Virgin Islands Receipt Template for Small Business

Description

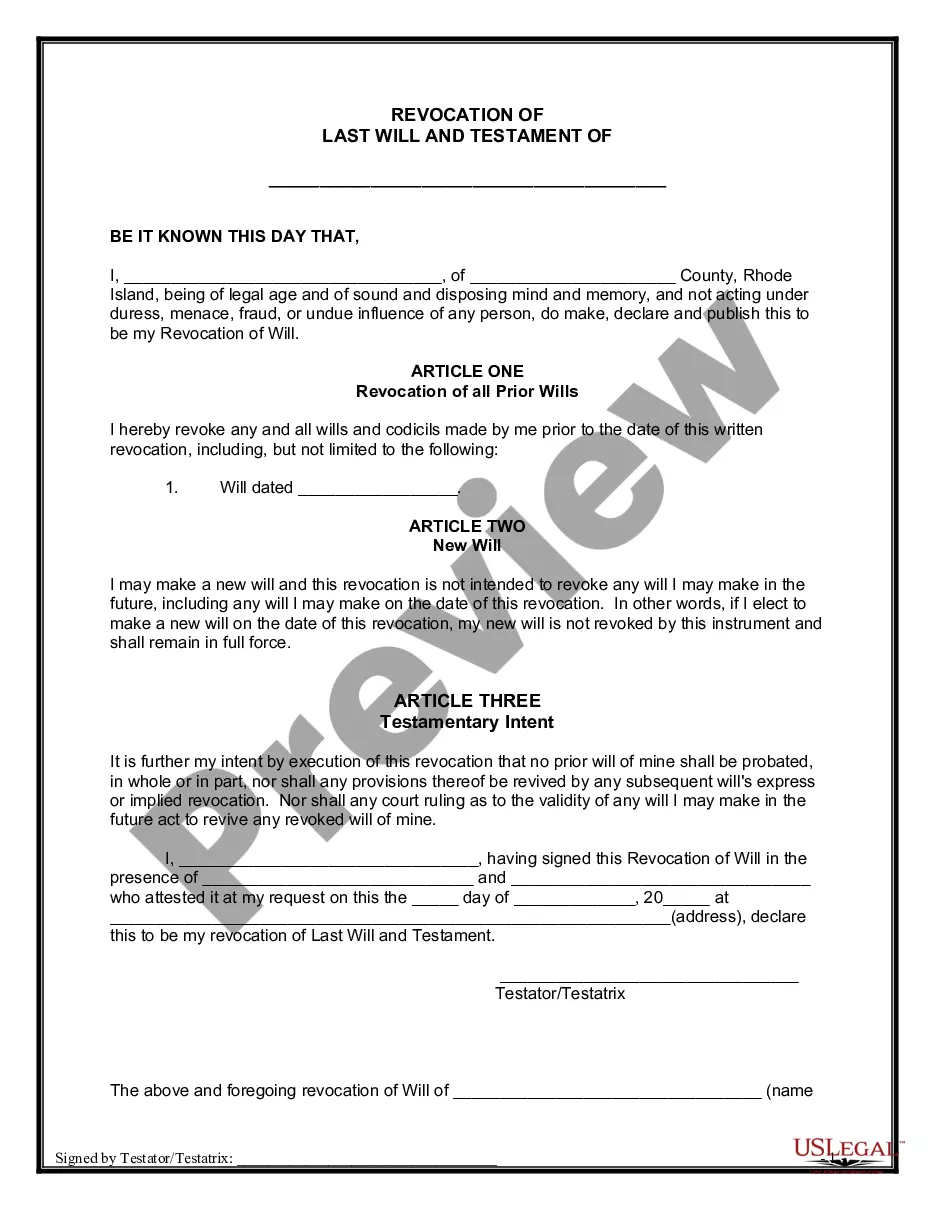

How to fill out Receipt Template For Small Business?

If you seek extensive, obtain, or producing authentic document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's straightforward and convenient search to locate the documents you require.

A range of templates for business and personal purposes are organized by categories, states, or keywords.

Step 4. Once you have located the form you need, select the Purchase now button. Choose your preferred payment plan and input your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to search for the Virgin Islands Receipt Template for Small Business in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to find the Virgin Islands Receipt Template for Small Business.

- You can also access forms you've previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview mode to examine the form's content. Don't forget to read the description.

- Step 3. If you are not content with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Creating your own receipt can be done easily with a template or from scratch. Start by gathering all necessary information, such as your business name, items sold, and payment totals. Opt for a Virgin Islands Receipt Template for Small Business if you want quick access to common formats, or design one that reflects your brand and customer transactions accurately.

Formatting a receipt involves organizing the information in a clear and logical way. Start with your business name and contact information at the top, followed by the transaction date and receipt number. List each item sold with corresponding prices neatly, followed by totals, ensuring each section is easy to read. A well-structured Virgin Islands Receipt Template for Small Business enhances professionalism.

Yes, Google Docs offers several receipt templates that can be customized for your small business needs. Simply search for 'receipt templates' within Google Docs to find options that suit your requirements. You can easily modify these templates to align with your branding and include the necessary details for your Virgin Islands Receipt Template for Small Business.

Creating a receipt format involves deciding on the essential components you want to include. Use simple headings like 'Receipt,' 'Date,' and 'Total' for clarity. You can start with a blank document or use a Virgin Islands Receipt Template for Small Business, allowing you to customize as needed. Tools like USLegalForms can help you streamline this process.

Filling out a receipt form is straightforward. Start by entering your business name and address at the top, followed by the date of the sale. Next, write a description of the products or services provided, their prices, and any taxes or discounts. Be sure to calculate the total amount and include that at the bottom of your Virgin Islands Receipt Template for Small Business for easy reference.

You should file Form 8689 with the Internal Revenue Service at the address listed in the form instructions. Timely and proper filing is essential to avoid penalties and ensure compliance. Using a Virgin Islands Receipt Template for Small Business helps you maintain organized records to support your filing process.

Form 8689 must be filed by individuals or businesses that have tax obligations in both the U.S. and the Virgin Islands. It ensures that any overpayment of taxes can be reclaimed. By organizing your finances with a Virgin Islands Receipt Template for Small Business, you can easily identify when and how to file this form.

To file taxes in the U.S. Virgin Islands, you typically must complete the necessary forms and provide required financial documentation to the Virgin Islands Bureau of Internal Revenue. Ensure your calculations are accurate and followed by relevant jurisdiction rules. Transitioning to using a Virgin Islands Receipt Template for Small Business can simplify your tax preparation process.

The U.S. Virgin Islands offer a range of tax incentives to encourage business development, including reduced corporate tax rates and exemptions for manufacturing. These incentives are designed to attract and retain businesses, thereby stimulating the local economy. Utilizing a Virgin Islands Receipt Template for Small Business helps you keep track of income and expenses subject to these incentives.

The gross receipts tax exemption in the Virgin Islands applies to certain types of income generated by small businesses, often motivated by local economic development efforts. This exemption can significantly boost your profits by reducing your overall tax burden. Using a Virgin Islands Receipt Template for Small Business can help in documenting your exempt transactions effectively.