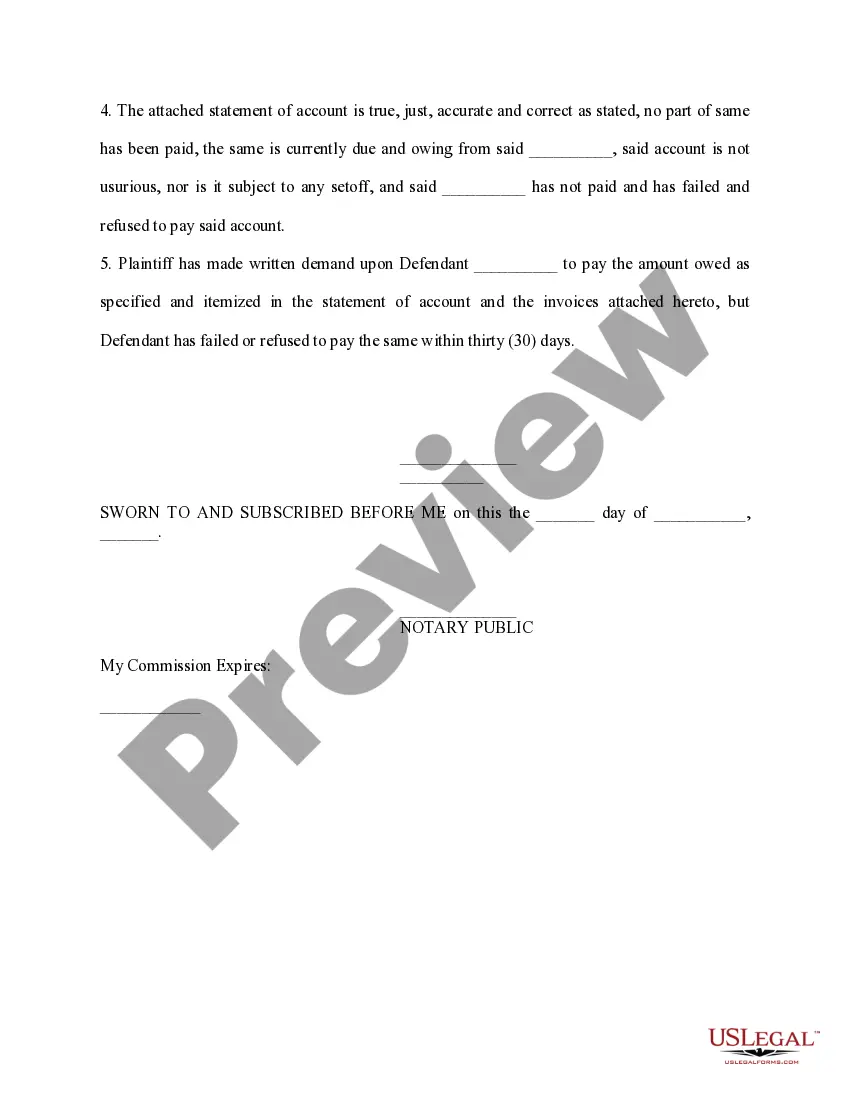

Virgin Islands Affidavit of Amount Due on Open Account

Description

How to fill out Affidavit Of Amount Due On Open Account?

Finding the right authorized record template can be a struggle. Needless to say, there are a lot of web templates available on the net, but how would you discover the authorized develop you will need? Use the US Legal Forms internet site. The support provides a large number of web templates, such as the Virgin Islands Affidavit of Amount Due on Open Account, which you can use for company and personal requirements. Each of the kinds are checked by experts and satisfy federal and state requirements.

Should you be previously listed, log in to your bank account and then click the Download switch to have the Virgin Islands Affidavit of Amount Due on Open Account. Use your bank account to check through the authorized kinds you possess ordered formerly. Go to the My Forms tab of the bank account and get an additional backup of the record you will need.

Should you be a fresh consumer of US Legal Forms, listed below are basic directions that you can follow:

- Very first, be sure you have chosen the appropriate develop for the town/county. You can check out the shape making use of the Preview switch and browse the shape outline to make certain this is the right one for you.

- If the develop will not satisfy your needs, utilize the Seach field to get the correct develop.

- Once you are certain the shape would work, click the Buy now switch to have the develop.

- Opt for the costs strategy you want and enter the needed information. Make your bank account and pay for the transaction with your PayPal bank account or credit card.

- Choose the document formatting and download the authorized record template to your product.

- Comprehensive, edit and produce and indicator the received Virgin Islands Affidavit of Amount Due on Open Account.

US Legal Forms may be the greatest collection of authorized kinds that you can see numerous record web templates. Use the service to download expertly-produced files that follow status requirements.

Form popularity

FAQ

No. Intuit only does US and Canada tax returns. The US Virgin Islands (USVI) has its own tax system.

Gross Receipts Taxes. The USVI imposes a tax of 4% on the gross receipts of USVI businesses. Businesses with annual gross receipts of less than $150,000 are exempt from tax on their first $5,000 per month of gross receipts.

People who are owed USVI tax refunds can check the status of their returns at or by calling (340) 715-1040. Note: States & U.S. territories may make changes to their tax laws with little notice.

INDIVIDUAL INCOME TAX Individuals who are bona fide residents of the Virgin Islands file Form 1040 with the Virgin Islands and pay tax on their worldwide income to the Virgin Islands.

The Virgin Islands Bureau of Internal Revenue and the IRS are not the same entity although the same tax rates and laws apply. If you are a US resident with income allocable to the Virgin Islands, file Form 8689 with your regular 1040 tax return.

U.S. citizens and permanent residents with income from the USVI, but who are not resident there, pay the same total amount of tax as they would if all their income were from U.S. sources, but the tax is apportioned between the United States and the USVI. This is done on IRS form 8689.

File a signed copy of your tax return (with all attachments, forms, and schedules, including Form 8689) with the Virgin Islands Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802. They will accept a signed copy of your U.S. return and process it as an original return.