A Virgin Islands Triple Net Commercial Lease Agreement is a legally binding contract that outlines the terms and conditions of renting a commercial property in the Virgin Islands, specifically utilizing the Triple Net (NNN) lease structure. This type of lease agreement is commonly used in real estate rental transactions and is favored by both landlords and tenants for its clear and detailed provisions regarding the financial responsibilities and maintenance of the property. In a Triple Net Commercial Lease Agreement, the tenant is responsible for paying three main expenses in addition to the base rent: property taxes, insurance, and maintenance costs. This agreement transfers the financial burden of these expenses from the landlord to the tenant, making it an attractive option for property owners. The tenant assumes greater control over the property's operations and has more flexibility in managing the property according to their business needs. There are different types of the Virgin Islands Triple Net Commercial Lease Agreements, such as: 1. Single-tenant NNN lease: This type of lease agreement involves a single tenant leasing the entire commercial property. The tenant is solely responsible for all expenses, including property taxes, insurance, and maintenance costs. 2. Multi-tenant NNN lease: In a multi-tenant NNN lease, there are multiple tenants leasing different portions or units within the commercial property. Each tenant is responsible for their share of property expenses based on the proportion of the leased space. 3. Ground lease: A ground lease is a long-term lease agreement in which the tenant leases the land and constructs their own building on the property. Typically, the tenant is responsible for all expenses, including construction, and pays a nominal rent for the land. 4. Absolute NNN lease: An absolute NNN lease is a lease agreement that places all financial responsibilities on the tenant, including major repairs and structural maintenance. The tenant assumes full control and risks associated with the property. When entering into a Virgin Islands Triple Net Commercial Lease Agreement, it is essential for both landlords and tenants to thoroughly review and negotiate the terms and conditions. This includes rent escalation clauses, tenant improvement allowances, and lease duration. Seeking legal counsel is highly recommended ensuring compliance with local laws and regulations and protect the interests of both parties involved.

Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental

Description

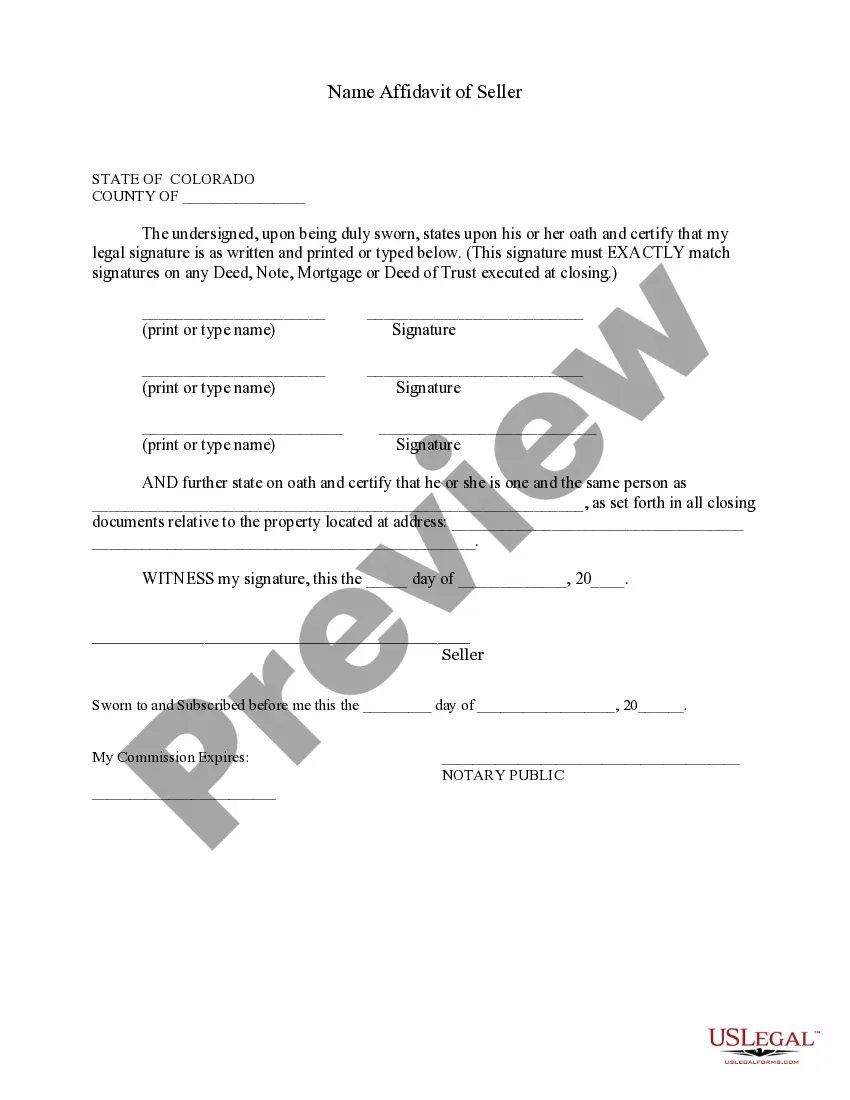

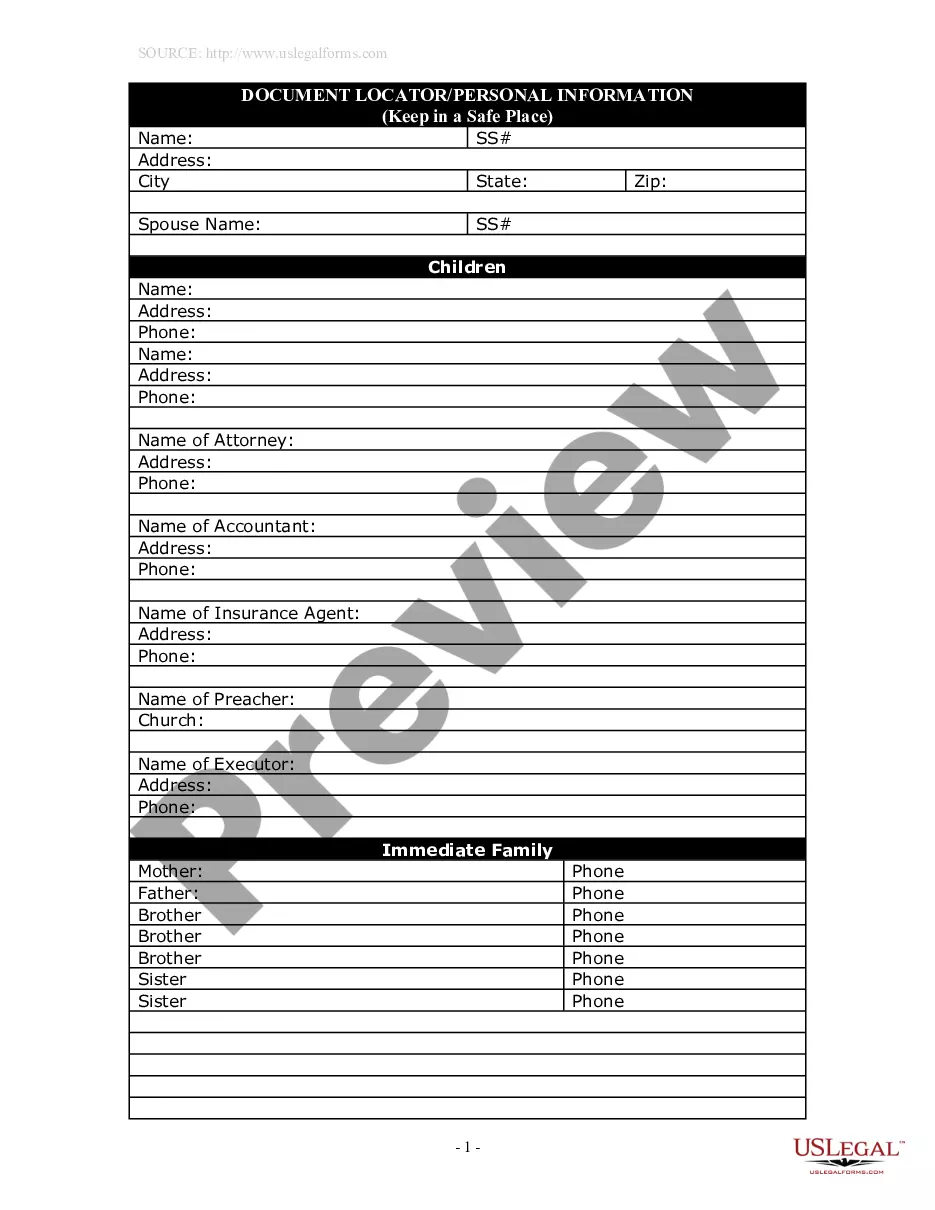

How to fill out Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental?

