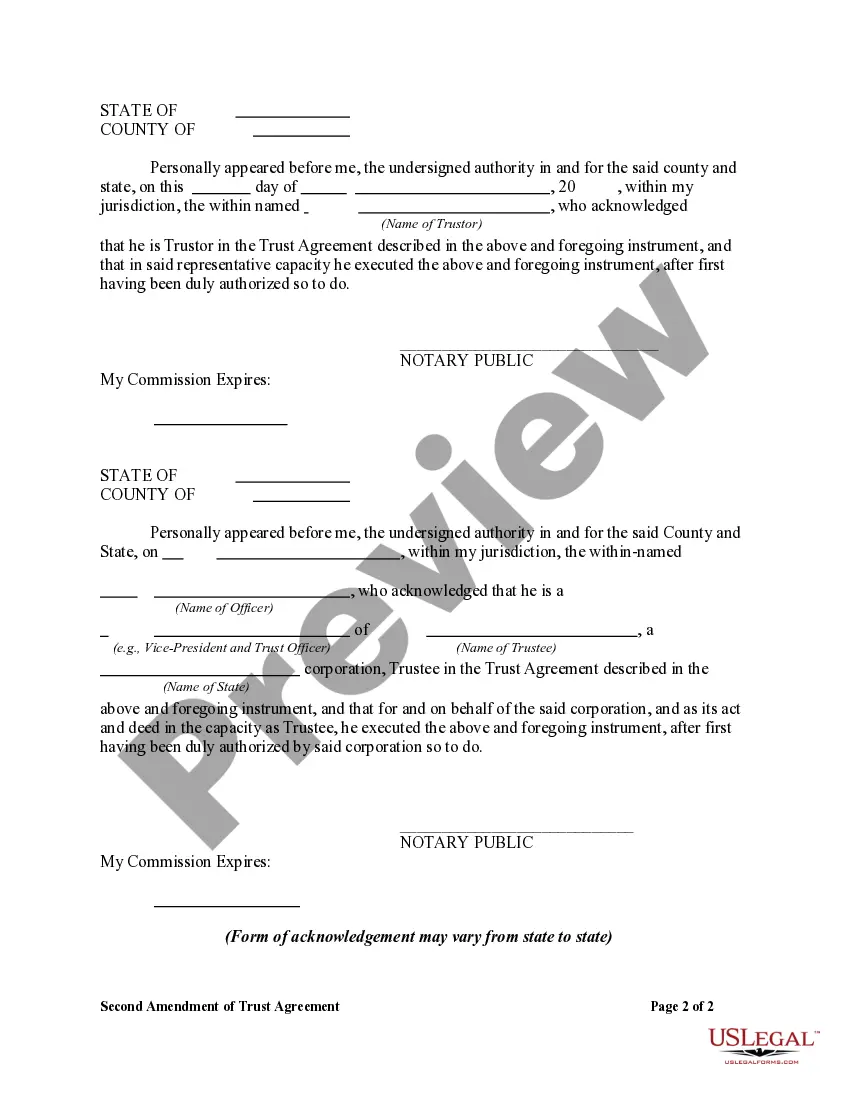

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Virgin Islands Second Amendment of Trust Agreement is a legal document that pertains to the trust laws in the United States Virgin Islands. This agreement serves as an amendment to an existing trust agreement and offers additional provisions and modifications to meet the changing needs and circumstances of the trust beneficiaries and settlers. The primary purpose of the Virgin Islands Second Amendment of Trust Agreement is to modify certain terms and conditions of the original trust agreement, ensuring that the trust remains in compliance with the latest regulations and legislation in the Virgin Islands. The trust agreement is tailored to meet the specific requirements of the settler and the desires of the beneficiaries. Keywords: Virgin Islands, Second Amendment, Trust Agreement, legal document, trust laws, United States Virgin Islands, amendment, provisions, beneficiaries, settlers, compliance, regulations, legislation, tailored, requirements. Types of Virgin Islands Second Amendment of Trust Agreement: 1. General Virgin Islands Second Amendment of Trust Agreement: This type of amendment applies to a broad range of trusts and includes modifications to various terms and provisions within the original trust agreement. 2. Revocable Living Trust Amendment: This type of amendment specifically focuses on revocable living trusts, offering changes to the provisions related to the management, distribution, and administration of assets during the settler's lifetime. 3. Irrevocable Trust Amendment: The irrevocable trust amendment is designed for irrevocable trusts, allowing for flexibility in modifying certain terms while ensuring the overall integrity and structure of the trust remains intact. 4. Special Needs Trust Amendment: This type of amendment applies to trusts set up to provide for the needs of individuals with disabilities. These amendments address the unique requirements of special needs beneficiaries, such as eligibility criteria, use of trust funds, and coordination with government benefits. 5. Charitable Trust Amendment: This category of amendment is specific to trusts established for charitable purposes. It may involve changes to the charitable beneficiaries, charitable goals, and the distribution of assets for charitable activities. 6. Dynasty Trust Amendment: A dynasty trust is intended to provide for multiple generations of beneficiaries. The Second Amendment to this type of trust agreement may include updates such as changing the trustee, modifying distribution provisions, or addressing changes in tax laws that affect the trust's structure. By utilizing a Virgin Islands Second Amendment of Trust Agreement, individuals can ensure that their trusts remain up-to-date and compliant with the changing laws and circumstances. Whether it involves adjusting provisions for beneficiaries, updating trustee appointments, or aligning the trust with current tax regulations, this legal document serves as a vital tool for preserving