommendations to obtain started off:

- Ensure you have picked out the best form for your town/state. Select the Preview key to review the form`s content. Browse the form description to ensure that you have chosen the proper form.

- In case the form doesn`t satisfy your specifications, utilize the Research industry towards the top of the display screen to obtain the one which does.

- Should you be satisfied with the form, verify your choice by clicking on the Get now key. Then, pick the costs plan you want and supply your qualifications to sign up on an accounts.

- Method the financial transaction. Use your Visa or Mastercard or PayPal accounts to perform the financial transaction.

- Choose the file format and down load the form on your own gadget.

- Make modifications. Load, change and print and indication the downloaded Virgin Islands Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft.

Every single web template you put into your money does not have an expiration day and it is your own forever. So, if you would like down load or print another backup, just go to the My Forms segment and click on about the form you require.

Obtain access to the Virgin Islands Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft with US Legal Forms, by far the most considerable catalogue of authorized document themes. Use thousands of specialist and state-particular themes that meet up with your organization or individual demands and specifications.

Form popularity

FAQ

If you have been a victim of identity theft, the Identity Theft Statement helps you notify financial institutions, credit card issuers and other companies that the identity theft occurred, tell them that you did not create the debt or charges, and give them information they need to begin an investigation.

You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report. An FTC Identity Theft Report subjects the person filing the report to criminal penalties if the information is false, and businesses can treat it as they would a police report.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Send copies of your police report and completed ID Theft Affidavit. Remind the credit bureaus that they must block or remove any information that you, as an identity theft victim, say is a result of the theft. Send your letters by certified mail, return receipt requested. Keep a copy of each letter.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.