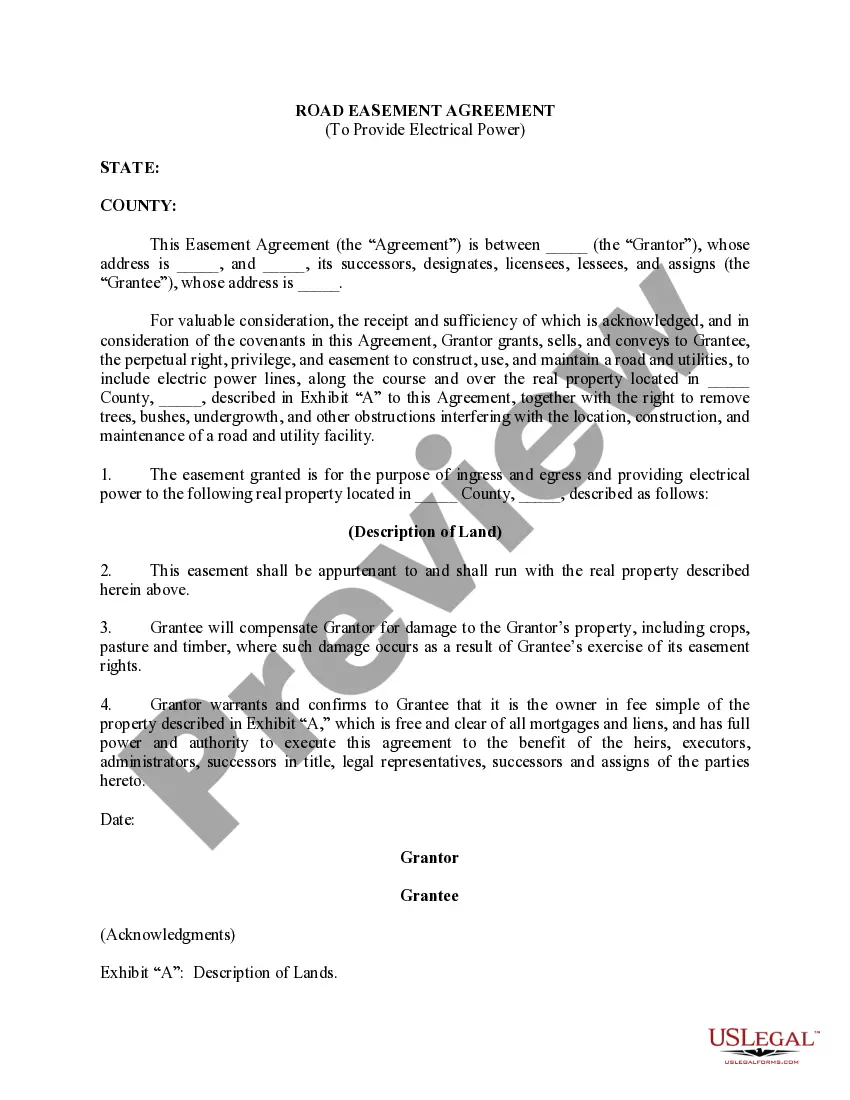

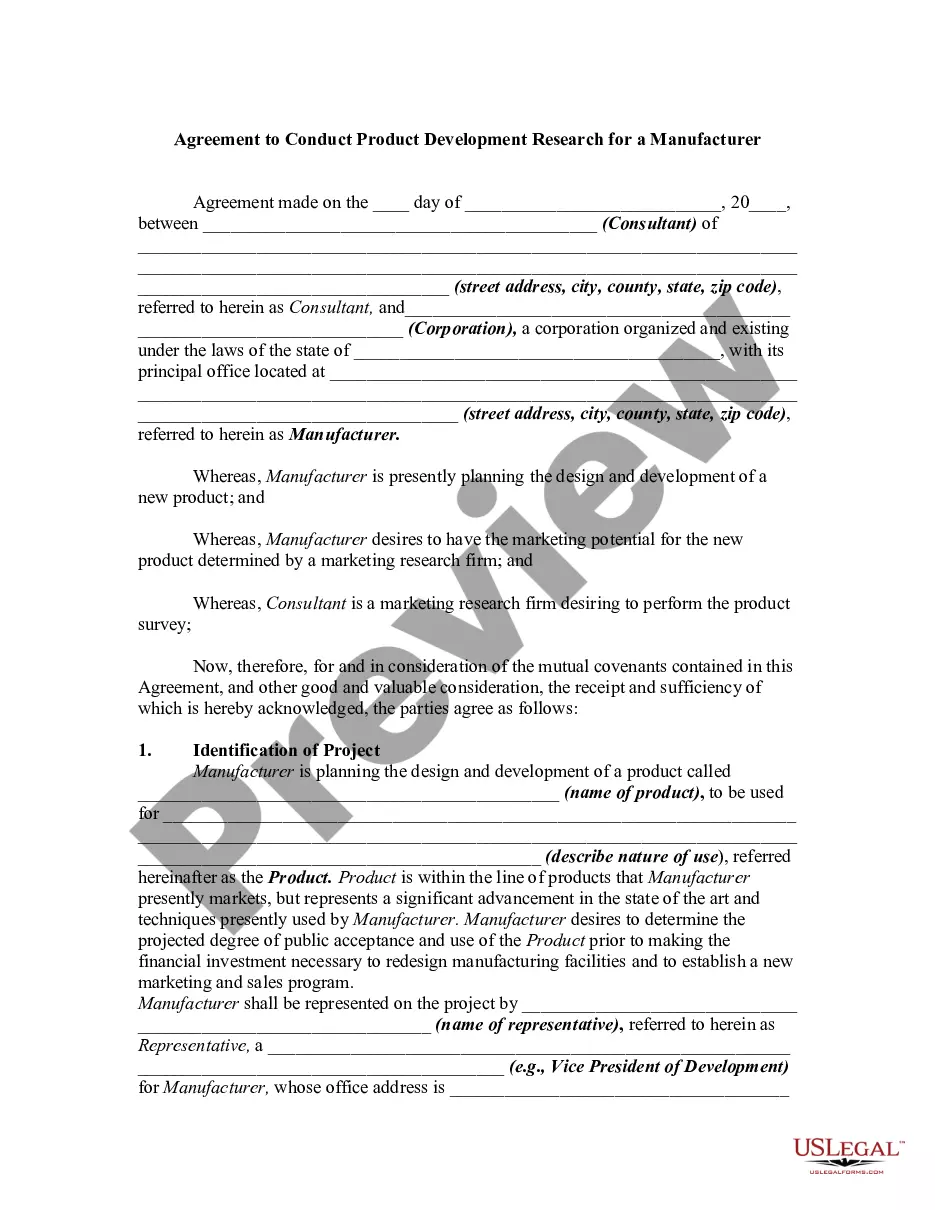

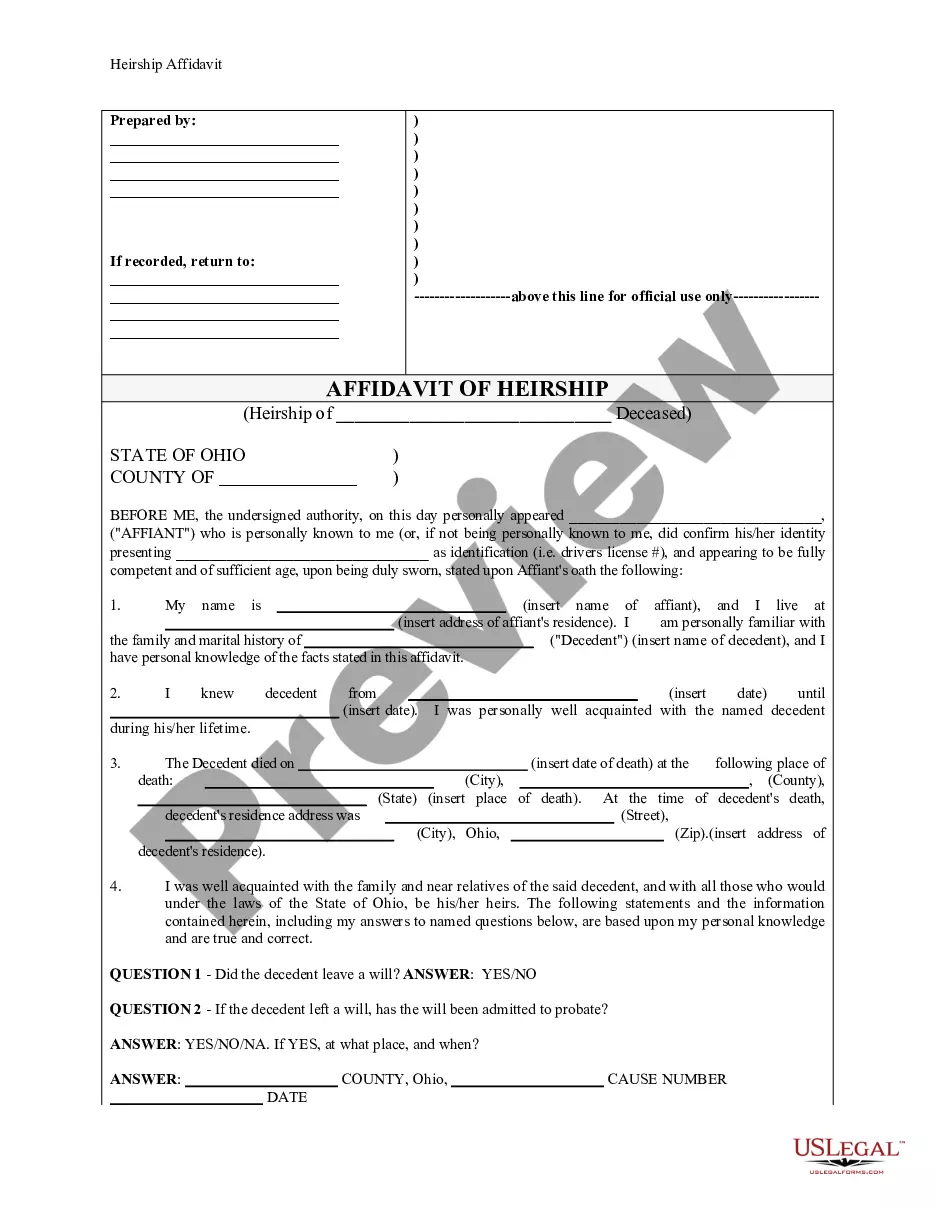

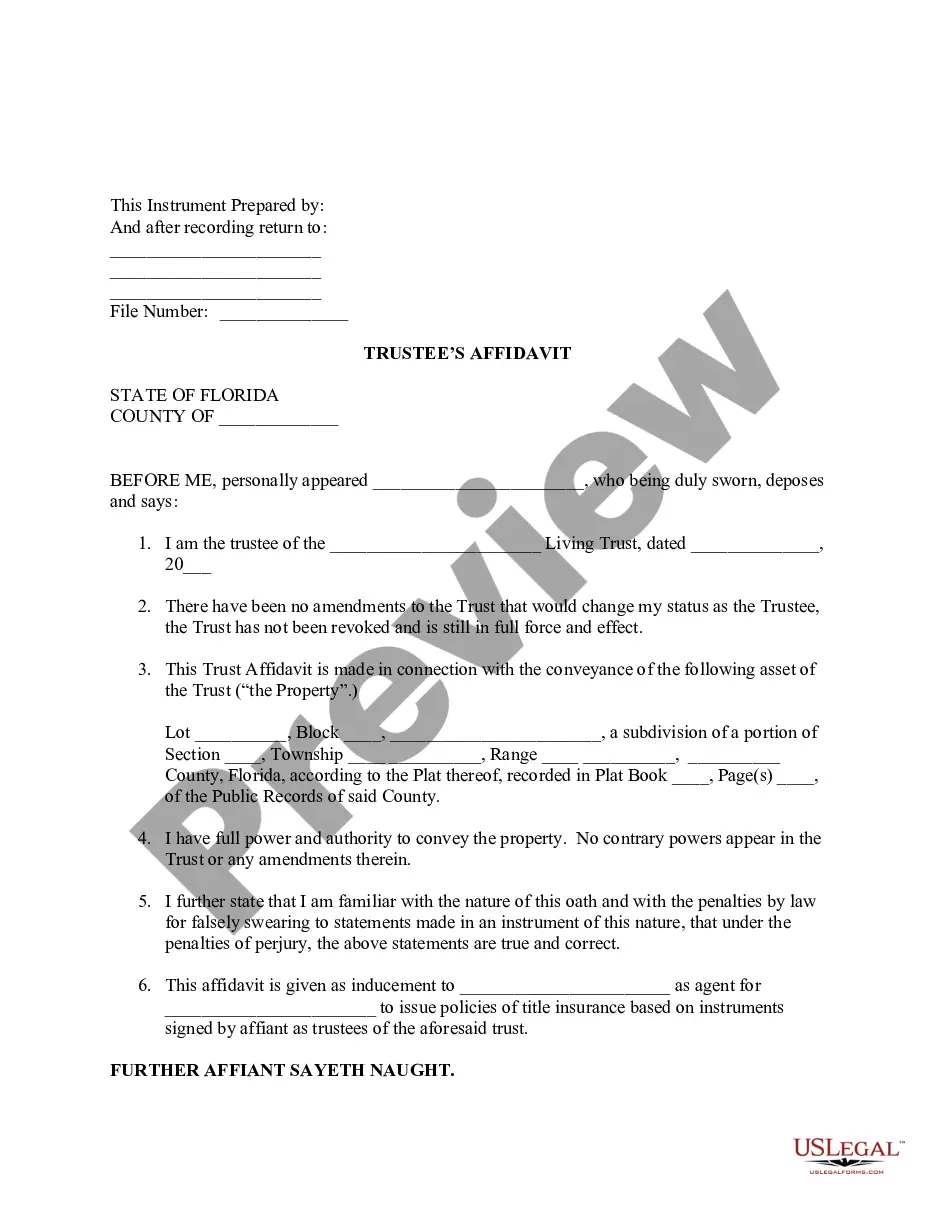

The Virgin Islands Bill of Transfer to a Trust is a legal document that transfers ownership of assets to a trust located in the United States Virgin Islands. This document outlines the terms and conditions under which the transfer of assets takes place, ensuring that the assets are protected and managed by a trustee on behalf of the trust beneficiaries. The Virgin Islands Bill of Transfer to a Trust is specifically designed to provide individuals with a reliable and secure means of