Are you in a location that you need documents for either organizational or personal reasons almost every day? There are many legal document templates available online, but finding reliable ones is not simple.

US Legal Forms offers a large selection of document templates, including the Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Afterward, you can download the Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental template.

Access all the document templates you have purchased in the My documents section. You can download or print the Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental again at any time if needed. Simply click on the required form to download or print the document template.

Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service provides expertly crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start simplifying your life.

- Find the document you need and ensure it is for your correct jurisdiction/region.

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the right document.

- If the form does not meet your expectations, use the Search box to locate the document that fulfills your needs and requirements.

- Once you find the appropriate document, click Purchase now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and complete the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

net lease is a lease agreement where the tenant is responsible for paying rent, property taxes, and insurance premiums. Unlike a triple net lease, which includes all operating expenses, the landlord retains some of the operational responsibilities. This can be a viable option in a Virgin Islands Triple Net Commercial Lease Agreement Real Estate Rental, especially for property owners seeking a balanced approach to risk and management responsibilities.

An absolute nnn lease is a lease agreement where the tenant assumes all responsibilities related to the property, including taxes, insurance, and maintenance. This type of lease provides the landlord with a predictable income stream and eliminates many management tasks. For individuals considering a Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental, an absolute nnn lease can be an attractive option due to its stability and reduced risk.

A net lease REIT is a type of Real Estate Investment Trust that owns properties leased out on net lease agreements, including triple net leases. Investors in a Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental may find this structure appealing, as it offers stable income through long-term leases with minimal management responsibilities. These REITs typically invest in high-quality commercial properties leased to reputable tenants.

The key difference between nnn and absolute nnn lies in the responsibilities of the tenant. In a traditional triple net lease (NNN), tenants cover property expenses, but the landlord may retain some responsibilities, such as structural repairs. In contrast, an absolute nnn lease puts all responsibilities on the tenant, including major repairs and replacements, providing the landlord with even less oversight on the property management side.

The best triple net lease tenants typically include established corporations with strong financials. These tenants often operate in essential sectors such as pharmacies, convenience stores, or fast-food chains. When considering a Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental, look for tenants with a solid credit rating and a proven track record to ensure long-term stability.

Setting up rent for commercial property involves evaluating market rates, property expenses, and the type of lease agreement. It's essential to consider the financial obligations each party will bear. A well-structured agreement, such as the Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental, helps to ensure both parties are satisfied with the financial arrangements.

The three main types of leases include the gross lease, the net lease, and the triple net lease. In a gross lease, the landlord covers all property expenses, while in a net lease, some expenses shift to the tenant. The triple net lease further increases tenant responsibilities. Many choose the Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental for its clarity and structure.

The most common lease in commercial real estate is the triple net lease. This agreement simplifies financial arrangements by placing most responsibilities on the tenant. As a result, it offers steady and reliable income for landlords. With the Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental, many invest confidently, knowing their interests are protected.

Structuring a triple net lease involves clear agreements on rent, property expenses, and responsibilities. Both the landlord and tenant must agree on which costs the tenant will assume, such as taxes, insurance, and maintenance. Additionally, it's crucial to include any specific terms or conditions in the lease. The Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental provides a robust framework for establishing these terms.

The most common type of leasehold is the leasehold estate, often associated with commercial properties. Under this arrangement, the tenant enjoys the right to use the property for a specified period while adhering to agreed-upon terms. This type of lease provides benefits for both tenants and landlords. For example, the Virgin Islands Triple Net Commercial Lease Agreement - Real Estate Rental facilitates a mutual understanding of rights and responsibilities.

Interesting Questions

More info

LD Trade Reports View Trade Reports Industry Trade News.