Virgin Islands Rental Lease Agreement for Business

Description

How to fill out Rental Lease Agreement For Business?

Are you currently in a circumstance where you need documents for either business or personal purposes almost daily.

There is a range of legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a multitude of form templates, including the Virgin Islands Rental Lease Agreement for Business, designed to meet state and federal requirements.

Select the pricing plan you need, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Rental Lease Agreement for Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct area/region.

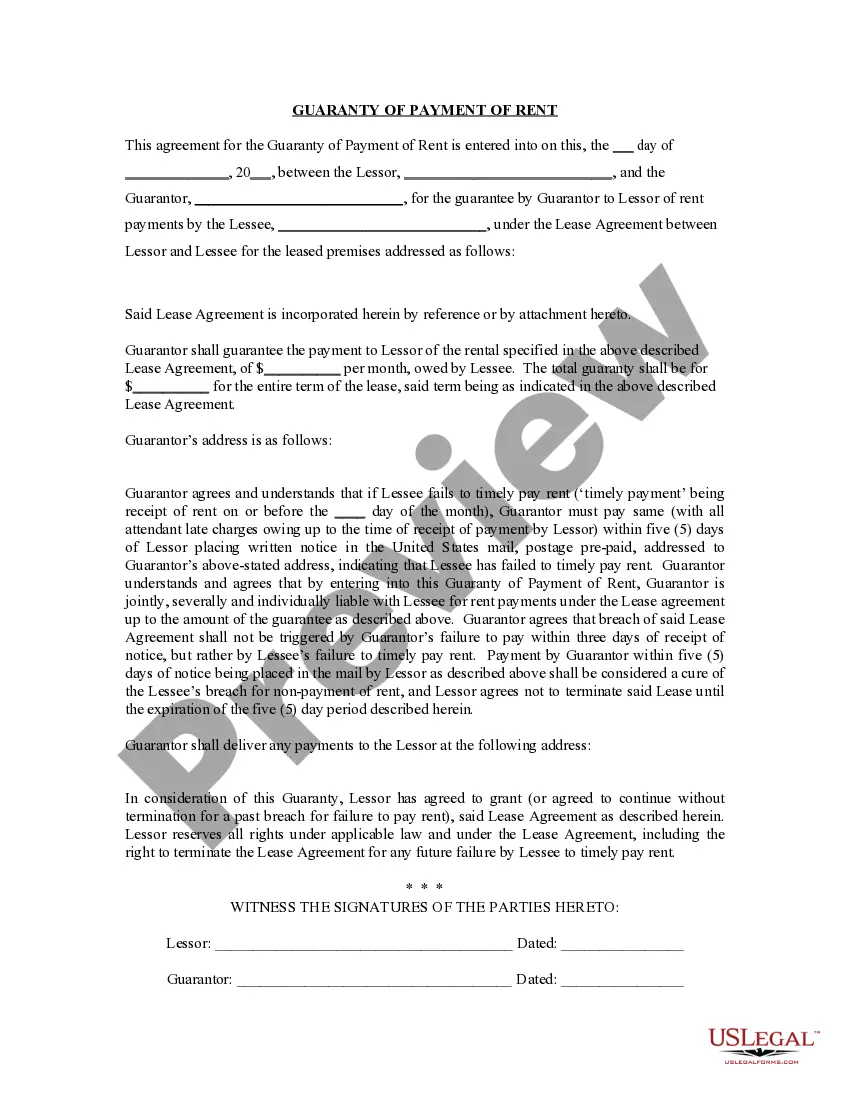

- Use the Review button to examine the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you seek, utilize the Search field to find the form that fits your needs and requirements.

- If you find the correct form, click on Acquire now.

Form popularity

FAQ

Writing a short-term lease involves outlining key terms like the start and end dates, rent amount, and maintenance responsibilities. Ensure that both parties understand their rights and duties through clear, concise language. Additionally, consider local regulations to ensure compliance. For an easy start, check US Legal’s resources for a Virgin Islands Rental Lease Agreement for Business, which offers ready-made templates.

An example of a short-term lease includes a lease for a retail space lasting three months during peak season. Such agreements can provide businesses with temporary locations to test markets or meet increased demand. Make sure the lease specifies the exact terms and conditions. Templates for these agreements can be accessed through US Legal, which provides tailored solutions for a Virgin Islands Rental Lease Agreement for Business.

term lease typically lasts for six months or less, although it can vary depending on local laws and stipulations. This flexibility allows businesses to adapt to changing circumstances quickly. It's important to clarify duration in the lease agreement to avoid misunderstandings. Consider the US Legal service for a compliant Virgin Islands Rental Lease Agreement for Business.

To write a business proposal for a lease, start with an introduction that includes your business's mission. Detail why you need the space, how it supports your business objectives, and the terms you're seeking. Highlight the benefits of the proposed lease for both parties. Using templates from US Legal can streamline the process for a Virgin Islands Rental Lease Agreement for Business.

Writing a short lease involves outlining essential terms, such as the duration of the lease, rent amount, and payment schedule. Clearly define the rights and responsibilities of both parties to avoid confusion later. Use straightforward language to ensure transparency. For a convenient starting point, visit the US Legal forms for a Virgin Islands Rental Lease Agreement for Business sample.

To record a short-term lease in the Virgin Islands, you need to ensure the document is properly signed and notarized by both parties. Submit it to the local land records office, if required. Recording protects your legal rights and provides public notice of your lease. Consider using the US Legal platform for templates that meet all local requirements.

The main difference between a lease and rent agreement is the period of time they cover. A rental agreement tends to cover a short termusually 30 dayswhile a lease contract is applied to long periodsusually 12 months, although 6 and 18-month contracts are also common.

Common contents of a rental agreement include:Names of the landlord and tenant and/or their agents.Description of the property.Amount of rent and due dates for payment, grace period, late charges.Mode of rent payment.Methods to terminate the agreement prior to the expiration date and charges if any.More items...?15-Mar-2022

By accepting rent without a written lease, after a year, a tenant will be entitled to security of tenure and compensation if the landlord recovers possession.

The primary disadvantage of a lease is that it kinds the tenant to the premises for a specified amount of time. Therefore, if you are planning to live in the unit for a very short period of time, you may not want a lease.