protecting their wealth and assets. By placing assets into a trust, individuals can avoid potential probate issues and establish a clear plan for the future distribution of their assets. There are different types of Virgin Islands Bill of Transfer to a Trust, each catering to specific purposes and objectives. Some key types include: 1. Revocable Trust Bill of Transfer: This type of bill allows individuals to transfer assets to a trust while still having the flexibility to modify or revoke it at any time. It provides a useful tool for estate planning and protecting assets from potential creditors. 2. Irrevocable Trust Bill of Transfer: This bill indicates an irreversible transfer of assets to a trust. Once assets are transferred, the individual has limited control over them and cannot easily modify or revoke the trust. This type offers significant protection against creditors and helps reduce estate taxes. 3. Special Needs Trust Bill of Transfer: This bill allows individuals to transfer assets to a trust specifically designed to provide for a loved one with special needs. By setting up this trust, the individual can ensure that their loved one's financial security and quality of life will be protected in the long term. 4. Charitable Trust Bill of Transfer: This type of bill allows individuals to transfer assets to a trust that benefits a charitable organization or cause. By doing so, individuals can support their favorite charity, potentially receive tax benefits, and ensure their contribution has a lasting impact. In conclusion, the Virgin Islands Bill of Transfer to a Trust is a crucial legal document for individuals seeking to protect and manage their assets effectively. With different types of trust bills available, individuals can choose the one that aligns best with their specific goals and objectives, whether it's for estate planning, protecting assets, supporting loved ones with special needs, or making charitable contributions.