the intent and effectiveness of the trust.The Virgin Islands Second Amendment of Trust Agreement is a legal document that pertains to the trust laws in the United States Virgin Islands. This agreement serves as an amendment to an existing trust agreement and offers additional provisions and modifications to meet the changing needs and circumstances of the trust beneficiaries and settlers. The primary purpose of the Virgin Islands Second Amendment of Trust Agreement is to modify certain terms and conditions of the original trust agreement, ensuring that the trust remains in compliance with the latest regulations and legislation in the Virgin Islands. The trust agreement is tailored to meet the specific requirements of the settler and the desires of the beneficiaries. Keywords: Virgin Islands, Second Amendment, Trust Agreement, legal document, trust laws, United States Virgin Islands, amendment, provisions, beneficiaries, settlers, compliance, regulations, legislation, tailored, requirements. Types of Virgin Islands Second Amendment of Trust Agreement: 1. General Virgin Islands Second Amendment of Trust Agreement: This type of amendment applies to a broad range of trusts and includes modifications to various terms and provisions within the original trust agreement. 2. Revocable Living Trust Amendment: This type of amendment specifically focuses on revocable living trusts, offering changes to the provisions related to the management, distribution, and administration of assets during the settler's lifetime. 3. Irrevocable Trust Amendment: The irrevocable trust amendment is designed for irrevocable trusts, allowing for flexibility in modifying certain terms while ensuring the overall integrity and structure of the trust remains intact. 4. Special Needs Trust Amendment: This type of amendment applies to trusts set up to provide for the needs of individuals with disabilities. These amendments address the unique requirements of special needs beneficiaries, such as eligibility criteria, use of trust funds, and coordination with government benefits. 5. Charitable Trust Amendment: This category of amendment is specific to trusts established for charitable purposes. It may involve changes to the charitable beneficiaries, charitable goals, and the distribution of assets for charitable activities. 6. Dynasty Trust Amendment: A dynasty trust is intended to provide for multiple generations of beneficiaries. The Second Amendment to this type of trust agreement may include updates such as changing the trustee, modifying distribution provisions, or addressing changes in tax laws that affect the trust's structure. By utilizing a Virgin Islands Second Amendment of Trust Agreement, individuals can ensure that their trusts remain up-to-date and compliant with the changing laws and circumstances. Whether it involves adjusting provisions for beneficiaries, updating trustee appointments, or aligning the trust with current tax regulations, this legal document serves as a vital tool for preserving the intent and effectiveness of the trust.