A broker is an agent who bargains and/or conducts negotiations for and on behalf of his or her principal as an intermediary between the principal and third persons in the acquisition of contractual rights. Such a broker normally receives a commission or brokerage fee for his or her services. While a broker's primary contractual duty is to procure prospects and negotiate with them on behalf of his or her principal, it is not uncommon for the broker to assume an advisory relationship to clients who are not knowledgeable in the types of contracts involved in the negotiations.

Virgin Islands Exclusive Agreement Between Employer and Broker to Secure Group Insurance

Description

How to fill out Exclusive Agreement Between Employer And Broker To Secure Group Insurance?

Are you in a position the place you need to have papers for possibly organization or specific purposes nearly every day time? There are a lot of authorized file templates available on the net, but finding types you can depend on is not straightforward. US Legal Forms delivers thousands of form templates, just like the Virgin Islands Exclusive Agreement Between Employer and Broker to Secure Group Insurance, that are created in order to meet state and federal requirements.

In case you are currently familiar with US Legal Forms website and have a merchant account, simply log in. Following that, you can obtain the Virgin Islands Exclusive Agreement Between Employer and Broker to Secure Group Insurance template.

If you do not offer an bank account and need to begin using US Legal Forms, adopt these measures:

- Get the form you want and make sure it is for your correct area/state.