Virgin Islands Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

Are you in a situation where you will require documents for possible use by companies or individuals nearly all the time.

There are numerous legal document templates accessible online, yet locating ones you can trust is challenging.

US Legal Forms offers a vast collection of document templates, including the Virgin Islands Bill of Transfer to a Trust, which can be customized to comply with state and federal regulations.

When you have the correct form, click Purchase now.

Choose the pricing plan you prefer, complete the necessary details to create your account, and finalize your order using your PayPal or credit card. Select a suitable paper format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Virgin Islands Bill of Transfer to a Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct state.

- Use the Preview button to examine the form.

- Read the description to verify that you have chosen the right document.

- If the form is not what you are seeking, utilize the Lookup field to find the document that meets your requirements.

Form popularity

FAQ

Generally, a transfer to a trust is not considered a taxable event. The Virgin Islands Bill of Transfer to a Trust facilitates this seamless transfer while helping you avoid immediate taxes. However, tax implications can vary based on specific circumstances and asset types. Consulting with a tax professional or legal advisor can provide clarity and ensure you meet all requirements.

Placing your bank accounts in a trust can provide significant benefits, including protection from creditors and a smooth transfer of assets upon your passing. By utilizing the Virgin Islands Bill of Transfer to a Trust, you ensure that your financial resources are managed according to your directives. This strategy can simplify estate management and provide clarity to your heirs. Always consider your personal situation and goals before proceeding.

A trust for the Virgin Islands is a legal arrangement that allows individuals to manage their assets for the benefit of specific beneficiaries. With the Virgin Islands Bill of Transfer to a Trust, you can effectively transfer ownership of your assets while retaining control. This process provides peace of mind and ensures that your wealth is preserved according to your wishes. It is a smart way to navigate estate planning within the islands.

Typically, gifts to a trust may be subject to taxation, depending on the value and specific circumstances. The Virgin Islands Bill of Transfer to a Trust outlines various tax implications for transferring assets, which you should review carefully. Understanding these tax rules can help you plan effectively and minimize tax obligations. Consulting with a financial advisor is a great step to ensure compliance and optimize your estate planning.

Yes, you can transfer assets from an individual ownership to a trust. The Virgin Islands Bill of Transfer to a Trust simplifies this process, allowing you to assign ownership of your assets efficiently. This transfer not only establishes your trust but can also help safeguard your assets for future generations. Consider using a reliable platform like US Legal Forms to facilitate this transition.

Moving your assets into a trust can provide various benefits, including avoiding probate and ensuring privacy for your estate. The Virgin Islands Bill of Transfer to a Trust offers a streamlined process for this transition. Additionally, placing assets in a trust can help in managing your estate and providing clear guidance for your beneficiaries. It's a wise choice if you wish to have more control over your assets.

Trust funds do carry certain risks, including the potential for mismanagement by the trustee or legal challenges from beneficiaries. Additionally, if the trust is not properly structured, tax liabilities may arise. Utilizing a Virgin Islands Bill of Transfer to a Trust can mitigate some of these risks through careful planning and strategic asset distribution, ensuring that the trust functions as intended.

A bill of transfer in a trust is a legal document that facilitates the transfer of ownership from one party to another. In the context of a trust, this document is crucial for formally transferring assets into the trust, ensuring they are managed according to the terms set forth. By employing a Virgin Islands Bill of Transfer to a Trust, individuals can achieve a seamless transition of assets while enhancing legal safeguards.

One potential downfall of having a trust is the ongoing management it may require. Trusts need to be administered properly to ensure compliance with legal requirements, which can be complex. However, choosing a Virgin Islands Bill of Transfer to a Trust can streamline these processes and provide clarity on asset management, ultimately protecting the interests of beneficiaries.

A common mistake parents make is not clearly communicating their intentions and decisions regarding the trust. Failing to inform beneficiaries about how the trust functions can lead to misunderstandings or conflicts. Through the Virgin Islands Bill of Transfer to a Trust, parents can clearly outline their wishes and facilitate open discussions, ensuring everyone understands the trust's purpose and benefits.