Virgin Islands Lease to Own for Commercial Property is a real estate agreement that allows individuals or businesses to rent a commercial property with the option to purchase it at a later date. This arrangement is designed to provide tenants with more flexibility and a pathway to property ownership. The lease to own option provides an opportunity for tenants to test the suitability of the commercial property for their business before committing to a full purchase. It allows them to assess factors such as location, market demand, and the operational needs of their business without the immediate financial burden of purchasing the property. This arrangement typically involves a lease term of several years, during which the tenant pays rent and potentially additional monthly payments towards building equity in the property. These additional payments are credited towards the eventual purchase of the property, reducing the final purchase price. There is usually an agreed-upon purchase price at the beginning of the lease to own period, providing clarity for both parties. One of the advantages of the Virgin Islands Lease to Own for Commercial Property is that it allows tenants to build credit and save money towards the down payment on the property. This can be particularly beneficial for those who may not have the financial means to make a large upfront payment on a commercial property. There may be different types of the Virgin Islands Lease to Own for Commercial Property. These can include options such as triple net leases, where the tenant is responsible for operating expenses, taxes, and insurance, or gross leases where the landlord covers these expenses. There may also be variations in the lease term and the amount of monthly payments credited towards the purchase price. It is important for both parties involved in a Virgin Islands Lease to Own for Commercial Property agreement to clearly outline all terms and conditions in a written contract. This contract should cover aspects such as the length of the lease term, the amount of monthly rent and additional payments, maintenance responsibilities, and the consequences of defaulting on the agreement. In conclusion, Virgin Islands Lease to Own for Commercial Property provides an alternative avenue for businesses to acquire a commercial property. This arrangement offers flexibility, allowing tenants to assess the suitability of the property before committing to a purchase. It also assists tenants in building credit and saving towards the down payment. Clear communication and a well-documented contract are crucial to ensure a successful lease to own agreement.

Virgin Islands Lease to Own for Commercial Property

Description

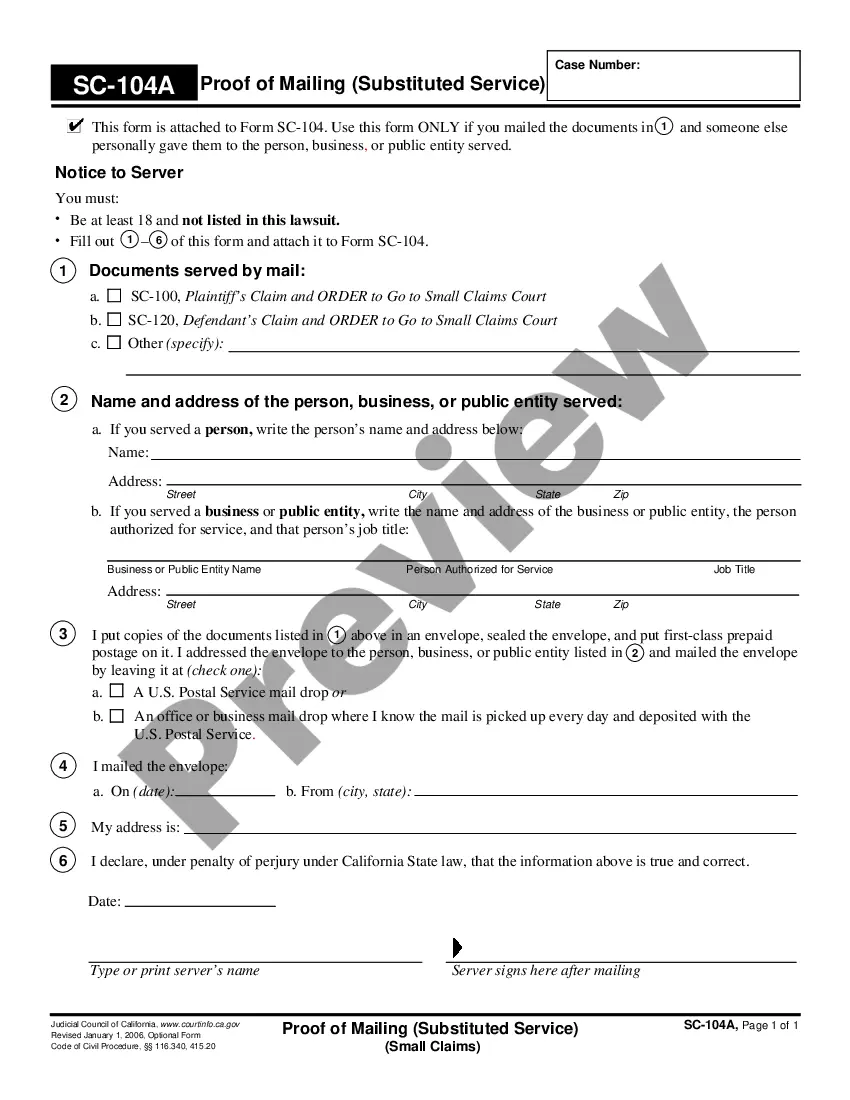

How to fill out Virgin Islands Lease To Own For Commercial Property?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest forms such as the Virgin Islands Lease to Own for Commercial Property within moments.

If the form does not suit your needs, utilize the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose your preferred payment plan and enter your details to create an account.

- If you already have an account, Log In and download the Virgin Islands Lease to Own for Commercial Property from your US Legal Forms library.

- The Download button will appear on every form you view.

- You will have access to all previously downloaded forms in the My documents section of your profile.

- If you are looking to use US Legal Forms for the first time, here are simple steps to start.

- Ensure you have selected the correct form for the city/county.

- Click the Review button to examine the content of the form.

Form popularity

FAQ

Thomas, St. John, St. Croix and Water Islandis the same as purchasing property in the United States. If you do decide to buy property in paradise, the title is handled the same and have the same guarantees and the Constitutional protections that one enjoys on the continent.

Buying costs are moderate in the US Virgin Islands (Global Property Guide): .

US Virgin Islands taxes are low Property: Property taxes are imposed at 1.25% of the property's assessed value. The assessed value of the property is generally 60% property's fair market value.

US Virgin Islands taxes are low Property: Property taxes are imposed at 1.25% of the property's assessed value. The assessed value of the property is generally 60% property's fair market value.

The US Virgin Islands currently imposes a real property tax at 1.25% of the property´s assessed value. The propertyA´s assessed value is 60% of its actual value or fair market value. Thus, the effective tax rate is 0.0075% of the propertyA´s fair market value.

2% for property worth up to $350,000. 5% for property worth $350,000 to 1 million. 3% for property worth $1 million to $5 million. 5% for property worth over $5 million.

The cost of living in the U.S. Virgin Islands is higher than on the U.S. mainland. On average, apartments cost $2,000 per month. A two-bedroom house costs at least $285,000.

The U.S. Virgin Islands.Real property is taxed at 1.25% of the property's assessed value, "which is 60% of its actual value or fair market value for an effective tax rate of .

The Deal Took 50 Years. During World War I, Denmark finally sold Saint Thomas, Saint John and Saint Croix to the U.S. for $25 million in gold coin.

Buying Process, Fees & TaxesYes, foreigners can buy property in the US Virgin Islands and the Government of the US Virgin Islands welcomes investment from overseas buyers. There are no restrictions on foreign buyers acquiring real estate in the US Virgin Islands.