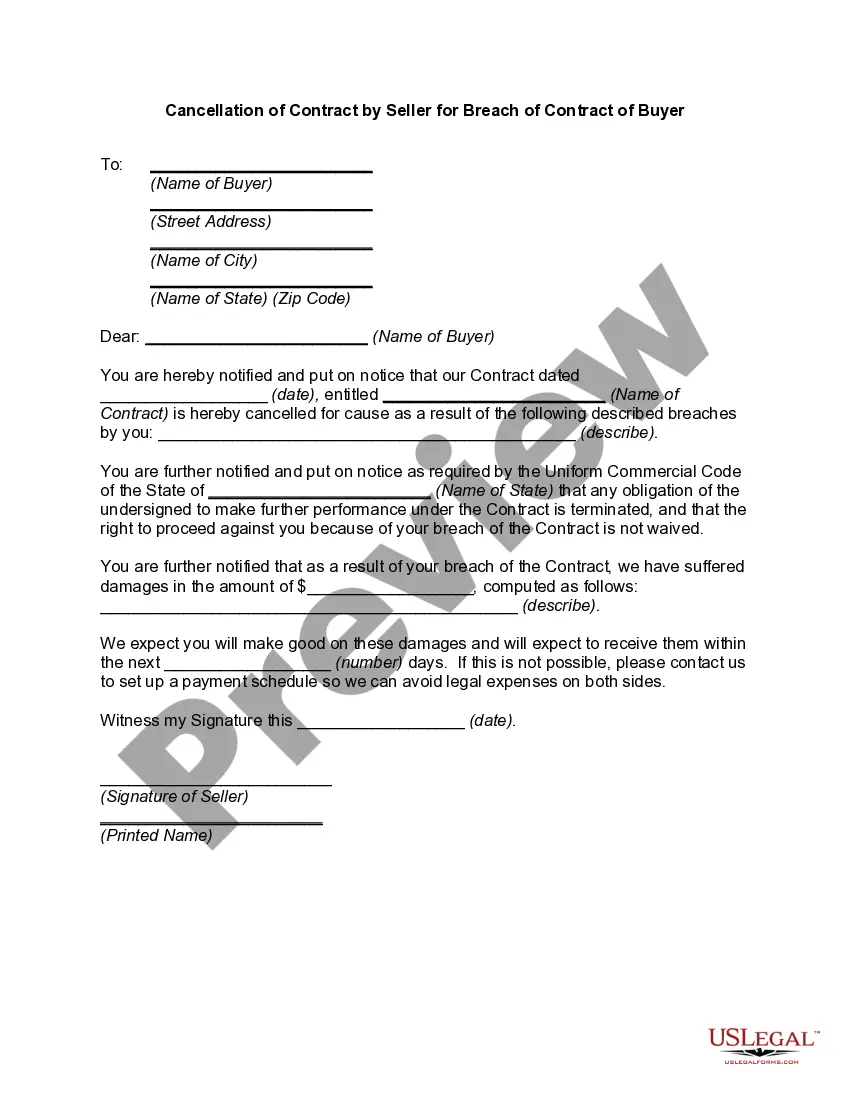

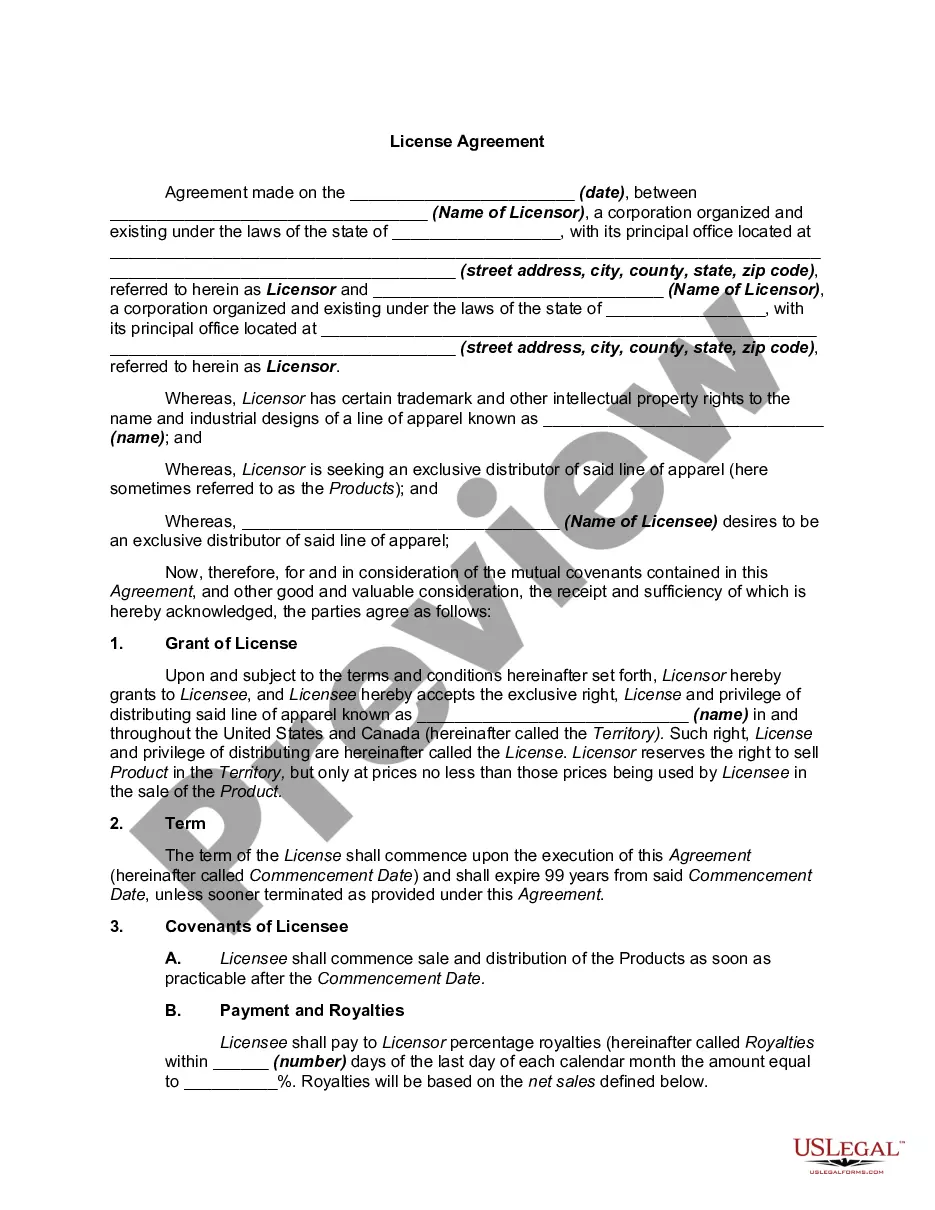

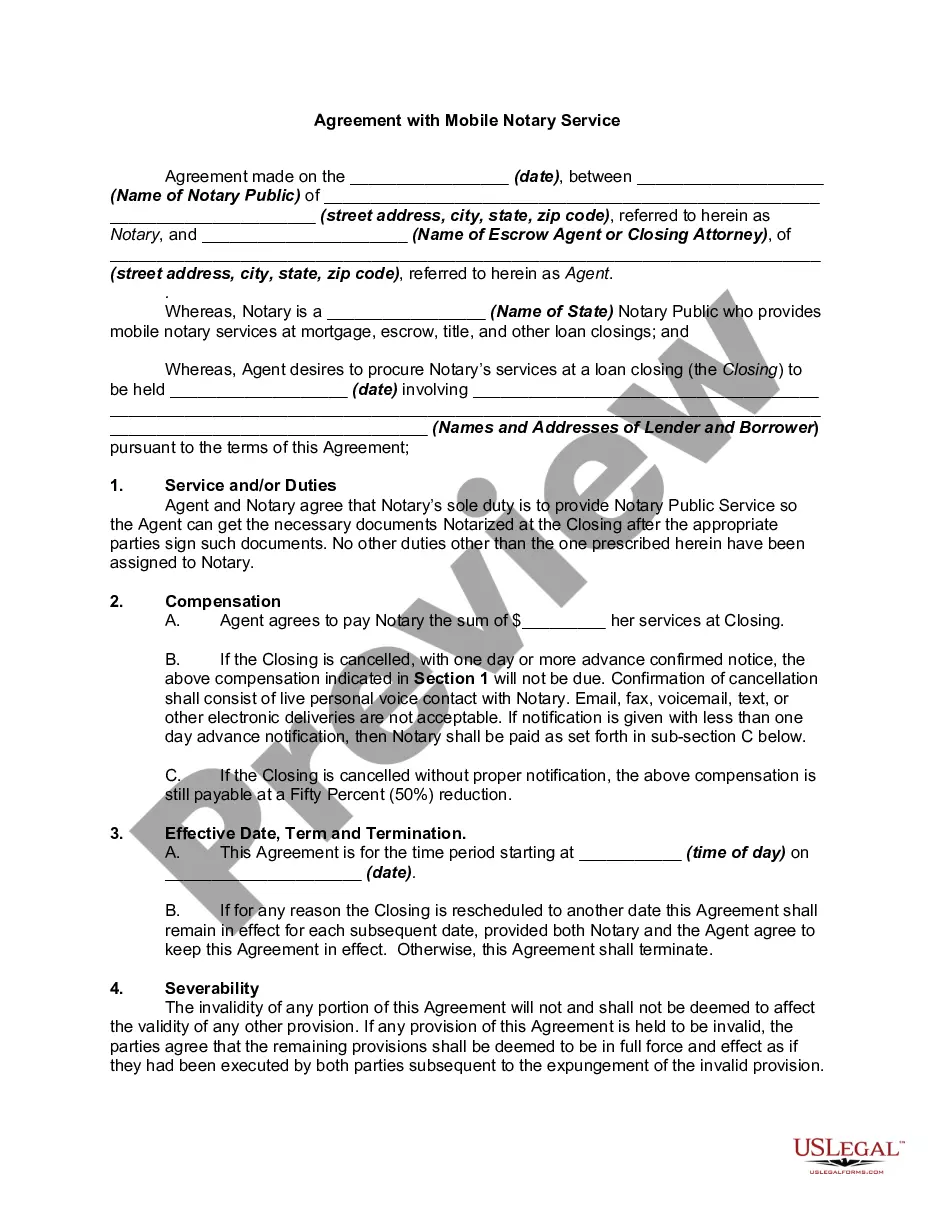

- Take advantage of the Review button to examine the form.

- See the information to ensure that you have chosen the right form.

- In case the form is not what you`re seeking, take advantage of the Look for field to discover the form that meets your needs and requirements.

- Whenever you get the correct form, just click Get now.

- Opt for the costs prepare you need, fill in the specified info to produce your money, and pay money for the order with your PayPal or Visa or Mastercard.

- Decide on a convenient file formatting and obtain your backup.

Get every one of the file templates you have bought in the My Forms food list. You may get a further backup of Virgin Islands Exclusive Agreement Between Employer and Broker to Secure Group Insurance anytime, if necessary. Just click on the needed form to obtain or print the file template.

Use US Legal Forms, the most extensive variety of authorized forms, to save lots of some time and steer clear of errors. The assistance delivers expertly manufactured authorized file templates that can be used for a variety of purposes. Create a merchant account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

A void contract, in the context of insurance, is an insurance contract or policy that does not have legal validity and is thereby unenforceable in court. A contract may be or become void for a number of reasons, depending on the exact circumstances.

It is a contract of indemnity. Claim payment Insurable amount is paid, either on the occurrence of the event, or on maturity. Loss is reimbursed, or liability incurred will be repaid on the occurrence of uncertain event. Premium Premium has to be paid over the years.

An insurance policy is a contract between the insured and the insurance company. You pay premiums to an insurance company.

The insurance contract or agreement is a contract whereby the insurer promises to pay benefits to the insured or on their behalf to a third party if certain defined events occur. Subject to the "fortuity principle", the event must be uncertain.

Insurance contracts are generally classified as either short duration or long duration. The distinction is based on the period of time of the insurance protection and the flexibility each party has in changing the terms of the contract.